If you're wondering which bank you can open a P-account with and you might have one or the other negative Schufa entry, you've come to the right place.

Because here you get recommendations from Which bank do you have a P-account with bad creditworthiness or negative Schufa can open. This is Schufa-free accountswhich can also be opened with negative Schufa entries. To the banks: Commerzbank, Comdirect, ING, norisbank, Consorsbank, DKB, Targobank, Sparda Bank, German Bank, postal bank as well as the Sparkasse and the Volks- und Raiffeisenbanken, since it is not possible to open an account there with a poor credit rating.

Open a P account – which bank? – If you are wondering which bank you should open a P account with due to negative Schufa entries or a bad credit rating, we recommend that Pay center with the Supremacard*, which can be fully digitally converted into a P account without Schufa. But that too N26 account* can be opened with bad credit and negative credit bureau and converted into a P-account.

In order to be able to open an account with a bad credit rating, you have to click on a checking account without Schufa to avoid this. The Account without Schufa Query from Pay center with the Supremacard* is particularly good. It can be converted into a P-Konto with just a few mouse clicks.

In addition, the Pay Center account is the only Current account without Schufathat is explicitly aimed at people with bad credit directs. This allows you to rule out the sudden termination of the account, as is common with other current accounts without a Schufa. But that too N26 account* can be opened with a bad credit rating and negative Schufa and converted into a P-account It convinces with many features and the lowest fees compared to other Schufa-free P-accounts.

What you can learn here

Which bank to open a P account with? (Despite bad creditworthiness)

At which bank can you open a P-account without any problems and despite poor creditworthiness (e.g. due to the garnishment)? Here are 6 accounts without Schufa which can also be opened with a negative credit bureau.

| Current account without Schufa | P-Konto Suitability | Rating as P-Konto | functions | Services |

|---|---|---|---|---|

P-account conversion without paperwork (not possible with any other bank) Opening possible despite negative Schufa entries As a P account: full account + seizure protection with German IBAN | Account that can be opened directly as a P-account despite negative Schufa entries Credit based account |

| More information: supremacard.de | |

| Easy to carry out P account conversion Opening possible despite negative Schufa entries As a P-account: Full account + seizure protection with German IBAN and many features such as sub-accounts, Moneybeam, etc. | Open an N26 standard account. If your credit rating is bad, you will automatically receive the N26 Flex. Credit based account |

| To the N26 review To the provider: N26.de |

| P account conversion is cumbersome and the app can only be used to view credit afterwards After P-account conversion, no more orders can be executed via the app and you have to contact support As a P account, it is not a full account, but effective protection against garnishment. | Inexpensive smartphone account - opening possible despite Schufa Credit based account Opening possible despite negative Schufa entries |

| More information: Tomorrow.de |

| Complicated opening: Identification via scanned ID card Opening via Post-Ident not possible Possible problems with direct debit payments due to Spanish IBAN No garnishment protection possible | Free current account from Santander Bank - the largest bank in Spain Credit based account Opening possible despite negative Schufa entries |

| More information: Openbank.de |

No garnishment protection possible | Inexpensive smartphone account - opening possible despite Schufa Credit based account Opening possible despite negative Schufa entries |

| More information: Bunq.de | |

| P account conversion is cumbersome and the app can only be used to view credit afterwards After P-account conversion, no more orders can be executed via the app and you have to contact support As a P account, it is not a full account, but effective protection against garnishment. | Free smartphone account that can be opened despite negative Schufa entries Credit based account Opening possible despite negative Schufa entries |

| Contract can only be concluded directly with the provider. |

| Western Union | p class="buttonrot"> P-Konto Opening not possible due to Austrian banking license No garnishment protection possible | Free smartphone account that can be opened despite negative Schufa entries Credit based account Opening possible despite negative Schufa entries |

| Contract can only be concluded directly with the provider. |

| insha | - Banking services according to Islamic principles

| |||

| monese |

| |||

Revolut |

| More information: Revolut.com | ||

| Wise (formerly TransferWise) |

| |||

| vimpay |

|

Open P-Konto - Which bank? The Pay-Center Supremacard [Recommendation]

