if you don't 157.284.162.530.582.281.403.420.671 % pa. If you want to take an enormous risk, I will present some new research to you in the following article. In this way, even as an average consumer, you can benefit as best as possible from high returns on shares with little risk. For 24 years, JP Morgan Chase has published a long-term capital markets outlook on the markets. This year, due to the coronavirus shock, the bank reassessed its earnings expectations for the first time outside of the usual annual cycle. In this article, I go into the key messages of the report: Stock returns and risk assessments after the crisis.

This post is through smart broker* Sponsored. The broker is currently the #1 in my depot comparison and has again improved his conditions. All securities at Gettex and all derivatives at Morgan Stanley, HSBC and Vontobel can be traded for EUR 0.00 per order. As a result, a free broker is available in Germany for the first time, which offers a fully-fledged desktop interface. You can find other interesting depots in the depot comparison. If you want to know more about my cunning depot model, where you can collect 0.75 % extra dividend, click here.

JP Morgan Chase's Long-Term Capital Market Assumptions

What you can learn here

- JP Morgan Chase's Long-Term Capital Market Assumptions

- Due to the corona shock, predicted returns are increasing in all asset classes

- More favorable return/risk profiles after the crisis

- Why the projected returns of stocks are better after the crisis?

- Technology: Growing strongly even after the crisis

- Higher Post-Crisis Stock Returns – A New Cycle?

The aim of the Long-Term Capital Market Assumptions (LTCMA) is to make forecasts about economic development, interest rates and important asset classes for the next few years. The forecast is therefore designed for the long term and covers at least one complete economic cycle or 10 - 15 years.

Due to the corona shock, predicted returns are increasing in all asset classes

Even if the effects of the pandemic are rampant for the economy, JP Morgan does not expect any lasting damage to long-term economic growth. Rather, the price slumps represent the beginning of a new cycle. In the current situation, it is important to distinguish between cyclical and non-cyclical issues with long-term challenges. If it's just a short-term, cyclical issue, companies have been penalized disproportionately in the stock market. If you are brave, you can now use this for yourself!

The return expectations for Euro Large Cap stocks have increased by 2.4 % due to the price drop 8.2 % increased. The situation is similar with US large cap stocks. The emerging countries promise the highest yields both before and after the crisis. Here, JP Morgan sees long-term returns in excess of 10 %.

Here again all the forecast returns of the upper bar chart for reading.

More favorable return/risk profiles after the crisis

Next, let's take a look at the risk profiles of stock returns. These too have improved considerably since the crisis. The risk profile is expressed using the Sharpe ratio. The Sharpe ratio measures the excess return of an investment vehicle per unit of risk. So higher Sharpe Ratios mean either:

- higher returns with the same risks or

- the same returns with reduced risks.

The higher the Sharpe ratio, the better.

Improved Sharpe ratios for all stocks since the corona crisis. The risk profile is expressed using the Sharpe ratio. The Sharpe ratio measures the excess return of an investment vehicle per unit of risk.

As you can see in the chart, Europe and the USA are now level. I find it amazing that Japan, which has been stagnant for a long time, is now even the leader in terms of the Sharpe ratio.

Why the projected returns of stocks are better after the crisis?

The all-important question is, why is everything the way it is? Why are projected stock returns rising when markets are still panicking?

As a buy-and-hold investor with a long-term investment horizon of 10 to 20 years, such short-term setbacks in the stock market can pay off extremely. This is also what the study looked at, and it's also what investor legends like Warren Buffett have been preaching for years. Also on Konto-Kredit-Vergleich.de has been advised several times to enter equities, especially at the current market low at the end of March. For example here, here , here and here.

Stocks with sound fundamentals are punished by market overreactions in crises. Courageous investors who can cope with further short-term setbacks can now benefit from this. The study says:

" The more pessimistic the assessment of the situation today, the more optimistic the long-term earnings outlook can be."

LTCMA, JP Morgan 2020

Long-term returns can almost double over 10-15 years once you get in at the bottom of the market. The return kick from the corona setback can be so strong. Congratulations to everyone who bought shares at the market low.

Since market timing is not possible, it is advisable in any case to refill the depot a little more when resetting.

Technology: Growing strongly even after the crisis

Heavy cash injections can cause the leadership in stock markets to shift. Growth stocks have been significantly more successful than value stocks over the past 10 years. Low interest rates favored this development. This benefited the strongly growth-oriented US market. JP Morgan even speaks of an "American decade". I wouldn't go that far at this point, since emerging markets have also brought decent stock returns over the past decade.

Nevertheless, the subject of technology will continue to play a decisive role on the stock markets in the future. The trend is supported by an expansive monetary policy, i.e. the strong pumping of money into all areas of the economy. Even if technology is still growing strongly, it is conceivable that other regions will catch up more in the future.

As bond yields have continued to fall, equity spreads are rising to near historic levels. In the USA, Europe and the emerging countries, the risk premiums are north of 7 percent.

Higher Post-Crisis Stock Returns – A New Cycle?

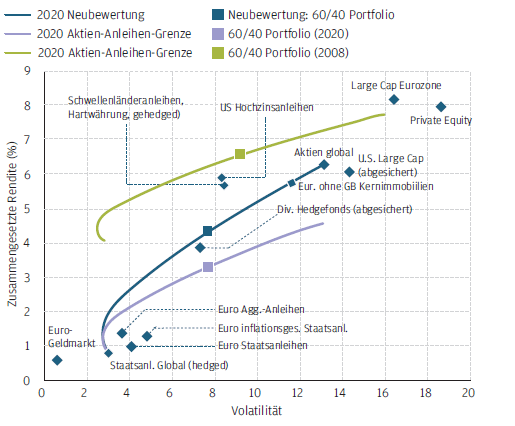

The crucial question is also whether a new cycle will begin on the stock market after the crisis. JP Morgan is currently assuming so. There is a very interesting representation of this, in which risk (as volatility) is plotted against return. A line is created that shows the above-mentioned excess return of an asset class in relation to its volatility. Equity returns will continue to be significantly higher than bonds in the future. In addition, JP Morgan believes that the new cycle will have its own characteristics. These include topics such as technology, sustainability, division of income between capital and labor as well as reflation. No matter how the new characteristics will turn out, one thing seems relatively reliable given the current discounts: In the long term, there will be higher returns on equities after the crisis.

The equity-bond efficiency limit line: With the revaluation after the corona crisis, the characteristic line rises sharply in areas of higher volatility. Stocks in particular deliver a high excess return in relation to the risk involved.

Source: LTCMA, JPMorgan Asset Management Multi-Asset Solutions; Status: April 2020.

This post is through smart broker* Sponsored. The broker is currently the #1 in my depot comparison and has again improved his conditions. All securities at Gettex and all derivatives at Morgan Stanley, HSBC and Vontobel can be traded for EUR 0.00 per order. As a result, a free broker is available in Germany for the first time, which offers a fully-fledged desktop interface. You can find other interesting depots in the depot comparison. If you want to know more about my cunning depot model, where you can collect 0.75 % extra dividend, click here.

I have written a new review of the N26 account. The N26 checking account is completely smartphone-based. The free account management from 0 EUR monthly cash inflow including Maestro and credit card is given. With N26, you get a good account that helps you keep your spending under control and is fun to use.

>> You can find the full review of the N26 account here <<

Graphs and tables taken from J.P. Morgan's LTCMA Report. The LTCMA Reports can be found here.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.