This is about buying a share with an online depot. If you are a stock market beginner and just starting to trade, the question "How do I buy shares?" arises. Therefore, I explain step by step how to buy a share using the example of the onvista depot* can buy. The procedure is similar for other brokers.

Without liquid market it will be expensive...

When buying shares, it is always important that the market is sufficiently liquid, otherwise the prices will be higher. It is therefore best to carry out your securities transactions on trading days between 9:00 a.m. and 5:30 p.m.

What you can learn here

How do I buy shares (as a beginner)?

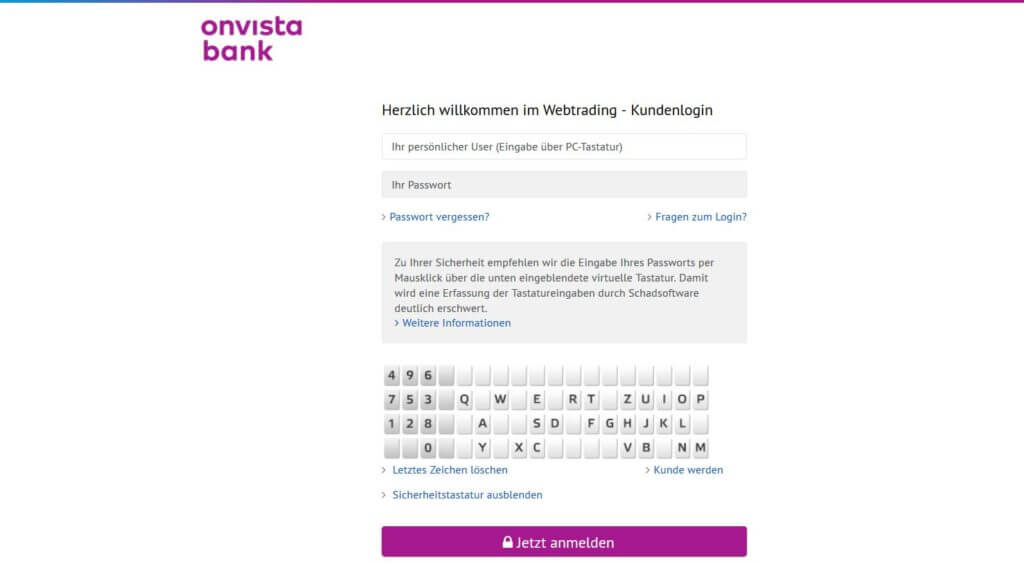

How do I buy shares? – Log into the depot

First you log in to your broker. The process is shown here using the example of the Onvista depot. However, the process is comparable with other banks and brokers. you need one username and a password. The bank will give you your username when you open the account. You set your password as part of the opening process.

Define risk classification according to MiFID II (only for first-time securities account use)