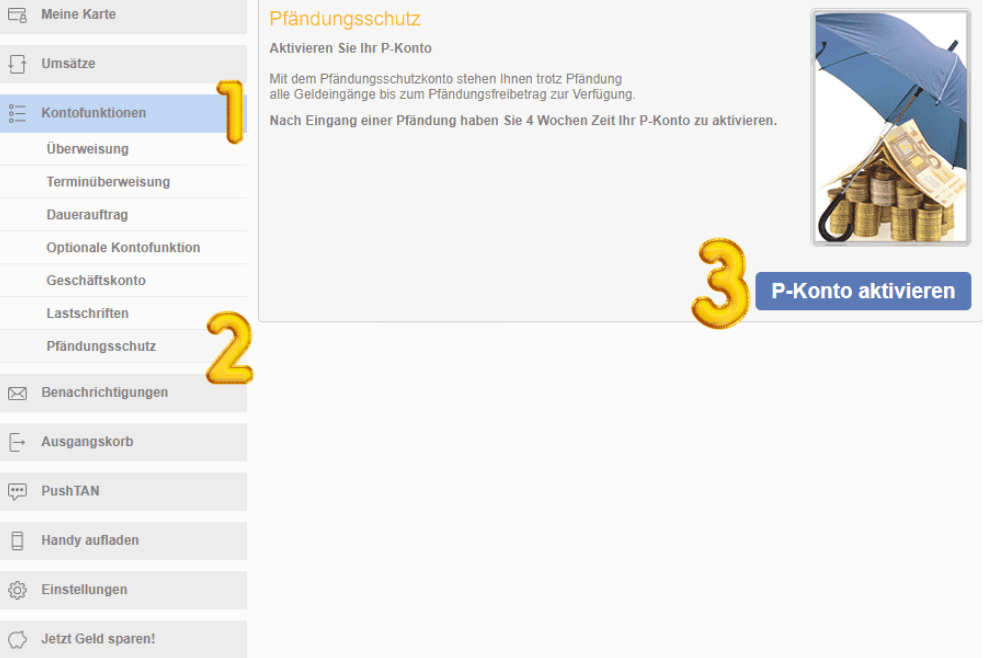

The provider Pay-Center has specialized in garnishment protection accounts. That's why the Pay-Center P account also stands out in the list. Because the Pay-Center P account is the only one that can be converted directly online into a P account. You can convert the P account after opening the account under "Account functions -> Protection against garnishment". The basic allowance is then protected against seizure. If you want to protect additional amounts, you can also find the necessary form at Pay-Center. You can open the Pay-Center account despite Schufa and seizure. You can then either use it as a checking account without Schufa or convert it to a P account with just a few clicks of the mouse.

No rejection or termination

The Paycenter Supremacard has no other products such as loans with which the provider has to earn its money. Instead, Paycenter focuses on the Girokonto incl. debit card for people with a poor credit rating and negative Schufa. Other products are not even offered.

This is an advantage, because with the Paycenter Supremacard you do not have to expect your account to be terminated unexpectedly by the provider, as is often the case with other current accounts without Schufa. Instead, Paycenter understands the needs of people in debt and offers them an easy-to-set-up Pfändungsschutzkonto without Schufa.

Pay-Center's account includes one Mastercard debit Map. Like the account itself, this is managed on a credit basis. One opening is at Paycenter possible despite negative credit bureau. The only drawback of Pay Center P-Konto is the high account management fees of over €10 per month. A further €5 is charged for the use of the Mastercard and transfers cost another €5.

For these fees, you get a fully-fledged account with a German IBAN and a debit card for cashless payments. In addition, Pay-Center is by far the easiest way to convert to a P-Konto.

