If you want to use the Credit agreement signed you probably just want to know: When will the money come? Thereby it depends on your creditworthiness, the Amount of the credit and the digitization of the loan application via video Identification, eSign and digital account check from when the payout takes place. While the first two points concern you, the latter depend on the bank. Therefore, the loan disbursement takes different times at the banks.

Many wait unnecessarily long because they put the loan agreement with the wrong providers

In addition, your credit rating must also match the risk profile of the bank. Most banks reject people with a negative Schufa or too bad credit rating. In order to no longer have to wait for a presumably to wait for payment that no longer takes place, you can read in the article 'Which bank gives credit despite negative credit bureau?' check whether your bank is one of the banks that do not throw in the towel even in difficult cases.

Direct banks are faster at loan disbursement

The payout is usually somewhat faster at direct banks than at the branch. In addition, you can online request and online account check Reduce the machining time to 1-3 days.

Thereby, the fastest disbursement is made via mini loans up to amounts of 3000 €. These small loans are already in about 30 min on the account.

What you can learn here

- Many wait unnecessarily long because they put the loan agreement with the wrong providers

- Direct banks are faster at loan disbursement

- Is there really already a valid credit agreement?

- Loan agreement signed: When will the banks' money arrive in the account?

- 1. santander loan approved, when disbursement?

- 2. SKG Bank Loan - How long does it take to get paid?

- 3. postbank credit - How long does the disbursement take?

- 4. how long does it take to get a loan from the savings bank?

- 5. DSL Bank loan approved, when disbursement?

- 6. targobank loan approved, when disbursement?

- 7. auxmoney loan: how long does the payout take?

- 8. how long does the loan disbursement take with Maxda?

- 9. bon credit - how fast is the disbursement?

- 10. smava loan agreement signed: When will the money come?

- 11. ING loan agreement signed: When will the money come?

- 12. DKB loan agreement signed: When will the money arrive?

- Understand background to the question "When will the money come when the loan agreement is signed?"

- What else you can do when the loan contract is signed to get the money faster

- Where the money comes faster when the loan agreement is signed

- Conclusion: Credit agreement signed: When will the money come?

Is there really already a valid credit agreement?

It is also important to distinguish whether the loan has actually been approved by the bank or whether the contract has merely been signed by you. This is because a valid loan agreement is only concluded once the bank has countersigned the agreement. If the Credit agreement signed, and still rejected is therefore probably something fishy.

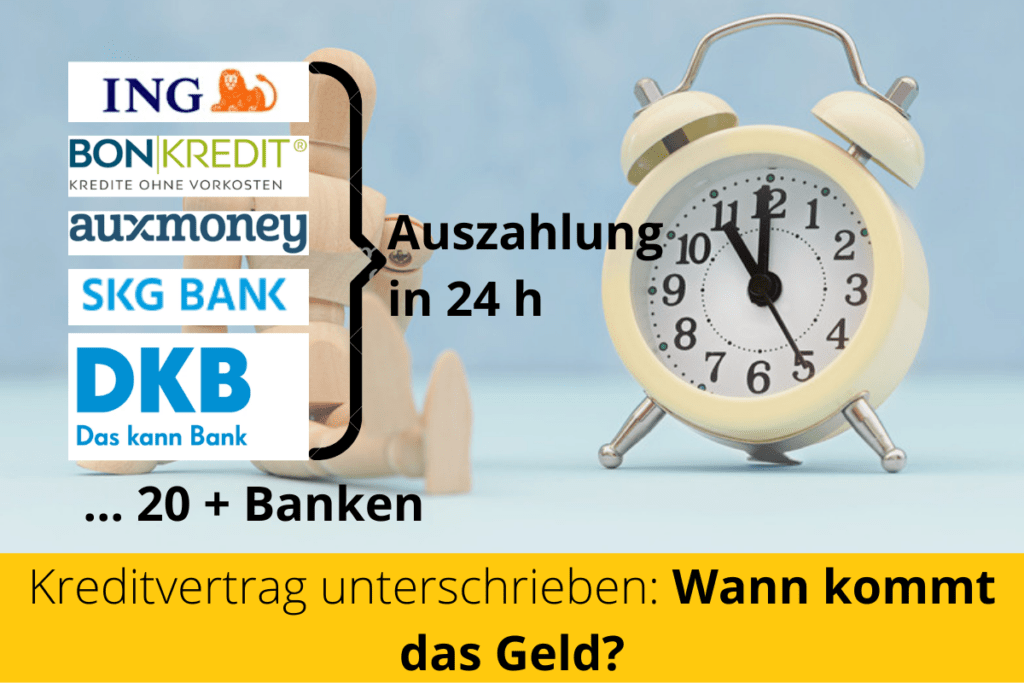

Loan agreement signed: When will the banks' money arrive in the account?

