This post is from the spring of 2020, and is a republication.

Coronaviruses are a group of viruses that cause disease in animals and humans. In humans, the virus causes respiratory infection. Initially, the illness is similar to a cold or flu. However, rarer forms of the coronavirus such as SARS and MERS can be much more deadly. Research is currently still working on vaccines against the corona viruses. In February 2020 there are still no approved vaccines against the virus. I've rounded up some key details on the coronavirus for investors.

How epidemics affected in the past

What you can learn here

- How epidemics affected in the past

- Putting the coronavirus in perspective for investors

- Effects of the coronavirus so far

- Update 02/29/2020: Outbreak of the corona virus in Europe

- Inexpensive opportunity to increase the portfolio

- The best ways not to get sick

- Corona virus: self-assessment of Chinese companies

One way to buy stocks is temporary Exploiting variables that do not affect a company's fundamentals. The crucial thing that is unknown about the Wuhan coronavirus is how far it is still spreading and how deadly it is.

The greater the fear of the Wuhan coronavirus, the greater the impact on the stock market. When people are scared, they stop traveling, buying goods, eating out, and so on. In addition, numerous factories have closed, so that less is produced.

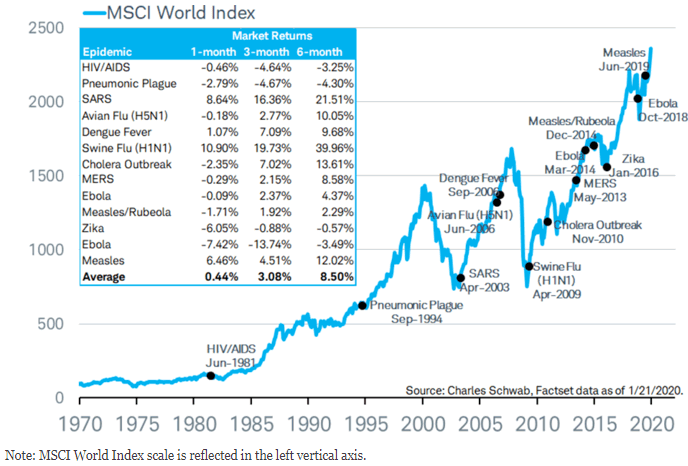

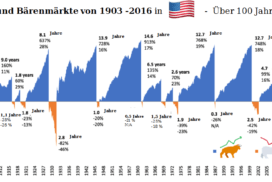

The chart below by Charles Schwab shows that 13 previous epidemics saw the MSCI World trade an average of 8.5 % higher after the outbreak 6 months later.

According to the data, a slight downturn is usually followed by a strong subsequent up move.

However, based on the chart below, the Wuhan coronavirus appears to be spreading much more aggressively. Is that because the Wuhan coronavirus is more deadly? Or is it because 18 years later we are traveling a lot more, further fueling the spread of the virus. Perhaps the answer is both. (Data sources for visualization: corona & SARS). The good thing about this sad graphic: The flattening of the corona curve from the 50th day after the spread. Day 50 corresponds to February 19, 2020.

In March - April 2003 the MSCI World did not correct at all due to SARS. Instead, the index continued to rise until the 2008 Great Depression.

As an investor, you want stock markets to overcorrect on viral breakouts so you can buy. Although it's still early days, the table below shows how the Wuhan coronavirus is stacking up against other major viruses. The table can help investors to better classify the danger of the corona virus.

| Year | illness | location | deaths |

| 2000 | EHEC | Walkerton, Canada | 18 |

| 2002/03 | SARS-CoV | worldwide | 774 |

| since 2004 | Virus flu, so-called bird flu (influenza A virus H5N1) | worldwide | > 450 |

| 2009-2010 | swine flu | worldwide | > 18,449 |

| since 2012 | MERS-CoV | Arabian Peninsula | > 850 |

| since 2016 | cholera | Yemen | > 3,430 |

| since December 2019 | COVID-19 (“Wuhan Virus”) | Mainly People's Republic of China, 26 other countries worldwide | 2,009 (February 19, 2020) |

As you can see from the table, the number of deaths from the coronavirus is still relatively low compared to other diseases. Although the number of deaths is already about three times the number of deaths from SARS, nine times the number of people died from swine flu in 2009-2010.