Advantages and disadvantages: Pay center Supremacard

| Benefits Pay Center P account | Disadvantages Pay Center P account |

|---|---|

| ✔️Account can be converted into a P account online, without paperwork and forms | ❌high fees |

| ✔️ The provider does not terminate accounts due to poor creditworthiness | |

| ✔️ Account despite Schufa and open attachment | |

| ✔️Mastercard Debit | |

| ✔️Provider knows the needs of people in debt |

Verdict: Pay Center Supremacard

This is suitable as a checking account without a Schufa Pay center with the Supremacard* is particularly good. It can be converted into a P-Konto with just a few mouse clicks and without any paperwork. In addition, the Pay-Center account is the only Girokonto without Schufa that is explicitly aimed at people with a poor credit rating and can be opened directly as a P-Konto.

This means you can rule out sudden account termination, as is common with other current accounts without Schufa. If you are wondering which bank you should open a P-Konto with and you already have a Schufa entry - you will find an account with good support and maximum ease of use at Paycenter - without paperwork and forms.

Open P-Konto - Which bank? - N26

If you are not yet a customer of N26, you can only do that with negative Schufa entries N26 Flex account open an account. You can open this account despite a negative Schufa. The N26 Flex account costs €6 per month. Since there are no other costs, the N26 Flex account is cheaper than the Pay-Center account, which costs between €10 and €20 per month depending on usage.

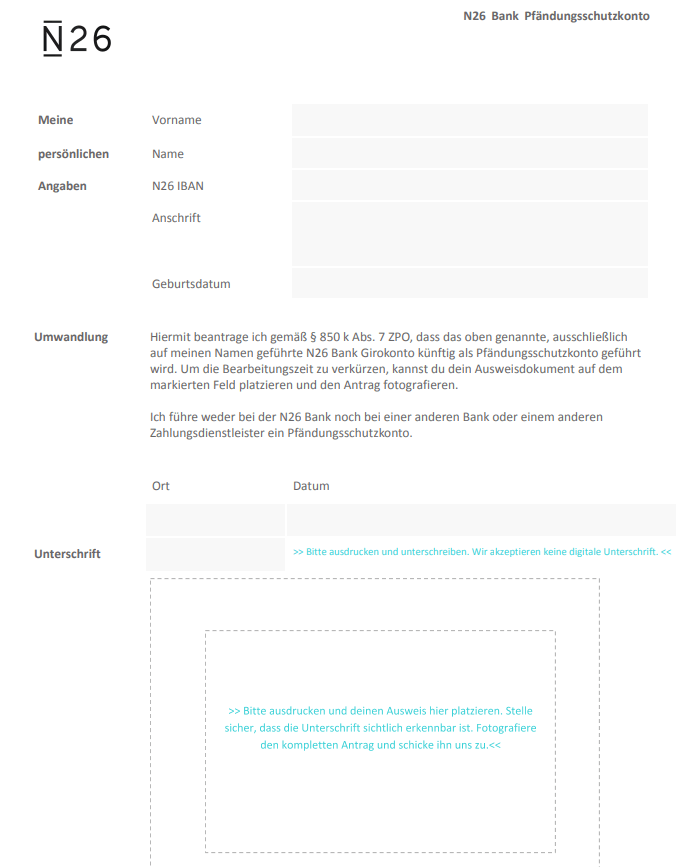

Conversion of the N26 P-Konto to a Pfändungsschutzkonto is possible via the N26 website* available form easily possible. However, converting the account into a P-account at Pay-Center is much easier and can be managed in 3 clicks in online banking. N26 still has to improve here. When opening the account you can on the N26 website* try opening the N26 standard account. If your credit rating is not good enough for this, the bank will automatically offer you the Flex account.

To open the Flex account, you have to open the N26 standard account for 0 euros. If the bank classifies your credit rating as too bad, they will assign you the flex account instead.

Free conversion of the N26 account to a P account

If you are already a customer of N26t, you can have both the N26 Standard account and the N26 Flex converted into a P account. There are no additional fees for this. The fees for the N26 P account are therefore the same as before the P account conversion. If you previously had the N26 Flex account, you will continue to pay €6 per month. On the other hand, if you had the N26 standard account, that is too P account still free.