| Bank name | Payout period | Interest rate information |

|---|---|---|

ING  | 1 business day (ING customers) 3 working days for all others 5-7 business days without digital account check | Check interest rates at ING Kredit |

bon credit | 1-7 workdays | Check Zinesen at Bon-Kredit free of charge |

| Auxiliary | 1 working day (Online portal) 3-6 working days (Documents by letter) | Check interest rates at Auxmoney |

SKG Bank | 1-2 working days (Online portal) 3-6 working days (Documents by letter) | Check interest SKG Bank via Smava |

DKB | 1 - 5 working days | DKB credit interest rate review |

postal bank | 2 - 3 working days (Instant credit) 4 - 7 working days (personal loan) | Check interest rates at Postbank |

Smava | 2 - 7 working days | Smava interest rate review |

SWK Bank  | 2 workdays | SWK Bank Apply for a Loan |

Bank of Scotland  | 2 workdays | Bank of Scotland Apply for Credit |

barclaycard  | 3 - 4 working days | barclaycard credit apply |

1822 direct  | 3 - 5 working days | 1822 direct credit apply |

Santander | 3 - 6 working days | Check interest Santander Bank |

Oyak anchor  | 3 workdays | Oyak Anker Bank apply via Smava |

targo bank  | 4 - 7 working days | Check interest rates Targokbank |

DSL Bank | 7 workdays | Check interest rates at DSL Bank |

Maxda | 7 workdays | Check Maxda interest |

| PSD bank | 8-14 working days (construction financing) | Apply for PSD Bank Loan |

| German Bank | 2 - 7 working days | Apply for Deutsche Bank loan via Smava |

| Savings Bank | 3 - 6 working days | Application via local savings bank |

1. Santander Loan approved, when disbursement?

Santander Loan approved, when will it be disbursed?

At Santander, online loan requests are processed on same banking day processed. Once your loan application is approved, you will receive the loan documents within one to two working daysn by mail. Now you have to read the contract carefully and then sign it and send it back. If you work quickly, the loan agreement will be ready in one to two more working days of the Santander Bank. This is followed by the final review of the bank, which is approximately one more working day lasts. If the verification is successful, you will receive the credit via real-time transfer after few seconds to your account.

Thus, the disbursement after approved loan application takes about 3 to 6 business days at Santander Bank.

Duration of credit processing Santander

- Approval Credit Request: 0 working days (Automated testing in a few seconds)

- Subsequently: Sending loan documents by mail: 1-2 workdays

- Return credit documents by mail: 1-2 workdays

- Examination of credit documents at Santander: 1-2 workdays

- Subsequently: Disbursement Credit: 0 business days (real-time transfer in a few seconds)

- Therefore the total time from application to payment for Santander loan: 3-6 business days

Santander Bank ranks first in the Installment loan comparison best rates on a regular basis. Use the button below to check which interest rates are currently available.

Check interest Santander Bank2. SKG Bank Credit - How long does it take to get paid?

SKG Bank - How long does the withdrawal take? of the credit?

→ 1-2 working days

At SKG Bank, you can choose between 100 % digital processing or submit your documents by mail. All loan requests are processed on the same banking day processed. Once your loan application is approved, you will receive the loan documents either within one to two working daysn by mail or directly online. Now you have to read the contract carefully and then send it back signed with a Postident or you just do it directly at the Online portal of SKG Bank. There you can also upload your proof of income or bank statements. If you do everything online, your loan application including all supporting documents will be submitted to SKG Bank on the same day. The next step is the final check by the bank, which takes about one more working day lasts. After successful verification, you will then receive the loan on the next day transferred to your account.

