In the credit industry, a Warning a written reminder, which a borrower receives from his lending bank if he violates the specifications of the loan agreement. The warning letter lists the amount of the loan, the amount of the monthly installments, the interest rate, the duration of the repayment and other fees that may apply. A warning notice is always in writing.

The purpose of a warning letter is to avoid legal action and communicate directly with the borrower. If the borrower does not fulfill his obligation and does not execute the payment, the dunning procedure may end up in court and the borrower will have to bear additional costs.

What do I have to consider when I receive a warning?

What you can learn here

If you, as the borrower, violate the loan agreement, the bank has the right to send a warning letter. If you continue to fail to meet your payment obligations after receiving the warning, the dunning procedure may be initiated, up to and including legal proceedings. Each step usually incurs further costs for the borrower, increasing the pressure. In addition, the bank can terminate the credit account. Furthermore, since April 2010 it is possible that Banks and other contractual partners the delay in payment already after the second warning to the Schufa report. However, this requires the Claim undisputed be. This means that the claim may only appear in the Schufa if you give it to this do not contradict.

At the same time, you are obliged not to give false information to the court. Therefore, if the claim is legitimate, you should not object to it.

What is the procedure for a warning?

A warning letter is a written warning sent by a creditor, such as a bank, to a debtor, such as a borrower, when the latter has breached the credit agreement. The warning letter asks the debtor to remedy the breach within a time limit. In the case of a warning letter for a Credits this is done by paying the outstanding amounts.

If the debtor does not fulfill his obligations within this period, the creditor may take further steps. These include initiating a Dunning procedure or one Court proceedings.

It is important to note that there must be four weeks between the first reminder and Schufa notification and that the debtor must be informed that further default will result in this step.

How bad is a warning?

It is important that the bank customer takes the warning letter seriously, because the credit institution also has the power to terminate the loan agreement. Another 2010 innovation states that after the second warning letter, the bank has the option to report the borrower to Schufa for late payment. This can have a negative impact on the borrower's credit rating and make future borrowing more difficult. Often, with negative Schufa, only loans through special providers are still possible. These are Loans despite negative credit bureau, which are from private individuals, mini loan-suppliers or from abroad.

Effects on the Schufa: None in case of contradiction!

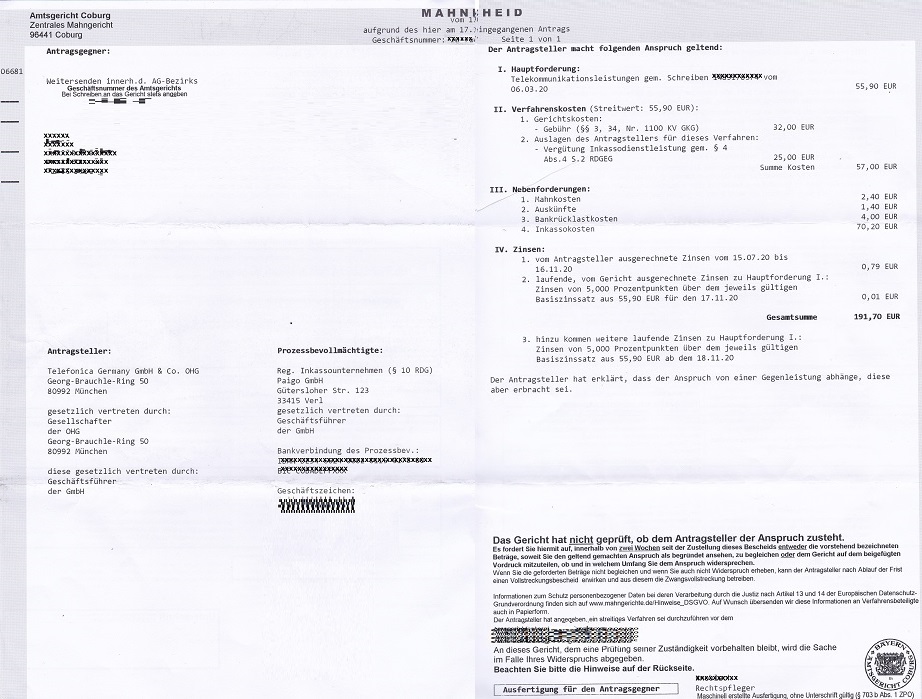

A court order for payment that you accept will have a negative impact on your SCHUFA score. However, a negative SCHUFA entry is not permitted for disputed claims and must be deleted immediately. If there is no violation, you must object to the request via the enclosed reply letter. To do so, simply check the appropriate box. See image above.

In addition to the dunning notice the Schufa also evaluates the following events negatively: insolvency applications, terminated loans, affidavits, foreclosures, and entries in debtors' registers.

How long does the reminder remain in the Schufa?

Dunning notices may not show up in your SCHUFA report forever. The Schufa stores the data on dunning notices 3 years long. However, it is important to note that the deletion period does not begin until you have settled the claim.

Conclusion

A reminder is a reminder or notice that the bank sends to the borrower. A warning is the first step when the borrower has not fulfilled agreed payments. With the warning letter, the bank reminds the borrower of outstanding payments. In addition, the bank announces further consequences in the warning letter if the borrower fails to meet payment obligations. After a warning, the further dunning process is often initiated via collection agencies. This is followed by legal proceedings.

From the second warning, borrowers receive a negative entry in the Schufa if they do not object to the claim. Negative Schufa Entries worsen modern life in many areas: Renting an apartment, signing a cell phone or DSL contract, or taking out a loan usually require a Schufa file without negative entries. Therefore, you should not take dunning notices lightly.