Using the Compound Interest Calculator

What you can learn here

- Using the Compound Interest Calculator

- The compound interest calculator: how it works

- The compound interest calculator in the application

- The interest

- The compound interest effect

- How you can influence the compound interest effect

- The effective interest rate or effective interest rate

- The compound interest effect: summary

Why did I develop the Compound Interest Calculator? The compound interest effect is an important helper when it comes to long-term wealth accumulation. This is known to many people. What is less known is the actual strength of this muscle over long periods of time. With the compound interest calculator, just a few entries make it clear how strong the compound interest effect actually is.

In order to be able to fully benefit from compound interest patience and discipline of crucial importance. After all, the effect only works if received interest or dividends are not withdrawn. If you take the interest, only the simple interest effect works.

The compound interest calculator: how it works

The compound interest calculator is kept simple and gets by with just a few details. For this reason, the following assumptions were made when creating the calculator:

- Subsequent interest, ie interest is only paid on the paid-in capital at the end of the month.

- Monthly Interest: Interest is calculated every month.

If other calculation methods are desired: Write a comment!

input from seed capital in the compound interest calculator

How much money do you already have available today? You enter the value in the field seed capital a. You haven't saved any seed capital yet? No problem. Enter a 0 in the field.

input from monthly savings rate in the compound interest calculator

If you're just starting out investing, your monthly savings rate (rough rule of thumb) should be at least 10 % of your net income.

The monthly savings rate is an effective way to increase your invested capital by x euros every month. Contrary to popular belief, even small amounts over a period of, say, 30 years and 5 % interest can have a big effect. Try it out!

A long period of time is particularly important for the compound interest effect. This is the only way it can come into its own.

Default one annual interest rate in the compound interest calculator

Since the interest rate for investments in shares and ETFs is not known in advance, assumptions have to be made here. However, delivered the DAX since 1987 has had a historical average return of over 7 %.

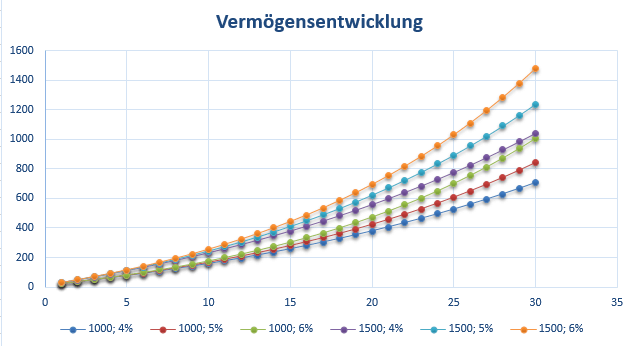

Play around with the interest rate. You will quickly find that it is the most powerful adjusting screw. Over a period of 30 years, the compound interest effect has such a strong effect that it can hardly be offset by a higher monthly savings rate.

Entering the Saving duration in years

How many years should the capital work for you? Enter it here! For short periods of ten years and less, you will find that your capital is largely made up of your own deposits. This changes drastically the longer the investment horizon becomes. Over 30 years, interest payments make up the majority of the money. So your invested capital with 5 % interest and 30 years term is only 43 % of the final capital.

I hope the compound interest calculator will help you. You have an addition, want another computer, or have discovered an error? Leave a comment!

The compound interest calculator in the application

Of the Compound Interest Calculator clarifies that the compound interest effect is a strong muscle of your investment. In particular, the effect of compound interest has a strong impact on long periods of 15 years or more. If you reinvest interest payments or stock dividends over a longer period of time, you can accumulate wealth faster because the compound interest effect helps you. In addition to a long investment horizon, the right stock portfolio is also made of one Stock portfolio comparison essential in order to be able to fully utilize the compound interest effect. You can use compound interest with a simple "Slipper portfolio“ take advantage, right Robo Advisor to use. However, the latter have slightly higher fees, which slightly reduces your return.

Of course, the compound interest effect runs against you as a debtor. Therefore, avoid taking out unnecessary loans and pay attention credit comparison on this reported effective interest. In this way you can avoid expensive cost traps.

The compound interest effect is the central building block of any asset accumulation. Only if you understand how it works can you make your money work for you in the long run. This is the working principle of compound interest. Money becomes more money and even more money.

Because the effect is so amazing, it has been referred to in the past as the eighth wonder of the world, or the greatest invention of human thought. That Albert Einstein should have said this is a nice story after a short Google search but a fairy tale. Doesn't matter!

Compound interest was the greatest invention of human thought

Unknown Author – A. It probably wasn't Einstein after all

The interest

Before we start explaining compound interest, first a simple example of interest. Suppose you invest 100 euros for one year at an interest rate of 4 %. Your interest payment is then four percent of 100, i.e. four euros. Your capital increases to 104 euros

Capital after year 1: 100 euros x 1.04 = 104 euros

If the four euros of interest are withdrawn and consumed, the bill will look the same again in the second year. There are again four euros interest on 100 euros. The situation is different if the four euros of interest remain on the fictitious savings account.

