If you have a loan from the savings bank, debt restructuring can be worthwhile in many cases. Especially given the current low interest rates. That leaves more money to live on. In particular, the following speak in favor of rescheduling a loan:

- In recent years, interest rates on loans have fallen sharply. If you have an older loan, you are probably paying significantly higher interest

- Pack it up: Restructure several loans together. This way you get better conditions for all your loans. SCHUFA likes it too.

- By rescheduling the loan, you can shake off the residual debt insurance (RSV) at the same time.

- ⚠️ Sparkasse can charge fees for loan rescheduling

In our article about Banks that lend easily you will find a top 10 tableau of banks and credit intermediaries that are especially easy to Grant credits ("Yes Banks").

Rescheduling savings bank credit: comparison of alternatives

What you can learn here

- Rescheduling savings bank credit: comparison of alternatives

- Rescheduling a loan from the Sparkasse means calculating, planning and analyzing

- Reasons why you should reschedule your Sparkasse loan

- Note the prepayment penalty for old loans

- ⚠️ Avoid trouble with the prepayment penalty ⚠️

- Rescheduling a car loan: is it worth the effort?

- There are many favorable alternatives to a savings bank loan. When rescheduling, it is worth comparing the loan conditions

- Loan rescheduling Sparkasse: Important tips

- Debt rescheduling: ING has fair conditions. I recommend the bank.

- Debt restructuring without Schufa, proof of income or in 30 minutes: The providers SMAVA, Ferratum & Vexcash!

- The best small loans from 100 to 3,000 euros

Rescheduling a loan from the Sparkasse means calculating, planning and analyzing

Debt restructuring is almost always possible. First, you can register on the Internet (e.g here) inform about current credit conditions. The old contract is then analyzed. Here are the points in particular

- notice period

- Prepayment penalty/transfer fee to the bank

in the foreground.

If your old loan agreement was concluded after June 11, 2010, the notice period is one month. Older contracts often have a period of 3 months. The Sparkasse and other banks have the right to demand a prepayment penalty. This is up to one percent of the remaining loan amount. Rescheduling a loan always means calculating, planning and analyzing. That's why you'll find the most important information here so that your debt restructuring goes smoothly.

Reasons why you should reschedule your Sparkasse loan

The interest on the loan is higher than three percent

Interest rates on loans have fallen steadily in recent years. Right now, there's no point in holding on to an old high-interest loan. Finally there is current installment loansthat are less than two percent.

The following graphic makes it clear: Debt rescheduling is worth it. After all, interest rates on loans are falling. Shown here are the interest rates on short-term loans (up to 3 months). If you don't reschedule your debt, you'll be paying too high interest for years!

Data Source: German Bundesbank, Own representation.

But the other conditions for old loans are sometimes no longer up to date. New loans can often score with free special repayment and monthly terminability. Old loans are not only more expensive, but often also more rigid in design.

Having the old Sparkasse loan rescheduled gives you breathing room again. Monthly rate and term can be readjusted. In addition, direct banks often offer customer-friendly extras. For example Installment breaks, free special repayments or a premature one Repayment without prepayment decision.

Rescheduling and increasing the credit savings bank

Debt restructuring and increasing or topping up is also an option. This allows several loans to be rescheduled in order to obtain more favorable conditions. This allows you to use the advantages described several times at the same time.

If you combine several loans into one loan from a bank, you increase the clarity and structure of your finances. But SCHUFA also likes structured finance. That's why SCHUFA usually increases your SCHUFA score if you combine loans from a bank.

Note the prepayment penalty for old loans

Old loans can have high prepayment penalties. In the meantime, the legislature has put a stop to this. This means that rescheduling your loan is now significantly cheaper. The prepayment penalty may be a maximum of 1 % of the outstanding amount for loans with more than 12 months remaining term. For a loan with less than 12 months remaining, the bank may not charge more than 0.5 % of the outstanding amount.

⚠️ Avoid trouble with the prepayment penalty ⚠️

In order to avoid frustration and trouble with the prepayment penalty, you should pay attention to the possibility of free special repayments when rescheduling. With a loan with a high special repayment without extra costs, the tiresome topic for the future is off the table. At the Credit from ING* you can pay everything back at any time. For free! That way you don't have a block on your leg if your circumstances change.

car loan reschedule: Is it worth the effort?

Debt restructuring is often worthwhile. This is because interest rates have been falling for years. By rescheduling old and expensive loans, several hundred euros can easily be saved over the years. But that's usually not all. New loans are much more flexible and can be terminated within a month, for example. Also, they often offer many free options like a unlimited special repayment right.*

If you combine several loans into one loan from a bank, you increase the clarity and structure of your finances. But SCHUFA also likes structured finance. That's why SCHUFA usually increases your SCHUFA score if you combine loans from a bank.

Debt restructuring and increasing the loan amount can also be an alternative if a cash injection is needed elsewhere. Of course, the effort to reschedule a car loan is also worthwhile because of the chance to adapt the loan conditions to your living conditions in a new and optimal way.

There are many cheap ones alternatives to a savings bank loan. When rescheduling, it is worth comparing the loan terms

A credit comparison is an important part of a successful debt restructuring. After all, the lower the new interest rate, the more you can save. But it's not just the interest rate that's important. Other options such as a free unscheduled repayment right also make your future life easier. Unproblematic banks also waive the retention of the letter. For this reason Konto-Kredit-Vergleich.de the uncomplicated Installment credit from ING*. In addition to free special repayments, the bank offers a fixed interest rate. This way you know right from the start what you are getting yourself into. Since the bank does not keep the letter, a subsequent sale of the car can quickly take place. ING's interest rates are also in the bottom quarter.