Duration of credit processing SKG Bank

| Online application | Application by mail | |

|---|---|---|

| Approval credit application | 0 working days (Automated testing in a few seconds) | 0 working days (Automated testing in a few seconds) |

| Sending credit documents | 0 working days (online portal) | 1-2 workdays |

| Return of credit documents | 0 working days (online portal) | 1-2 workdays |

| Disbursement credit | 1-2 workdays | 1-2 workdays |

| Total duration | 1-2 workdays | 3-6 workdays |

3. postal bank Credit - How long does it take to get paid?

Postbank loan - How long does it take to get paid??

→ 2-3 working days

Postbank also offers an instant loan with fully digital closing process and a regular installment loan (Postbank designation: personal loan). But only with the latter do you submit documents such as proof of income by mail. In contrast, the documents for the Sofortkreditkomplett are checked online. However, the preliminary check for the instant loan and personal loan is carried out digitally and thus still on the same day. Once your loan application is approved, you will receive your personal loan documents either within one to two working days by mail or with the instant loan directly online.

Now you have to read the contract carefully and then send it back signed with a Postident to get the personal loan quickly. With an instant loan, this step is also done digitally. If you do everything online, Postbank will receive your loan application including all supporting documents on the same day. The final check by the bank then takes place, which takes around two to three working daye lasts. After successful verification, you will receive the loan as early as on next day to your account.

Thus, the processing time for the Postbank personal loan takes about 4 -7 business days in total. The Postbank Sofortkredit is thus paid out to you within 2-3 business days.

Duration of credit processing Postbank

| Instant credit | personal loan | |

|---|---|---|

| Approval credit application | 0 working days (Automated testing in a few seconds) | 0 working days (Automated testing in a few seconds) |

| Sending credit documents | 0 working days (Online) | 1-2 workdays |

| Return of credit documents | 0 working days (Online) | 1-2 workdays |

| Disbursement credit | 2-3 workdays | 2-3 workdays |

| Total duration | 2-3 workdays | 4-7 workdays |

4. how long does the disbursement of credit take at the Savings Bank?

How long does it take to get a loan from the Savings Bank?

→ 3-6 working days

At the Savings Bank, online loan requests are usually made on the same banking day processed. Once your loan application is approved, you will receive the loan documents within one to two working daysn by mail. Some savings banks also offer digital processing. Now you have to read the contract carefully and then sign it and send it back. If you work quickly, the loan agreement is in one to two more working days your savings bank. Now the final check of the bank takes place, which approximately one more working day lasts. After a successful check, you will receive the loan by bank transfer On the next day to your account.

The payment after the approved loan application takes about 3 to 6 working days at the Sparkasse. If you are already a Sparkasse customer, the process can also go faster.

Duration of credit processing Santander

- Approval Credit Request: 0 working days (Automated testing in a few seconds)

- Subsequently Sending credit documents by post: 1-2 workdays

- Return credit documents by mail: 1-2 workdays

- Subsequently Checking credit documents at Sparkasse: 1-2 workdays

- Disbursement Credit: 0 business days (real-time transfer in a few seconds)

- Accordingly, the Total duration from application to payment at Sparkasse personal loan: 3-6 working days

5. DSL Bank Loan approved, when disbursement?

DSL Bank Loan approved, when disbursement?

→ 7 business days

The DSL Bank offers both installment loans as well as construction financing which differ significantly in the duration of the application. The DSL Bank is one subsidiary of the German bank.

Duration payment installment loans at the DSL Bank

The payment after the approved loan application takes about 7 working days at the DSL Bank. However, it can sometimes take longer. The DSL is notorious for long processing times, cumbersome forms and poor availability.

Total duration from application to payment for the DSL Bank personal loan: 7 working days

Duration of payment of construction financing (land charge loan) at the DSL Bank

Construction financing generally takes longer than an installment loan due to the increased complexity. However, the DSL bank is not really fast here either. Numerous reports from loan seekers at the DSL Bank report weeks of duration, grueling forms and poor accessibility of customer service. Therefore, before closing, take a look at the current construction financing recommended. It is generally difficult to specify a duration when paying out mortgage loans. Because the payment also depends on the notarial entry of the land charge. land charge away.

6. targo bank Loan Approved, When to Pay Out?

Targobank credit approved, when payment?

