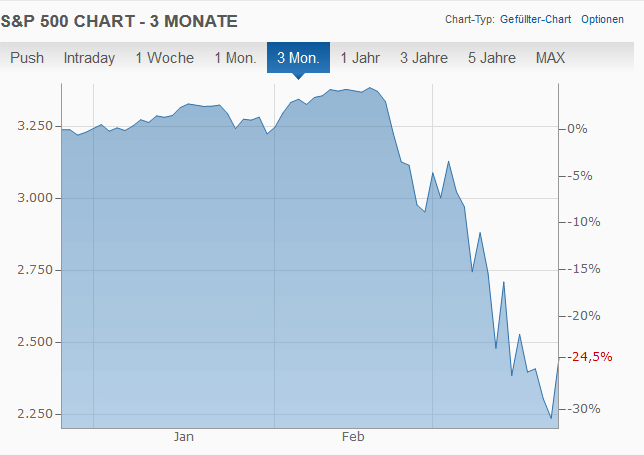

Whether on YouTube, in the relevant financial blogs or in the mirror. Many are reasonable and advise: to use the stock market crash to buy shares. It's the best time in a long time! After all, everything is much cheaper now! The S&P500 crashed from 3,394 to 2,192 points. Price losses of a third. The Dax is even wilder. And that within a month. The crash is due to the ongoing coronavirus pandemic. Below is the chart of the S&P 500.

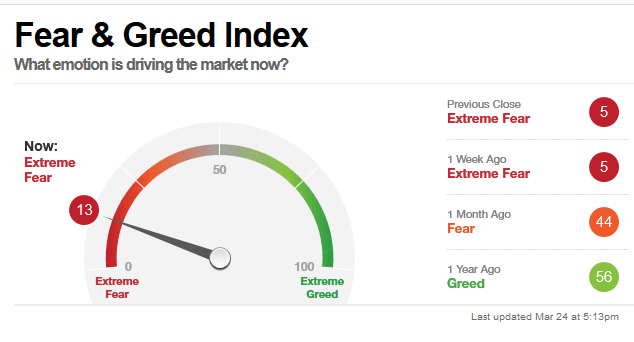

fear and greed

What you can learn here

- fear and greed

- Buying shares in the stock market crash: intelligence is not everything

- Buy stocks in a stock market crash with Emotional Intelligence

- The right mindset of successful investors in the corona crisis

- How to invest successfully in the crisis

- With 2 rules to success!

- Buy shares in the stock market crash: with a world ETF you are doing everything right!

- one further amendment

Fear and greed are the reasons why it's so hard to buy stocks during a stock market crash. Fear and greed are the main price drivers in the markets. Smart investors can take advantage of both cases. In an environment where fear reigns, there is a sell-off of securities of all kinds. Even well-established quality companies are punished unduly.

The key to success now lies in buying companies that have been wrongly penalized. So those where the price has collapsed sharply, although the Fundamentals still excellent are. A common mistake is to buy companies that have been hit hardest by a drop in prices (tour operators like TUI, or airlines like Lufthansa). This rarely ends well. Most of the time it's the grip of a falling knife.

The CNN stock market barometer shows fear on the stock markets. A signal for long-term investors to buy high-quality stocks now.

Legendary investor Warren Buffett said the following:

be greedy if the other fear have and scared, if they are greedy

Warren Buffett

As we have seen in other posts (e.g here, here and here) have already dealt with, it is important to proceed in moderation. By increasing ETF savings plans, buying companies with solid financial metrics, you chart paths to long-term success and operate real investing. On the other hand, betting on the next vaccine manufacturer or the travel industry is speculation, since the outcome is totally open.

By the way: Even low earners can and should save and invest. We have some ways to do this in a past one post Office treated.

Buying shares in the stock market crash: intelligence is not everything

I would like to present three sentences from an interview that Buffett gave to the American business newspaper Businessweek in June 1999. There is a lot more depth in these sentences than you might think at first:

“Success in investing does not depend on IQ. If you're of average intelligence, you need the right temperament to control the emotions that get other people into trouble when investing. Investing is not a game where the player with IQ 160 beats the other player with IQ 130.”

Warren Buffett again

Buffett aims to ensure that analyzing stocks with precision is a secondary priority. It is more important to be able to keep your emotions, i.e. fear and greed, in a controlled state. What is meant is the "emotional intelligence" (EQ) that a successful investor needs. I conclude from his review that EQ > IQ applies to investing, which makes sense since many professors are documented as not being millionaires either.

Buy stocks in a stock market crash with Emotional Intelligence

Emotional intelligence is the ability to perceive, understand and influence one's own feelings and those of others. Emotional intelligence plays the main role in the stock market. On the other hand, the intelligence that an investor puts into his analysis only plays a subordinate role. The key to success in the stock market is right mindset. In other words, being aware of your own feelings. This makes it possible to keep fear and greed under control.

The right mindset of successful investors in the corona crisis

Many investors - especially if they have not yet experienced a stock market crash, as we are currently experiencing due to the Corona Pandemic - find it difficult to deal with price losses. You can't stand the deep red numbers in your portfolio. In such a situation, instead of seeing an opportunity to buy stocks of great companies at deep discounts, people become afraid that they will lose their money. This fear then often leads to panic selling at rock-bottom prices.

On the other hand, those who can control their emotions make a better cut. Warren Buffett's yield with Berkshire, or the high long-term yield of the MSCI World, which can't sell anything, are good examples. When the guns are thundering outside, it's time to stock up on your portfolio.

How to invest successfully in the crisis

In addition to a certain indifference to the constant fluctuations on the stock market, there are other pieces of the puzzle that will make you successful on the stock market. This includes regular investment. This smooths price fluctuations over time. If you invest money through a monthly savings plan, you buy more stocks when prices are low than when prices are high. The Americans say "Dollar cost averaging“.

Since the stock market is too complex even for professionals to really understand, this approach is much more successful than trying to find the best times to buy and sell. If you want to save up a cushion for your retirement provision, it makes no sense to sell anyway.

The points of regular investing and composure in the event of price declines are the two points that make up a long-term successful investment. The other things that keep coming up, like asset allocation or rebalancing only come in third and fourth place. Of course, there is nothing wrong with thinking about it. However, you should prioritize the two top priorities regular repurchase and Calmness in price declines then already ticked off.

The points of regular investing and composure in the event of price declines are the two points that make up a long-term successful investment

With 2 rules to success!

These two rules are simple. And they work. If you manage to apply them, you can beat numerous fund managers in their investment strategy. In contrast to you, the professionals are subject to several constraints. I have in me what these are this article treated. This gives you great advantages over professionals! And exploiting them isn't even difficult...

Buy shares in the stock market crash: with a world ETF you are doing everything right!

You don't have to be an expert in the stock market to make money. All you have to do is follow the two rules. This also works if you're saving a world ETF like the Vanguard FTSE All World.

A mixed bag of stocks contained in a world ETF will make you wealthy for 15 years or more. Control your emotions. Emotions are deadly in the stock market. Stick to your investment strategy even on bad days when the stock markets are tumbling down. You will reap the fruits of this stubbornness a few years later.

one further amendment

With this article I assume that Blog parade by Jürgen from the ETF blog on the topic of "Private wealth creation in Corona times". You can find articles by other authors in under the link on Jürgen's ETF blog.

3 thoughts on “Börsencrash: Die Beste Zeit um Aktien zu kaufen. 2 einfache Regeln!”