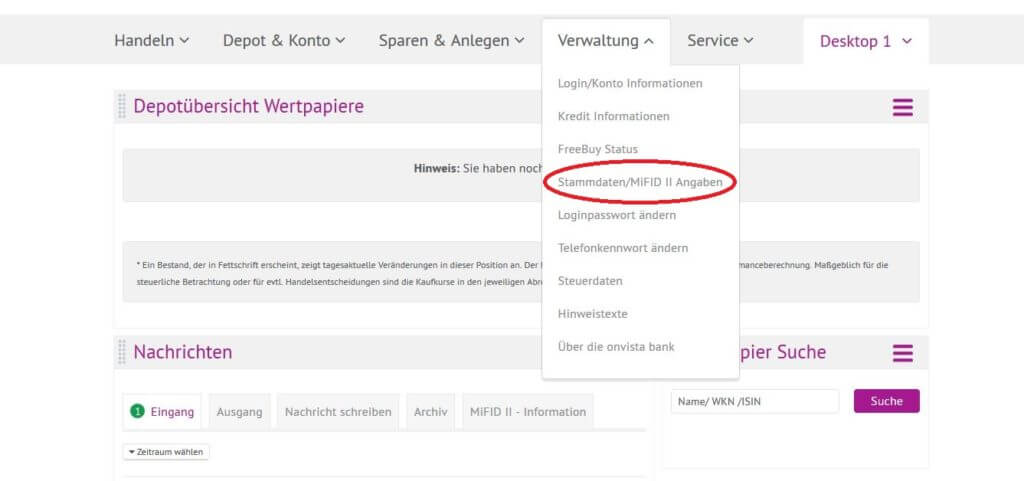

When you use your portfolio for the first time, you must first determine your risk rating. The bank only allows you to trade securities that are within the risk rating. Go to the tab administration and click Master data/MiFID II information. Here you can also check your personal data, such as your address, again.

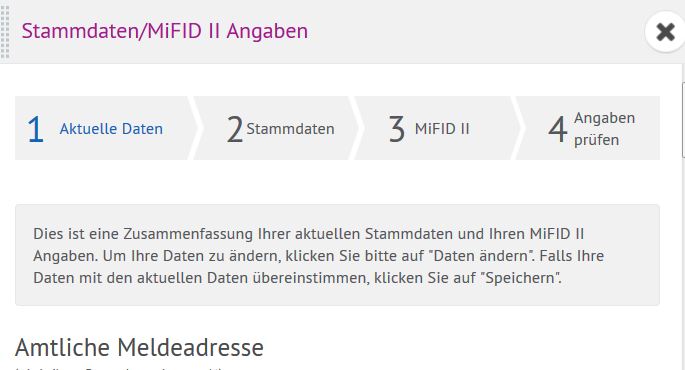

A window will then open in which you can define your master data and your risk classification in accordance with the MiFID II financial market directive. You can navigate through the menu by clicking on the appropriate tabs. To make changes, you must first click the button at the bottom change data click.

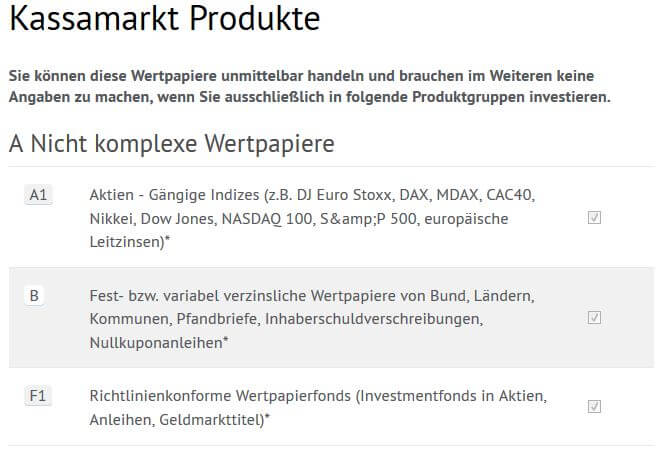

If you only want to invest in the large and common indices, fixed and variable interest securities and funds that comply with the guidelines, the standard rating A, which onvista set for you when you opened a securities account, is sufficient. If you would like to invest in other stocks, tick the appropriate box and enter the number of trades in the last three years. We bought the Vanguard FTSE All World. The standard classification was sufficient for this.

After you have made your risk settings and clicked through all 4 tabs, save your settings on the last page.