→ 2-3 working days

But at Targobank, too, identification is carried out conveniently and easily from home via video. If Targobank has accepted the loan, you can upload the proof of income via the bank's online portal. However, Targobank still offers to send in the documents by post. When everything is in place, the final check of the payout at Targobank only takes a few minutes few working days.

Thus, dThe payment after the approved loan application at the Targobank totals about 2 to 3 working days with digital application. Payment by letter, on the other hand, takes time 4-7 business days.

If the Targobank has already approved the loan, the transfer to your account only takes about 2-3 working days.

If you are also already a Targobank customer, the process is usually quicker.

| Fully digital application | Proof of income by letter | |

|---|---|---|

| Approval credit application | 0 working days (Automated testing in a few seconds) | 0 working days (Automated testing in a few seconds) |

| Sending credit documents | 0 working days (Online) | 1-2 workdays |

| Return of credit documents | 0 working days (Online) | 1-2 workdays |

| Disbursement credit | 2-3 workdays | 2-3 workdays |

| Total duration | 2-3 workdays | 4-7 workdays |

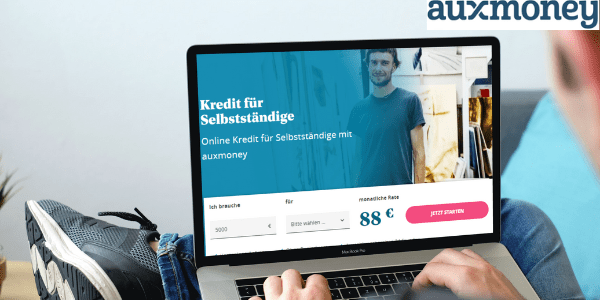

7. Auxiliary Credit: how long does the payout take?

Auxmoney credit how long does the payout take

→ 1 business day

After requesting one Auxmoney instant credit* the preliminary check of your creditworthiness takes place. This is done automatically without human intervention. Within a few minutes you will find out whether the Auxmoney loan can be paid out directly. If you want to accept the offer, identify yourself via video and sign on the mobile phone screen using eSign. Your documents will then be checked for completeness. If everything fits, the money is already in 24 hours on your account.

If you send the documents in by post, you will receive the money in your account within a few working days. are common 3 to 6 business days.

| Fully digital application | Proof of income by letter | |

|---|---|---|

| Approval credit application | 0 working days (Automated testing in a few seconds) | 0 working days (Automated testing in a few seconds) |

| Sending credit documents | 0 working days (Online) | 1-2 workdays |

| Return of credit documents | 0 working days (Online) | 1-2 workdays |

| Disbursement credit | 1 workday | 1-2 workdays |

| Total duration | 1 workday | 3-6 workdays |

8. How long does the loan payment take Maxda?

How long does the loan payment at Maxda take??

→ 7 business days

Maxda is not a bank, but cooperates with several banks as a credit broker. Therefore, the duration of the payment for the loan payment at maxda also depends on the partner banks. In many cases, the processing from the application to the transfer of the money takes about 7 working days. The submitted documents are checked on the same day. The actual loan request is then made to a partner bank.

Total duration from application to payment for Maxda loans: 7 working days

9. bon credit – How fast is the payout?

Bon Credit – How fast is the payout?

→ 1-7 business days

The credit professional Bon-kredit works relatively quickly. Therefore, in the best cases, the payout only lasts 24 hours. However, additional fees often have to be paid for this. Because the partner bank charges additional fees for the “lightning loan”. Here is the lightning fast one Credit in 1 hour on the account without Schufa.

It has already been noted: The duration of the credit payment for Bon Credit always depends on the partner bank away. Then Bon-kredit does not issue the loans itself. If the partner bank is from Germany, the regular payout (without an express surcharge) often takes 3-4 working days. The prerequisite for this, however, is legitimation via Video Ident and a digital account check.

At the Swiss credit without Schufa The Sigmabank is processing in 3-4 business days though not possible. As an intermediary, Bon-kredit cannot change or accelerate this. Because at the Sigmabank, all documents still have to be submitted by post. This extends the duration of the payment of the loan to 7 to 8 working days

10. Smava Loan agreement signed: When will the money come?

Smava loan agreement signed When will the money come??