Loan rescheduling Sparkasse: Important tips

- First, analyze your current loan agreement. What notice period or early repayment penalty are specified therein?

- If you take out a new loan, consider the prepayment penalty for the loan amount.

- Not only interest rates are important. A flexible contract with free special repayment is valuable!

- At some banks, lending rates depend on the creditworthiness and term. In general, the better your credit rating and the shorter the desired term, the lower the interest rate.

- You should not cancel the old loan until you have the approval for the new loan.

- Residual debt insurance must be analyzed precisely: it is often quite expensive.

Bad credit? Here you can find out from which bank you can get a loan.

Debt rescheduling: ING has fair conditions. I recommend the bank.

ING is a very uncomplicated and customer-friendly bank. For example, ING offers its low interest rate regardless of creditworthiness. With the ING installment loan, you can make special repayments as much and as often as you want. Incidentally, this is also the reason why the ING installment loan is the ideal loan for rescheduling your car loan. Especially if you want to sell the car. The interest rates are also pretty cheap at 3.39 % pa.

| Bank | loan amount | Duration | free special repayment | interest rate independent of creditworthiness | Available in 24 hours | More information |

|---|---|---|---|---|---|---|

ING* | 5.000 € until 50.000 € | 12 months until 96 months | possible at any time ✅ | crystal clear conditions ✅ | Immediate confirmation ✅ | To offer: ING.de* |

More information on the ING installment loan (free use)* »

But the processing of the ING car loan is also very simple. As a rule, the proof of purchase does not have to be submitted. In this way, ING reduces the bureaucratic effort for borrowers to a minimum. In addition, as a borrower at ING, you can free special payments make. You can even refund everything at any time.

| Bank | loan amount | Duration | financing without vehicle registration | interest rate independent of creditworthiness | financing without proof of purchase | More information |

|---|---|---|---|---|---|---|

ING car loan* | 5.000 € until 65.000 € | 24 Months until 84 months | flexible ✅ | crystal clear conditions ✅ | unbureaucratic ✅ | To offer: ING.de* |

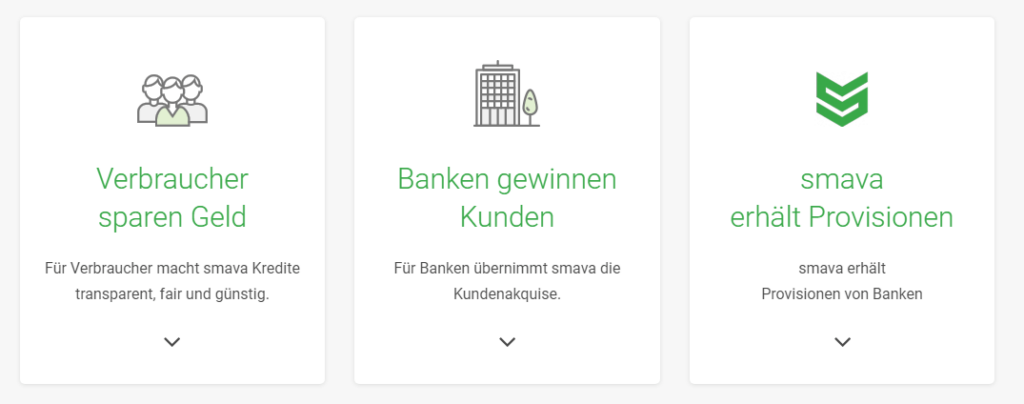

Debt restructuring without Schufa, proof of income or in 30 minutes: The providers SMAVA, Ferratum & Vexcash!

If you are looking for a loan without SCHUFA, you should consult the loan experts at Smava* seek advice. The credit experts can also give you good advice on rescheduling your savings bank loan. This is especially true if you are looking for a loan without SCHUFA!

Read more about "Which bank gives credit despite negative SCHUFA?"

- Smava* → without SCHUFA query!

- ferratum* → Borrow up to EUR 1,000 without proof of income

- Vexcash*→ lightning credit in 30 min! Fastest loan in Germany!**

**Write a comment if you know a faster one!

However, Smava does not offer one Loan without proof of salary at. With Smava, a regular income of 601 euros is required. Therefore, the self-employed, students, unemployed and people in the probationary period are better off at Ferratum. ferratum* does not require any proof of income! There is also a 24-hour express credit for an additional charge. More on the subject " Express credit without SCHUFA and proof of income!"

There is a faster express loan within 30 minutes Vexcash*. The provider convinces with low fees, fast payout and a high level of customer satisfaction. You need money today? Go to Vexcash! More on the subject "24-hour express credit without proof of income with immediate payment“ you can read here.

More information about the ING car loan (for car financing only)* »

BONUS: Selling a car on credit where the bank has the vehicle registration document

If you are thinking about selling your financed car, there are several options. You can read about all the options in the linked article.

The best small loans from 100 to 3,000 euros

- Do you need a small loan of 100 to 500 euros? You can find the best providers for a loan amount of up to 500 euros here!

- Do you need a small loan of 500 to 1,000 euros? You can find the best providers for a loan amount of up to 1,000 euros here!

- Do you need a small loan of 1,100 to 3.00 euros? You can find the best providers for a loan amount of up to EUR 3.00 here!

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️