Mini loan without SCHUFA? Get a loan despite negative SCHUFA! After sending the Forms* is a Credit without Schufa comparison possible. If you are looking for a loan, it is often difficult to get past the SCHUFA, because banks are obliged to obtain information about creditworthiness. A way out is offered by loans that are brokered, for example, through private individuals. Konto-Kredit-Vergleich.de shows how to get a loan despite Schufa entry.

Mini loan without SCHUFA: where to take it out?

What you can learn here

- Mini loan without SCHUFA: where to take it out?

- What are the advantages of a mini loan without SCHUFA?

- Mini loan without SCHUFA: tips

- Recognize dubious credit providers without a SCHUFA query

- Requirements for conventional loans

- SMAVA vs Ferratum vs Vexcash

- Mini loan without SCHUFA: Just 4 simple steps

- Loan comparison for small amounts: The best small loans from 100 to 3,000 euros

Through our financing partner, there is the possibility of a Credit despite negative SCHUFA and creditworthiness. Thus, even people with moderate creditworthiness or self-employed persons with highly fluctuating income can obtain a loan "without SCHUFA query".

An instant loan despite a SCHUFA query is possible through our financing service provider. Enter the desired loan amount as well as the desired term and purpose. You will then be asked to enter your basic personal data. Once the form is completely filled out, you don't need to do anything else. You will receive further information by e-mail in the near future. If you want to know which bank gives a loan despite negative SCHUFA, I recommend that Form from our partnerfill out completely and send. The exact conditions depend on your personal situation.

The loan "despite negative SCHUFA" is suitable for everyone. Not only for employees or civil servants, but especially for the self-employed and entrepreneurs. After the request has been checked, it is possible to borrow money without a SCHUFA query. Small business owners in particular benefit from this loan without SCHUFA. After all, depending on the order situation and the customer's payment behavior, it can easily happen that a bad credit rating arises due to fluctuating income. The scenario described is a common reason why the approval of a classic bank loan for the self-employed becomes a problem.

What are the advantages of a mini loan without SCHUFA?

A bank loan sometimes takes a long time. Time-consuming measures and thorough checks of borrowers are often carried out. A big advantage of a loan without a query at the SCHUFA is also a big time saver! Therefore, a short-term loan without SCHUFA is also suitable for those in a hurry!

The advantages of a loan without a SCHUFA query at a glance:

- The credit without SCHUFA: Suitable for all people!

- Borrowers with moderate credit ratings can get a chance here!

- Significantly faster processing than traditional bank loans

- Expeditious payout

- No impairment of the SCHUFA score

- Fast and serious processing

- There are no upfront costs

- Renowned provider of loans despite Schufa entry

- Fast processing and individual examination

Mini loan without SCHUFA: tips

You can get a loan despite a Schufa entry via the Form from our partner. Consider carefully whether you can repay a loan despite a SCHUFA entry. It is not uncommon for banks to have plausible reasons for rejecting a loan application. Thanks to the simple application process and few preliminary checks almost everyone gets a loan. If you would like to take out a loan without SCHUFA information, the following tips will help

Tip #1: Are crucial payment practices and expected solvency

It is the business model of lenders to lend as much money as possible. Because they earn with every euro lent. So, in principle, lenders have an interest in lending money. This is all the more true in periods of low interest rates. If an offer is rejected anyway, it is probably due to an internal review. The bank suspects poor payment behavior. The lender then expects not to get the money back. Therefore, he refrains from granting the loan. Another reason could be that the loan amount was too high. This means that the household income is not sufficient to repay the loan installments.

Tip #2: Plan realistically: create one household bill

Contrast income and expenses. After all expenses have been deducted from your income, the freely disposable income remains. The maximum rate of the loan is based on this. Keep in mind that not all expenses can always be planned. The Washing machine can suddenly break down, a visit to the car repair shop will be more expensive than expected, or an additional payment for electricity, gas or telephone costs flutters into your house. You should plan a buffer for such cases.

Tip #3: Check your SCHUFA entry

Errors happen with SCHUFA entries. Do you have the impression that the bank is unjustifiably refusing you a loan with a SCHUFA entry? It may well be that the SCHUFA score is incorrect. Take advantage of the opportunity once a year Access the SCHUFA score for free. If errors are discovered here, you can arrange for incorrect information to be corrected or for obsolete entries to be deleted.

Where can I get SCHUFA information?

The order form cannot be found immediately on the SCHUFA site. But the following link will take you there. By the way: The free self-disclosure corresponds to a data copy according to Art. 15 DS-GVO on the website.