. The provider provides you with a form on the website for converting your account into a garnishment protection account that you have to print out and sign. You then send the form with a copy of your ID as a photo or scan to N26. To do this, simply place your ID on the fully completed and signed form below and take a photo of it with your mobile phone, which you then send to the bank.

N26 P account: lots of features and still cheap

That's how convincing it is N26 P account* with easy handling and many features that even put the Supremacard account in the shade (e.g. Moneybeam). In addition, at €6 per month, it is significantly cheaper than the Pay-Center account. Customers with bad credit bureau are not rejected at N26. Instead, the bank offers the N26 Flex account if the credit bureau is negative.

Advantages and disadvantages: N26 P account

| Benefits N26 P account | Disadvantages of N26 P account |

|---|---|

| ✔️ Cheaper fees than pay centers | ❌no specialization on people who need a P account |

| ✔️ Open an account despite Schufa and seizure (N26 Flex) | ❌P account conversion only possible via form |

| ✔️ Mastercard Debit | |

| ✔️ Apple and Google Pay can also be used with the N26 P account |

Verdict: N26 P account

This is suitable as a checking account without a Schufa N26 Flex account* as a cheaper alternative to the Pay-Center account. It cannot be converted into a P account without any paperwork. If you are wondering at which bank you should open a P-account and you already have a Schufa entry - you will find an account without compromises with the N26 Flex account. The N26 account not only comes with a Mastercard debit, you can also use many other functions such as Apple and Google Pay for payment. Only an overdraft of the account is no longer possible after the account has been converted into a P account (as with all other banks).

Open P-Konto - Which bank? - Vivid

Vivid offers a free account that can be opened despite negative Schufa entries. To do this, you first enter your telephone number on the page from Vivid* and then install the app. The Vivid account is included without Schufa and to open Postident. Instead, it is sufficient if you identify yourself via video identification. You can then fully use the account. the Opening takes place despite Schufa and garnishment, as Vivid does not check these registers. Here's how you can use this account as a new account despite seizure open.

However, the conversion of the Vivid account into a P account is complicated and only works through the Solaris Bank. The Vivid app can no longer be used after conversion into a seizure protection account. Any bookings must go through support.

Advantages and disadvantages: Vivid P account

| Benefits Vivid P account | Disadvantages Vivid P account |

|---|---|

| ✔️ Open an account despite Schufa and seizure | ❌The conversion into a P-account is cumbersome to carry out via the Solarisbank |

| ✔️ free account | ❌The app can hardly be used after converting to a P account |

| ✔️virtual debit card |

Verdict: Vivid P account

The Vivid account is a good choice if you want to open a checking account without a Schufa. You can also use Vivid to invest in stocks and ETFs. With the virtual debit card you can get cash for free. On the other hand, if you are wondering which bank you should open a P account with, Vivid is not a good address. The reason for this is the strong restrictions of the app after the P account conversion. Here you can find out more about Vivid account without Schufa*.

Open P-Konto - Which bank? - Tomorrow

The Tommorrow account is a credit bureau-free checking account, which can also be converted into a P account with a few hurdles. However, app usage will be severely restricted after converting to P account. Transfers, direct debits and card payments when converting to a P account at Tomorrow are only available via support. Unfortunately, you can no longer submit these yourself via the app. In the Tomorrow app you can only see your account balance and booking history. The Tomorrow account has a debit card for a small monthly fee of 3 euros. The provider is also committed to environmental projects. The account is held at Sutorbank.

Advantages and disadvantages: Tomorrow

| Benefits Vivid P account | Disadvantages Vivid P account |

|---|---|

| ✔️ Open an account despite Schufa and seizure | ❌Converting to a P account is cumbersome |

| ✔️ cheap account | ❌The app can hardly be used after converting to a P account |

| ✔️Debit card | |

| ✔️Sustainability criteria |

Verdict: Tomorrow

Even if that Tomorrow account* is definitely worth recommending, the P account is not much use. The fact that you have to handle every booking process via support is a huge time waster. Here the P accounts offer from paycenter* or N26* Significantly more convenience, which more than justifies the somewhat higher fees charged by the two providers.