Open the Security Order module

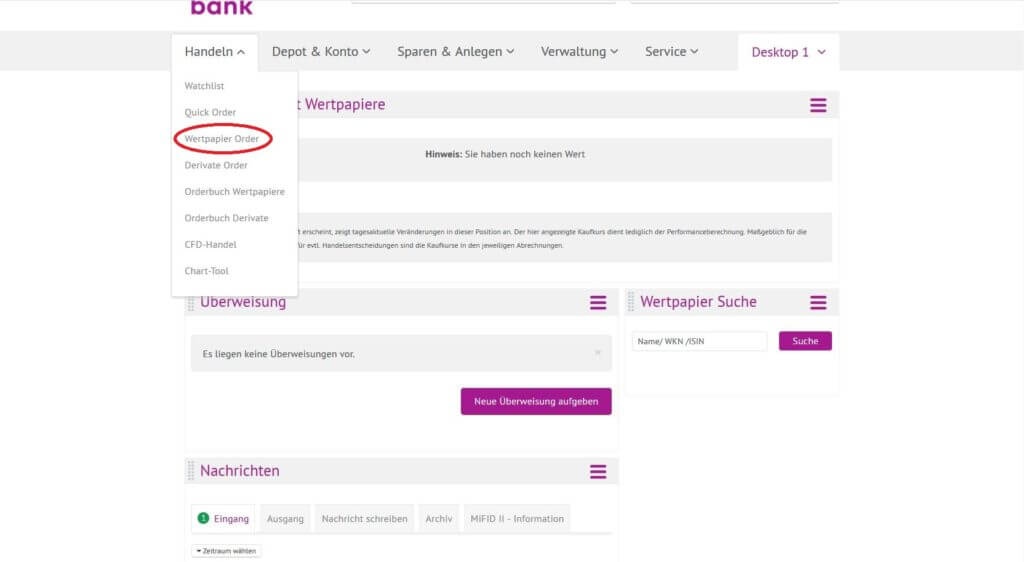

This step is onvista specific. Other banks have different input masks for securities orders.

After you set your risk preferences, you can buy any security that falls within your risk rating. To buy a stock, you have to onvista clearing account be covered. If this is not the case, make sure you have sufficient funds on your onvista clearing account and then come back to this page. Is your account already covered? Excellent! Then go to the menu Trade → Security Order.

The Security Order window opens on the page. If you get a message that this window is already open, scroll down. If you get the message that it cannot be opened because more than 5 modules are already active, first close another module and then try opening the Security Order module again.

Search for shares, check costs and place orders

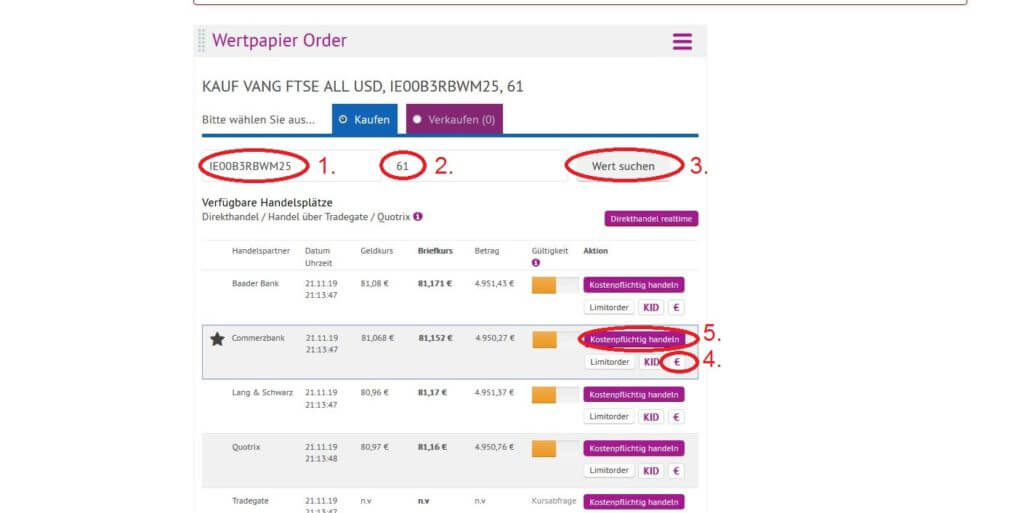

in the security order Window allows you to specify the securities on WKN or ISIN (Field 1 in the picture) and the number of desired number of pieces (Field 2 in the picture) by clicking on "seek value“ (Field 3 in the picture). In the example we are looking for the Vanguard All World ETF with the ISIN IE00B3RBWM25. You can find the WKN or ISIN via a Google search or e.g. B. also about finanzen.net. Different trading places are shown where the share can be traded. When buying the share is the ask price to pay when selling the bid rate. About the small € symbol (Field 4 in the picture) you can check the fees for buying the share again at the trading venues. In our case, there were €8 total fees for the purchase.

