Find out in the following test report what experiences we have had with the free checking account of comdirect. How reputable is the bank and what does it offer?

comdirect is the direct bank of Commerzbank. This makes it one of the largest direct banks in Germany and has another subsidiary, onvista Bank. The current account of the Comdirect is an unconditionally free current account. On top of that you get one free VISA debit card and a giro card (EC card). the free VISA debit carde allows you to withdraw cash worldwide for free. In addition, three deposits at Commerzbank per year are free of charge. Furthermore, transfers and standing orders are free of charge.

Comdirect new customer offers: The bank is constantly making new offers for new customers. There is currently a bonus of 25 euros when using Apple or Google Pay.

Comdirect current account, is there an account management fee?

What you can learn here

- Comdirect current account, is there an account management fee?

- Comdirect current account – Withdraw cash free of charge – WORLDWIDE

- Google Pay & Apple Pay integration

- Giro and Visa debit card

- Comdirect experiences and conditions - all the essentials in brief

- Comdirect experiences of other users

- Conclusion on my experience with comdirect

The comdirect current account is another unconditionally free current account. The main rival is certainly the account of the DKB Cash.

Comdirect current account – Withdraw cash free of charge – WORLDWIDE

In Germany you can get cash free of charge with your free giro card (EC card) at the following banks: Commerzbank, German BankHypoVereinsbank and the postal bank . Furthermore at all participating Shell service stations and at up to 13,000 retail partners

In the euro countries except Germany at all ATMs that accept debit cards (EC cards) (almost all of them).

In all other countries you can get cash free of charge at all ATMs with the VISA symbol with the VISA debit card.

So you can access cash anywhere in the world for free. However, there is one exception: In some cases, the ATM operator charges individual fees. These are to be paid. The fee is then displayed on the machine.

Deposit cash at comdirect

Three payments a year are free of charge at Commerzbank. From the fourth payment per year, a fee of 1.90 euros will be charged. However, the deposit and withdrawal machine in the Commerzbank branch in Quickborn is free.

Google Pay & Apple Pay integration

comdirect now also supports Apple & Google Pay App. Cashless payment is even faster with the Apple or Google Pay app of the comdirect Visa card (debit card). After all, the Visa card no longer has to be dug out of the wallet. On the other hand, all you have to do is pull out your smartphone and you can pay in seconds using the smartphone app. You can also pay at any contactless terminal. If the amount is less than 25 euros, it is sufficient to switch on the smartphone display. On the other hand, for amounts over 25 euros, release by password or fingerprint is required.

To offer:comdirect.de

Giro and Visa debit card

The Girocard of the Comdirect account is provided by V-Pay. Transactions in euros with the Girocard are free of charge. There is still a small drawback: in non-euro areas, 1.75 percent of the corresponding amount is due when using the Girocard. but within Germany you can use the giro card to get cash free of charge at the machines of all banks in the "Cash Group". These include Commerzbank, Postbank, Deutsche Bank and HypoVereinsbank. There is also free cash supply at all participating Shell petrol stations. In addition, you refer in other euro countries Cash free of charge at all machines with the V-Pay symbol.

A Visa debit card is part of the checking account. This is a big advantage, because you can use it at all machines with the VISA symbol worldwide withdraw money for free.

Unfortunately, there is also a small shortcoming with the VISA card, namely cashless payment in foreign currency, a transaction fee for foreign currency sales of 1.75 percent. However, this fee is average. There is also the possibility of cash free of charge in Germany, only with the giro card. Unlike other banks, withdrawing money in the euro area with the VISA card is not free of charge.

Experiences with using the Girocard and debit card from Comdirect #Hacks for free payment

- Within Germany cash withdrawals are restricted to Cash Group ATMs. If another machine is used, fees will apply. The amount of the fee depends on the operator of the machine and is advertised there.

- In all other euro countries Cash is available as long as the machine has the V-Pay symbol. If V-Pay is not available, a fee of €9.90 must be paid.

- In all non-euro countries you can get cash free of charge at all ATMs with the VISA symbol with the VISA debit card.

- For cashless transactions in foreign currencies a fee of 1.75 percent of the amount will be charged.

Comdirect experiences and conditions - all the essentials in brief

- Furthermore, the account is unconditionally free of charge. This means that no monthly salary payment is necessary to get a free account.

- Up to 3x per calendar year free of charge at the Commerzbank deposit money.

- In addition, I was always helped quickly by customer service if I had any problems or questions about my checking account. Even late in the evening.

- Withdraw cash worldwide free of charge with the Giro or VISA card.

- VISA and Girocard with NFC function. This allows contactless payment up to 25 euros.

- Apple and Google Pay support: Even faster cashless payment via smartphone.

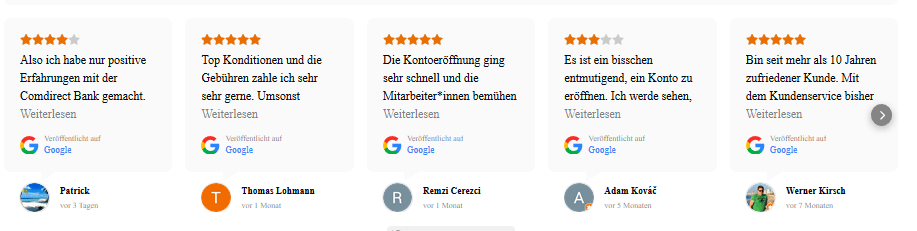

Comdirect experiences of other users

What experiences have other users had with the Comdirect? Take a look at the following reviews and judge for yourself!

Conclusion about my experiences with comdirect

liked that

The comdirect current account scores with free account management from €700 incoming money.

If the account slips into the negative, you benefit from low overdraft interest at comdirect. In addition, the cash options are excellent (free worldwide). The handling in online banking and the smartphone app were also convincing. Furthermore, the complete integration of Google and Apple Pay is interesting. Finally, I liked the fact that the account opening can be done quickly and easily using video identification.

Didn't like that so much

The charging of fees when paying outside the euro zone attracted negative attention. So for globetrotters this is DKB Cash here is the better alternative. Another shortcoming is the required minimum payment of €700. Unfortunately, the Comdirect account is no longer included in the list Free checking account with no minimum deposit out. Overall, however, the positive impression prevails, which is further reinforced by the easily accessible customer service.

Overall I give the account 4 out of 5 stars. There is a point deduction for the really excellent account due to the fees when paying outside the euro zone. I recommend this as an alternative to comdirect free current account of DKB Cash.

In addition, I have also displayed numerous other opinions on the Comdirect below. You can find out at a glance what experiences others have had with comdirect.

comdirect.de