Is the pension secure? What pension gap will there be later? By what percentage does the last monthly net income before retirement exceed the pension? This number is provided by statisticians from the German Institute for Old-Age Provision regularly re-determined. The number is also called the pension gap.

Retirement income: 3-pillar model

What you can learn here

Ideally, retirement income is not based solely on statutory pension insurance, but is based on the following three stable pillars:

- Statutory pension insurance

- Company pension scheme

- Additional private pension plan

The pension is similar to a house that only stands on one pillar: the more pillars your pension has and the thicker and more stable these pillars are, the more secure the pension is actually.

What income do I need in old age so that my pension is secure?

The income required in the retirement phase varies from person to person. As a rule, however, it is below the income required during active working hours. There are mutliple reasons for this:

- There are no costs related to work. These include, for example, travel expenses or the second car purchased especially for this purpose.

- Contributions to pension schemes are no longer necessary: You are already retired!

- Due to the lower income, there are also fewer taxes

For the sake of simplicity, like many statisticians, you can assume a need of about 80 % of your last net income

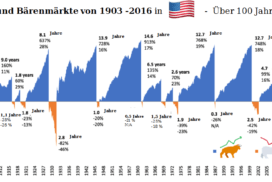

How secure is the pension with a growing pension gap?

The German pension is a pay-as-you-go insurance. This system works cost-neutral as long as the population remains constant. If the number of young contributors decreases, the ratio of pensioners to pensioners deteriorates. As a result, the pension insurance contributions must increase. Another influencing factor is the development of productivity. A certain decline in the labor force and the higher life expectancy of pensioners can be compensated for by increased productivity.

Find and close your pension gap in four easy steps

You don't yet know how big your pension gap is and how you can close it. In just 10 minutes you will know more after following the four steps.

Total Time: 10 minutes

Determine your pension gap

Would you like to know how much money you will probably lack in old age? There are various clever tools on the Internet to determine this.

Have an investment proposal made for you

Now you have a goal: You should save the amount calculated in step monthly. In the second step you need a suitable investment strategy. If you already know them, you can now join us the right depot get started right away and post ETFs.

invest money

Now you can start saving for later. You can open your custody account in no time at all via video legitimation. Once everything is set up at VisualVest, you don't need to do anything else until you retire. The investment experts will take care of your portfolio, rebalance it and make sure that your strategy is implemented correctly.

withdraw money

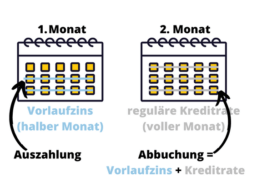

After you retire, you have the amount paid out in monthly installments or a one-time payment. Over many years, your money has now increased through compound interest. The payout is not tied to the statutory retirement age. This means that you can have part or all of the amount paid out at any time before that. Furthermore, it is possible to pause, top up or reduce the savings installments. In this way, the pension plan is fully adapted to your life circumstances. And not vice versa.