>> Request a free SCHUFA report online here <<

A copy of the identity card or passport + confirmation of registration is optionally required for the form. When I asked for a self-assessment, Schufa explicitly requested a copy of my identity card.

Recognize dubious credit providers without a SCHUFA query

Dubious providers can be recognized by the fact that they require an advance payment for the loan. This should set alarm bells ringing for borrowers. Another feature is promises that are not kept.

No prepayment with reputable providers!

Reputable providers who arrange a loan without SCHUFA information never require an advance payment in advance. Even particularly fast processing is not invoiced separately by such providers. Furthermore, reputable providers do not offer insurance about "scary" phone calls. Instead, you help your customers apply for the loan quickly and are there for you. I hope that the article has provided you with a suitable answer on the subject of "mini credit without SCHUFA query". You can find a suitable bench via this Form from our partner*.

Requirements for conventional loans

To apply for a loan, certain conditions must be met. The reason for this is that lenders want to protect themselves against payment defaults. It also protects the customer from excessive loan amounts, which may then no longer be repayable. In principle, each bank has its own credit guidelines. However, they are similar in many respects. These are often the following conditions:

- Residence in Germany

- of legal age

- German bank account

- regular income

- good credit

- some additional collateral such as Vehicle letter for a car loan

Our financing partner offers the possibility of obtaining a loan despite poor creditworthiness. In this case, borrowing money without SCHUFA does not work through a bank, but through the mediation of a loan by private individuals.

SMAVA vs Ferratum vs Vexcash

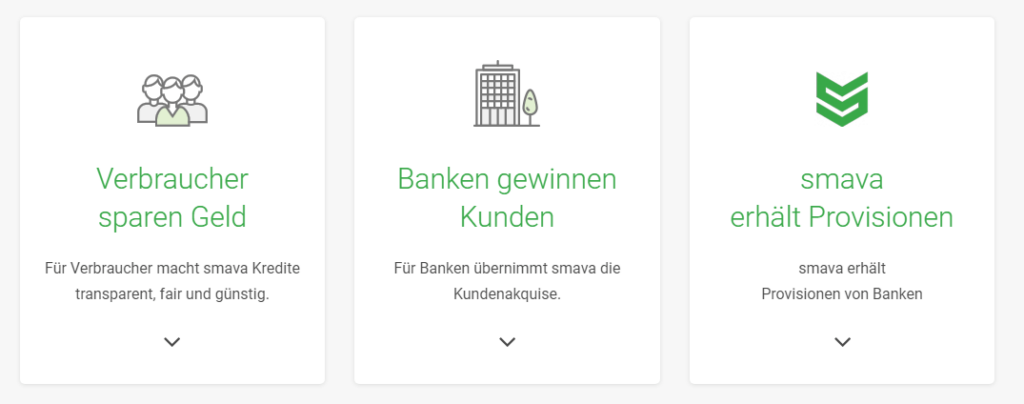

If you are looking for a loan without SCHUFA, you should consult the loan experts at Smava* seek advice. Especially if you are looking for a loan without SCHUFA, you should ask the credit experts at Smava* seek advice. Read more about "Which bank gives credit despite negative SCHUFA?"

- Smava* → without SCHUFA query!

- ferratum* → Borrow up to EUR 1,000 without proof of income

- Vexcash*→ lightning credit in 30 min! Fastest loan in Germany!**

**Write a comment if you know a faster one!

However, Smava does not offer one Loan without proof of salary at. With Smava, a regular income of 601 euros is required. Therefore, the self-employed, students, unemployed and people in the probationary period are better off at Ferratum. ferratum* does not require any proof of income! There is also a 24-hour express credit for an additional charge. More on the subject " Express credit without SCHUFA and proof of income!"

There is a faster express loan within 30 minutes Vexcash*. The provider convinces with low fees, fast payout and high customer satisfaction. You need money today? Go to Vexcash! More on the subject "24-hour express credit without proof of income with immediate payment“ you can read here.

Mini loan without SCHUFA: Just 4 simple steps

credit comparison for small amounts: The best small loans from 100 to 3,000 euros

- Do you need a small loan of 100 to 500 euros? You can find the best providers for a loan amount of up to 500 euros here!

- Do you need a small loan of 500 to 1,000 euros? You can find the best providers for a loan amount of up to 1,000 euros here!

- Do you need a small loan of 1,100 to 3.00 euros? You can find the best providers for a loan amount of up to EUR 3.00 here!