→ 2-7 business days

With Smava, the money comes to your account within 2 working days after the preliminary loan agreement (actually: loan application) has been signed. The prerequisite for this is that the identification via Video done and you your income over that digital account check proves. If you prove your income by letter, the loan payment takes about a week or 5 to 7 working days.

11. ING Loan agreement signed: When will the money come?

ING loan agreement signed: When will the money come?

→ 1-5 business days

You complete the loan application online at ING. The application only takes a few minutes. The final loan approval usually takes then three business days. When the money arrives in your ING account also depends on your creditworthiness and the amount of the loan. With ING credit, however, the money gets into the account of existing customers faster.

Because ING customers often receive payment of the loan within 24 hours.

Another special feature of the ING loan is the choice of the payment date. Because you can get the loan immediately or at a desired time within 3 months.

12. DKB Loan agreement signed: When will the money come?

DKB loan agreement signed: When will the money come??

→ 1-5 business days

If you give the bank permission to view the account, the payout with the DKB loan is extremely fast. If everything goes well, the money will come within 24 hours to the account.

The contract is electronically signed beforehand. When the DKB has all the documents, the bank decides immediately whether to approve the loan. However, the payment is even faster for DKB customers. Because as a customer of the DKB, you will receive the loan amount on the same day.

Background to the question "When will the money come after the loan agreement is signed?” to understand

What influences the loan payment?

You can influence the duration of the loan payment by the type of application.

- Do you ask that application online this saves postal routes and the money gets to your account faster.

- Furthermore, the money comes to your account faster if you over identify video. Because the video identification saves a postal route compared to Postident and thus about one to two working days processing time.

- Of the digital account check also saves another two working days. Because the cumbersome printing out of payslips and posting is no longer necessary. Instead, the bank checks your salary digitally via an interface to your online banking.

What is the process between applying for a loan and paying out the money?

First you provide one credit application at the bank. When applying for a loan, an initial preliminary check of the creditworthiness is usually carried out. If you want the payout to be quick, the bank you apply to must match your credit rating. Because banks often reject the smallest abnormalities in the Schufa. Therefore you will find in the article 'Which bank grants credit with bad credit?, Help. Because the credit providers listed there pay out quickly and unbureaucratically even in difficult credit cases.

After you have submitted the loan application, the next step is the Legitimation. Your identity will be checked here. The quickest way to do this is via a video call where you show your ID. The bank will send you a special link for this.

Following will more documents how payslips or the registration certificate part II car loan, required. Assuming the Bank takes the vehicle title as security. Many banks offer online services such as portals for uploading PDF documents or a digital account check. This saves a lot of time and paperwork. The bank then reviews the loan application. If everything digital as with Smava* works, the payout only takes about two working days after the application has been submitted.

What else you can do when the loan contract is signed to get the money faster

Use digital opportunities to take out a loan. videoident and digital account check halve the time to payout.

Where the money comes faster when the loan agreement is signed

1. Direct bank

With direct banks such as DKB or ING, the loan is paid out the fastest. For existing customers, the payment is usually on the account within 24 hours. With most direct banks, no more paperwork is necessary. But their people also receive a loan from direct banks in about three working days.

2. Branch bank

In the case of branch banks, on the other hand, a somewhat longer duration of the loan disbursement is to be expected. Since a lot of things are still done by letter here, the loan payment takes between 4 and 7 working days. However, existing customers are again an exception here. Many branch banks can also pay out loans to existing customers within 24 hours.

3. Credit Intermediaries

Credit intermediaries like Receipt credit* or Smava* can keep up with the speed of loan payouts from direct banks. Finally are Payouts in 24 hours possible through express or instant credit. However, the payout speed also depends on the credit rating and loan amount. The payment is faster with a good credit rating. This is due to automated credit checks by the banks. Because these algorithms generally reject people with poor credit ratings. If the credit rating is poor, however, the money can only be paid out after manual control.

Conclusion: Credit agreement signed: When will the money come?

In summary, it depends on your creditworthiness, the Amount of the credit and the digitization of the loan application via Vvideo identification, eSign and digital account checkwhen the payment takes place.

With the fastest providers, small loans are already in 30 min on the account. With most banks, on the other hand, these larger installment loans need between 2 and 7 working days to be paid out.