The compound interest effect

If you leave the interest from the first year in the fictitious account, in the second year you will earn interest on the interest you already earned in the first year. This is called compound interest. The interest in the second year would then be calculated as follows:

Capital after year 2: 104 euros x 1.04 = 108.16 euros

You have now not earned 4 euros as in the first year, but 16 cents more, i.e. 4.16 euros. The difference of 16 cents seems relatively small, but the compound interest effect increases with each passing year.

Suppose you leave the money in the fictitious account for 20 years with an interest rate of 4 %. Your final capital is then:

Capital after year 20 with compound interest effect: 100 euros x 1.04^20 = 219.11 euros

Even though the interest payment is only 4 percent, the money has more than doubled in 20 years. Another calculation for comparison if you were to spend the interest every year. Your share capital is then 100 euros even after 20 years and you will receive 4 euros in interest for 20 years. That's 80 euros. The final capital is then calculated as follows:

Capital after year 20 with simple interest: 100 euros + 0.04 x 100 x 20 = 180 euros

While in the case with compound interest the capital has multiplied by a factor of 2.19, in the case without compound interest the factor is only 1.8. This is the compound interest effect. While it is barely noticeable over short periods of time, it develops an exponentially increasing force over long periods of 15 years or more.

For the sake of simplicity, the example calculations were based on the Inflation waived. You can take inflation into account roughly by subtracting the inflation from the interest rate. If you assume e.g. 2 % inflation at 6 % interest, you can calculate your money with 4 % interest.

How you can influence the compound interest effect

The final capital is influenced by the following factors:

- The time - how long do you invest the money

- The seed capital, i.e. the capital that you have from the start

- The interest rate

- The time of interest payment

time

By the factor time To make the best use of it for you, it is very important to start investing early. If you're already in your 20s with investing in a ETF savings plan begin, you have almost forty years until your sixtieth year. The long time horizon lets compound interest through the roof while you just get on with your life. Go to work, do sports, or take care of the kids. Later you will be able to benefit from a solid capital stock, even with a low savings rate.

In order to be able to fully benefit from compound interest patience and discipline of crucial importance. After all, the effect only works if received interest or dividends are not withdrawn. If you remove the interest, only the simple interest effect works.

Seed or initial capital

That seed capital you can influence badly. It's just a given size in life that you start with. Take care of the other two.

interest rate

When investing, the interest rate is linked to the risk. If you are willing to take on more risk and accept short-term losses, you will be rewarded with a higher interest rate in the long run.

The frequency of interest payment

Another factor affecting the final principal is the frequency of interest payment. The more frequently interest is paid, the faster the compound interest effect takes effect when reinvesting. In the example above, 100 euros were compounded at an annual interest rate of 4 %. The interest payment took place at the end of the year. How does the bill change if the interest is paid a quarter of each quarter?

Interest per quarter = 4 % : 4 = 1 %

To calculate the effective interest rate for the entire year, you need to multiply the quarterly interest rates together. The whole thing works the same way as with an interest rate of 1 % interest over 4 years.

Quarterly interest: APR = 1.01 ^4 = 1.0406 ⇒ 4.06 %

The effective annual interest rate, is determined by the quarterly payout thus increased by 0.06 %.

If we now carry out the calculation for a monthly interest payment, we get:

Monthly interest: APR = 1.0033^12 = 1.0407 ⇒ 4.07 %

The effective interest rate or effective interest rate

A shorter interest payment is advantageous for you as an investor. The more frequently the interest is paid out, the greater the effective Annual interest rate. The more you as an investor can also profit from the compound interest effect.

If you have debts instead, it's the other way around. Therefore, when you take out a loan - be it for a private loan or a construction financing - also important always compare the effective interest rates. The interest rates on the website Konto-Kredit-Vergleich.de Comparison calculators used therefore also always take into account the effective annual interest rate. A comparison calculator for a personal loan you can find here. A Mortgage Calculator is linked here.

The compound interest effect: summary

Compound interest is a powerful muscle in your investing, with strong effects over long periods of 15 years or more. If you reinvest interest payments or stock dividends, you can accumulate wealth faster because the compound interest effect will help you.

Of course, the compound interest effect runs against you as a debtor. Therefore, avoid taking out unnecessary loans and pay attention credit comparison on this reported effective interest. In this way you can avoid expensive cost traps.

Because the compound interest effect takes 15 years or more (depending on the interest rate) to kick in, you should start investing as early as possible. If you haven't started yet but are older, I have good news for you: You haven't missed the second best day to start yet. He is today! When you're ready, open one cheap depot and start with a world stock index as an initial investment. Too complicated? Then leave one Robo Advisor manage your first financial investment.

Then I link to a video by Thomas from Finanzfluss. The topic of compound interest is also explained very clearly here. If you have read the post, you do not need to watch the video, the content is comparable!