Enter the WKN or ISIN of the security you want to buy in the search field. Select "buy" and give the number of pieces a.

Once you have reviewed fees and familiarized yourself with the appropriate trading venue, you need to go through the "seek value' (Step 3 in the image) as the time to act, represented by the elapsing time bar, is likely to have expired after these checks. When buying a share, direct trading is often cheaper than the stock exchange. However, you can always check this on a case-by-case basis, as all courses are displayed to you.

Note: When buying a share, direct trading is often cheaper than the stock exchange

After the page has loaded new ones, you then click on "Trade for a fee" (step 5 in the picture). If everything went well, you will now receive a confirmation of the process. Attention: There is no further TAN or PIN query onvista.

Securities are traded over-the-counter direct bought from or sold to a specific trading partner. In contrast to the stock exchange, investors trade here direct with the respective trading partner – without going through a course broker who brings together buy and sell orders.

Direct vs. exchange trading

in the direct handsl securities are bought from (or sold to) a specific trading partner over-the-counter. In contrast to trading on the stock exchange, there is no need to go through a price broker who brings together buy and sell orders. By eliminating the broker, direct trading often has a cost advantage.

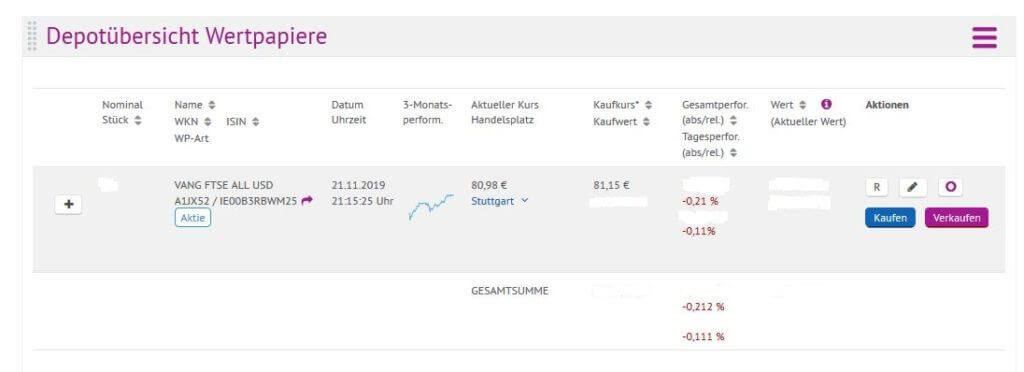

Checking the purchase in the depot overview

About the rider Custody account overview securities you can follow the file now. It is usually displayed in the overview immediately after purchase. In exceptional cases, however, it can also take one or two bank working days for the share to appear in the overview.

Conclusion: How do I buy stocks

The best way to buy stocks, funds and ETFs is online via your securities account. The fees are many times lower than at branch banks. When it comes to the purchase itself, direct trading is often cheaper than the stock exchange. There are thus two advantages to direct trading: First, the security is purchased at a current, fixed price. Furthermore, the purchase is often cheaper overall than on the stock exchange.

If you are buying a share for the first time, here are all the steps at a glance:

- Log into the depot

Define risk classification according to MiFID II (only for first-time securities account use) - Open the Security Order module

- Search for shares, check costs and place orders

- Checking the purchase in the depot overview

With this I was able to bring you a little closer to the topic "How do I buy shares". When buying shares, it is always important that the market is sufficiently liquid, otherwise the prices will be higher. It is therefore best to carry out your securities transactions on trading days between 9:00 a.m. and 5:30 p.m. Make sure to choose the cheapest direct dealer. If there is no difference in prices, choose the lowest purchase price. Before you finally place your order, you should always check how much your order costs in total.

You can find more articles on stock exchanges and depots in the category Brokerage account. You can find the best securities accounts in the depot comparison and if you already feel confident about increasing your risk, you can Securities loan comparison check the conditions for this. Note that Stock market crashes are usually the best time are for repurchase.