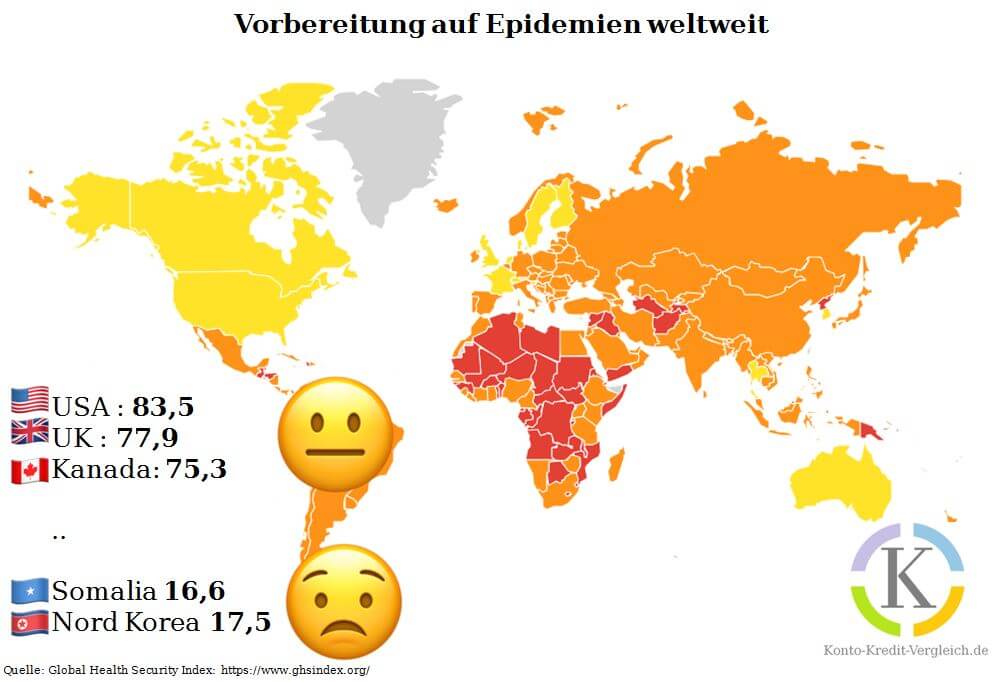

Also to be taken into account is the Readiness of states to fight the virus. China and many African countries are closely intertwined. Maybe the coronavirus is already there. Hardly any African country is prepared. The graphic below shows how countries around the world are preparing for epidemics such as Corona. The Global Health & Security Index measures the preparedness of individual countries using 34 indicators. While the western world is well prepared, Africa in particular is looking bad. The fact that there are hardly any confirmed cases from the continent so far could also point to inefficient information dissemination. As the chart shows, the ability of a country to fight an epidemic effectively is closely related to gross domestic product. The richer a country, the better the preparation. Again, this is something investors should consider when making decisions about the coronavirus.

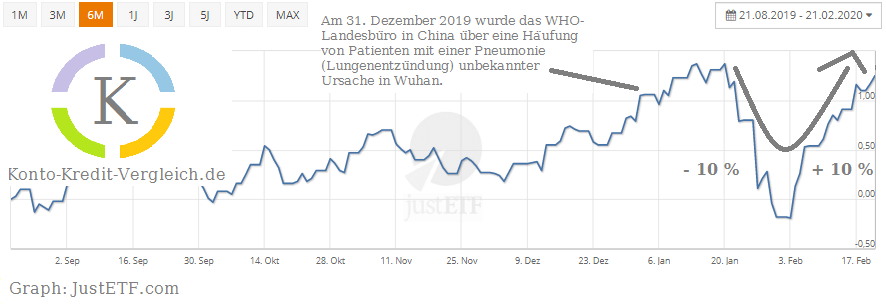

Although people have continued to contract the coronavirus since the outbreak in January, are were investors in Europe until the outbreak of Corona bullish tuned. The Chinese stock market has already recovered from the 10 % dip in early February. The chart left me amazed at how fast the stock market recovery could go after the outbreak of the virus. Despite the exceptional situation in China, the Chinese stock market is back to the level it was before the outbreak.