Open Bank - Unconventional seizure protection through Spanish bank details

The Openban account is free to open and account management is also free without receipt of money. You can also withdraw cash free of charge with the supplied Я42 debit card. This makes the Openbank account one of the last remaining free checking accounts without minimum deposit. In which Current account without Schufa Openbank is a Spanish account. Hence one Conversion to a P account is not possible.

. However, a Spanish current account can be an alternative to deposit money unconventional way to protect. Because the account is held under a Spanish IBAN, it is much more difficult for creditors to access it. Even if it is possible to garnish accounts across borders within the EU, in practice it is not worth the effort for smaller garnishments of less than €1,000. However, the “Spanish account” model cannot compete with a seizure protection account, where you have a legal right to the protection of your credit balance.

Advantages and disadvantages: openbank

| Advantages of Open Bank | Disadvantages Open Bank |

|---|---|

| ✔️ Open an account despite Schufa and seizure | ❌ The conversion into a P account is not possible, therefore no real garnishment protection account |

| ✔️ Certain seizure protection through Spanish IBAN | |

| ✔️ free account | |

| ✔️Debit card |

Verdict: openbank

The Openbank account is a good choice if you want to open a free checking account without Schufa. Get cash for free with the Я42 debit card. The Openbank current account is a Spanish current account, which is why there is a certain amount of protection against seizure, since your money is in Spain on the account. On the other hand, if you are wondering which bank you should open a P account with, Openbank is not a good address. Because a P-account conversion is not possible with Openbank. In addition, the protection is not comparable to that of a real P account.

Open P-Konto - Which bank? - Bunq

Bunq is another checking account without Schufa that recently also has a German IBAN. Nevertheless, Bunq's banking license is from the Netherlands. Therefore, you cannot currently open a P-account with Bunq. So if you have a Bunq account and the bank receives a seizure or enforcement order against you, it must comply with the legal requirements.

When it makes sense to open a checking account without a Schufa as a P account and when not

A new account could be a way out if you are in debt and the bank is having problems converting your account into a P account. But even if you have a joint account with your partner, you have to register in the event of a seizure New account open, because the garnishment protection can only be granted on individual accounts. It is therefore not possible to convert a joint account into a P account. Otherwise, you can have any German giro account converted into a P account free of charge by submitting an application to your bank.

It doesn't really matter which bank you keep your checking account with, because all banks have to convert an account into a P account within three days. However, as described in the previous chapter, there are some providers with foreign banking licenses, especially in the area of current accounts without Schufa. With these, it is not possible to open a P account. On the other hand, it is possible new account despite seizure to open - as was presented in another contribution. Credit bureau-free checking accounts from providers such as pay center* Particularly good due to their anonymity.

With which banks you can be New customer cannot open a P-Konto

At the banks:

- Commerzbank,

- Comdirect,

- ING,

- norisbank,

- consor bank,

- DKB,

- targo bank,

- Sparda Bank,

- german bank,

- postal bank,

- many Savings banks,

- and many Volksbanks and Raiffeisenbanks

is an account opening in the event of a seizure that has already occurred not possible. This is because these banks only offer an account to customers with good credit. However, if you are already a customer of the banks, it is possible to convert your existing account into a P account and this may not be charged.

Opening a new account as a P account can be very important

The opening of a new account despite garnishment can become very important in some cases. For example, if you only have one joint account with your partner, no credit can be protected on it. But even if you a lot of debt you, opening a new account can minimize the damage.

Checking account without Schufa as a way out

In order to be able to open an account in these cases, you must click on a Current account without Schufa evade. The account without Schufa query is suitable for this Pay center with the Supremacard* especially good. It can be converted into a P account with just a few mouse clicks. In addition, the Pay-Center account is the only current account without a Schufa that explicitly addresses itself people with bad credit directs. This allows you to rule out the sudden termination of the account, as is common with other current accounts without a Schufa.

What do you need to open a P account?