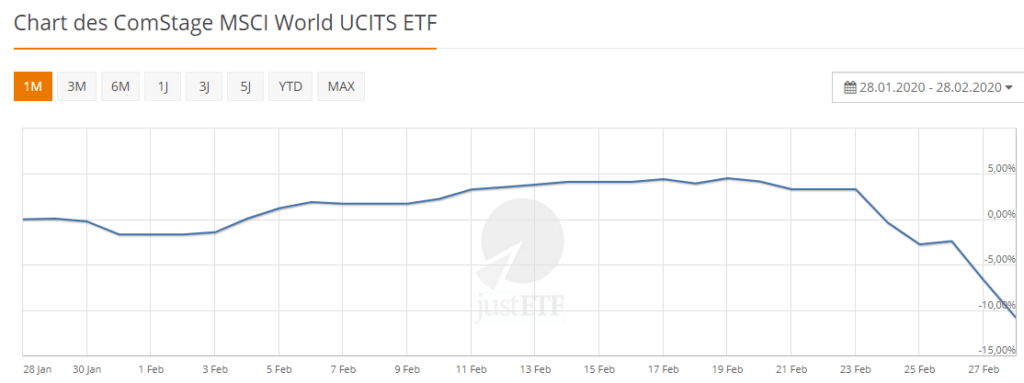

Only 3 days after the publication of the article, the corona virus arrived in Italy and shortly afterwards in numerous other European countries. Switzerland now bans all major events with more than 1,000 participants. The Geneva Motor Show and the Basel Fastnacht were also canceled. The stock market crashed properly. The mood changed in the major markets around the world. The MSCI World is already over 10 % in the red at the end of February.

Anyone who was or is invested in shares during the corona crisis needs strong nerves – prices have plummeted. For long-term investments, there is therefore an opportunity that has not existed for a long time to invest cheaply in quality companies via ETFs. In another article we have meanwhile determined further advantages of a crisis. The correct behavior in a financial crash is here written down.

Inexpensive opportunity to increase the portfolio

Stocks are now discounted due to the coronavirus. There is much speculation about how far the stock markets will fall. Since I don't know that either, I'll top up my savings plans. I'm still waiting for my new one DKB securities account* * is opened. I like the depot because you can currently buy Vanguard ETFs for 0.49 euros.

The best ways not to get sick

Finally, a few options and strategies on how you can best protect yourself from a deadly infection of the coronavirus:

- Wash your hands often with soap and water. Best for 20 seconds or more. Especially after blowing your nose, sneezing or coughing.

- Avoid touching your eyes, nose and mouth as this speeds up the spread of infection. On average, we touch our face about every 15 minutes.

- Keep a distance (approx. 1 to 2 meters) from people who are suspected to be ill.

- Don't share glasses, dishes, water bottles, and other items that can transmit bodily fluid.

- When coughing or sneezing, keep at least three feet away from other people. Also, turn away.

- It is best to sneeze or cough into a disposable handkerchief. Use this only once and then dispose of it in a trash can with a lid. Wash cloth handkerchiefs at a temperature of at least 60 °C.

- If you don't have a tissue handy, cough or sneeze into the crook of your arm. Turn away from other people.

Even if the stock market has recovered in the meantime, production in China is not yet running at full speed again and further slumps may occur. In this AmCham survey give:

- 41 % of companies indicate that staff shortage is their biggest challenge in the next 2 to 4 weeks.

- 30 % of companies indicate that logistics problems will be their top concern.

- 78 % of companies indicate that they do not have enough staff to fully utilize production.

- 41 % of companies indicate that staff shortage is their biggest challenge in the next 2 to 4 weeks.

- 58 % of companies expect lower demand than usual.

- 38 % of companies do not have a sufficient number of masks to protect their employees from coronavirus infection.

- 35 of the % of the companies rated a clearer explanation of the requirements as the most important thing the government can do to speed up approvals for factories to open.

As investors, we'll likely have to wait until the summer of 2020 for the effects of the coronavirus to be erased. So in the meantime, make sure your portfolio is positioned according to your goals and risk tolerance.

For science: Fingers crossed that we will have a licensable vaccine available soon.

1 thought on “Wichtige Details zum Coronavirus für Investoren”