Depending on the bank and garnishment protection, different documents are required. The easiest way is to open a P account with basic protection of 1,260 euros. For this you need with the Pay center with the Supremacard* only 3 mouse clicks (see screenshot above). For other P-accounts such as N26, a copy of an ID card is also required.

If you want to increase the garnishment protection, you can do this by preparing the documents listed below. Armed with the documents, you go to a debt counseling service or a lawyer you trust and have a P account certificate issued to you. You then submit this to your bank maximum seizure protection to obtain.

With these documents you go to a debt counseling service to increase the P-account protection:

- you need one payslip from your employer to open the P account

- If you have an unequal monthly income, you must submit a current payslip for each month.

- If you receive unemployment benefit, you need the notification of approval to open the P account

- Du need the current one notice to child support to open a P account, pif you get any.

- Put the bank preferably in addition to the child benefit notice corresponding statement of account beforeright

- You also need bank statements from the last six months to open a P account

- Also the identity card is necessary

- If you have one alimony title you should have this Likewise show

- It is best to provide additional proof of payment of maintenance by submitting bank statements.

- If you have children, you also need them to open a P-account Children's ID cards

- Alternatively, you can also give the bank a one School or study certificate or a registration certificate show your children

How can I open a P account?

You can apply for a P account at your bank or savings bank. If you are the sole account holder, you can convert any German current account into a seizure protection account. According to the law, the bank may not charge any fees for the conversion of the P account. Even if your checking account is in the red, banks have been obliged to convert your account into a P account since December 2021. Previously, this circumstance was not clearly regulated and customers with debts were often rejected.

If you convert your account to a P account, the basic allowance will automatically be adjusted according to the current garnishment table set. If you are entitled to a higher allowance (e.g. due to maintenance obligations), you must provide the relevant evidence for this. In the section "What do you need to open a P account?" you will find a list of the documents you need to get the maximum seizure protection on your P account. You can convert your P account back into a checking account at any time. A message to the bank is sufficient for this.

Conclusion: Opening P-Konto - Which bank is best suited?

Open a P account – which bank? – If you are wondering which bank you should open a P account with due to negative Schufa entries or a bad credit rating, we recommend that Pay center with the Supremacard*, which can be fully digitally converted into a P account without Schufa. But that too N26 account* can be opened with bad credit and negative credit bureau and converted into a P-account.

Sophisticated P account concept of the Paycenter Supremacard

In order to be able to open an account with a bad credit rating, you have to click on a Current account without Schufa evade. The account without Schufa query is suitable for this Pay center with the Supremacard* especially good. It can be converted into a P account with just a few mouse clicks. In addition, the Pay-Center account is the only current account without a Schufa that explicitly addresses itself people with bad credit directed.

directs. This allows you to rule out the sudden termination of the account, as is common with other current accounts without a Schufa. A shortcoming of the Paycenter Supremacard account are the increased fees of between €10 and €20 per month. However, if you earn more money than the allowance anyway, you don't need to worry about it. Because you wouldn't have the money anyway.

Alternate N26

But that too N26 P account* is easy to use and has many features that make it even better than the Supremacard account. At €6 per month, it is also significantly cheaper than the Pay-Center account. Customers with a poor Schufa are not rejected by N26. Instead, the bank offers the N26 Flex account for negative Schufa.

To open the Flex account, you must open the N26 Standard account for 0 euros. If the bank deems your creditworthiness to be too poor, it will assign you the Flex account instead. However, N26 does not have a digital P-Konto opening, which is why the process takes a little longer. Nevertheless, N26 is a good alternative if you want to open a new P-Konto and are wondering which bank is best suited.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

I am a long time customer of Targobank. Wanted to convert my Girokonto (which is unfortunately in the negative) to a P-Konto. My request was rejected.

Targobank should not have rejected your application. Section 850 K of the German Code of Civil Procedure (ZPO) clearly states that accounts in the negative must also be converted. Specifically, it says here:

"A natural person may at any time request that a payment account held by him or her there be maintained as Pfändungsschutzkonto. Sentence 1 also applies if the payment account has a negative balance at the time of the request“