The past financial crash in 2020 during the corona pandemic was a scary situation for many. Back then, buying hamsters in the supermarkets, especially canned goods, spaghetti, rice & Co., made it clear how scared many were. The question of whether the corona virus will bring the next major financial crash was also relevant for many investors. After all, at the end of April 2020, the exchanges lost over 50 % in value. After that it went uphill again quickly. Can we perhaps learn something from this? What is the right way to behave in a financial crash?

Wrong behavior during a financial crash almost always results in large losses. Instead, act confident. Without panic!

No hasty actions – sit out the crisis

What you can learn here

The period from March to June 2020 was no fun on the stock markets: The German Dax as well as the Msci World index both lost more than 50 percent in value. However, advises Konto-Kredit-Vergleich.de invest with a long-term investment horizon anyway. And this then inevitably raises the question, which is why a long-term investor should be interested in what is happening on the stock markets in the short term. Money that you need in the short term should not be invested in shares or ETFs. Long-term investors should simply sit out the constant noise on the stock exchanges.

During the crisis, passive investors should: Stay passive, let savings plans run. As we discussed in another post, sticking stubbornly to the investment strategy, even in times of crisis, is a key advantage private investors have over professionals. actually are This often puts professionals at a disadvantage compared to private investors: If they don't do anything, customers get angry and accuse managers of laziness. Laziness on the stock market is usually correct if you are broadly positioned with the right savings plans.

If you feel good about it, there is a chance to take advantage of the sell-off on the stock markets disproportionately during crises. Unfortunately, no one knows whether the stock markets will continue to fall. But the fact is that you can get your ETFs cheaper during the crisis compared to before and therefore can often top up with peace of mind.

More on mooring with a Simply structured ETF portfolio is available here.

Seizing opportunities through the crisis

The financial crisis also offers opportunities for investors. Sectors such as tourism or the travel industry were hit hard by the epidemic because people simply travel a lot less. Numerous companies have imposed travel bans. During the corona crisis, there was a curfew in many districts in Germany. It was to be assumed in advance that even after the bans were lifted, people would travel less due to the uncertainty, as they were not comfortable with the idea. Major events have been canceled worldwide. As a result, airline and cruise tour operator profits are collapsing.

Certain industries weather crashes better than others. During the last crash, tech stocks did exceptionally well. There were plausible reasons for this: companies in the software and internet sectors were less affected by the corona crisis. They could even benefit from it because people are more inclined to order home and use delivery services. While the stationary trade has to close its shops, Amazon's online trade is booming. The group is hiring 100,000 new employees in the middle of the corona crisis. A solid business model, which ensures that profits increase as reliably as possible even in times of crisis, is a guarantee for further growth, from which risk-affine investors can now benefit, if you dare to buy!

Crash prophets – they often mislead people into misbehaving in a financial crash

Some crash prophets have also predicted a financial crash in 2020. The theories were often justified with the fact that the mass of cheap money keeps companies alive that are not worth preserving. These zombie companies are said to not be able to operate properly. However, other crash prophets predicted a crash in 2019. Investors who followed you were unable to participate in the historically unique run in 2019 and stayed on the sidelines. So it was wrong to follow them and it will be wrong in the future as well, since financial markets are simply too complex to make even halfway reliable statements. The question "When will the next stock market crash happen??” is therefore idle.

Who should even be concerned?

It is useful for everyone to give some thought to what is happening in the financial markets. After all, a correction on the stock market always offers opportunities. By getting your finances in order, you can take advantage of these opportunities. First of all, it is important not to be invested to 100 %, but also over liquid funds available in order to remain able to act.

Liquid funds – always available

You should always have sufficient liquid funds on hand. As an emergency cushion, I think a few monthly net salaries make sense. In principle, overnight money is protected across the EU up to at least 100,000 euros via the deposit protection fund. I don't think it makes sense to hold money in foreign currencies, as I consider the deposit protection fund to be sufficient protection. In addition, a foreign currency account has many disadvantages. The main ones are the foreign currency risk, the exchange fees and the time-consuming declaration in the tax return. You can find your emergency cushion in the Daily Allowance Calculator some good deposit accounts.

Silver, gold or other Precious metals to hedge?

Many swear by gold or silver (⇾ cheaper!) to protect against stock market crashes. I think that makes only limited sense, since precious metals, unlike companies, do not create any real added value. Their value derives solely from the fact that they are rare.

However, it must also be said that the risk of gold and silver being confiscated should be quite low. If you look at the Precious metal physically stored in a safe deposit box, it does not count as part of the bankruptcy estate if the bank goes bankrupt. However, this is not worthwhile for small amounts, because a safe deposit box also incurs costs of 70 to 80 euros per year.

As I said, I consider it due to the non-existent value creation power however, it does not make sense to hold a significant proportion of commodities in the portfolio or safe deposit box. However, those who feel more comfortable with this can hold small amounts (up to a maximum of 10 % of the portfolio) in gold or silver. By the way, there is also a suitable one for this Slipper Portfolio (⇾ Resource Slippers).

Avoiding stocks during a crisis is not smart

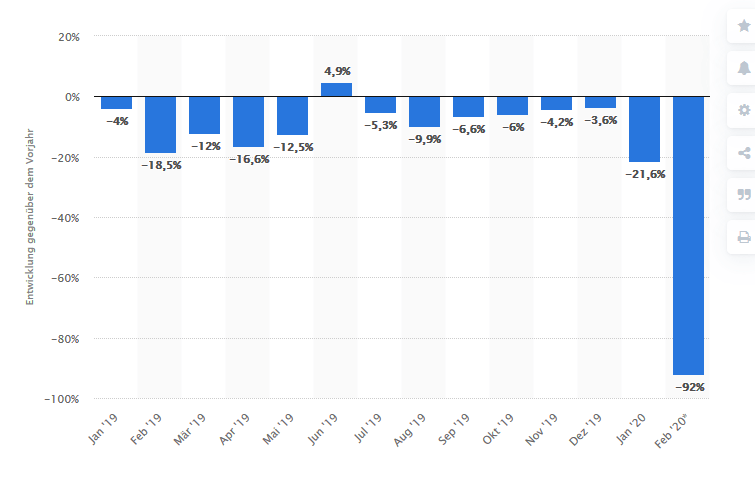

Even in a financial crash, people need products. Some are in much greater demand even in times of crisis. Empty canned goods shelves in supermarkets bear witness to this. In addition, smoking and drinking are likely to increase. Therefore, one also speaks of non-cyclical consumer goods. Cyclical consumer goods, on the other hand, are in much weaker demand in times of a crisis. These include, for example, large capital goods whose purchase can simply be postponed. cars for example. Anyone who was in quarantine during the tough lockdown in China did not think about buying a car. Therefore, according to Statista, car sales in China are up in February 2020 over 92 percent decreased compared to the previous year. A historical graphic illustrates this slump impressively:

Behavior in the financial crash: individual stocks

Anyone who owns several individual shares does not have to change their strategy even in the crisis. Because it will still be important to pay attention to quality and growth. Because quality is always important when it comes to long-term investing. Whether there is a crisis or not. Equities count as special assets. This means that in the event of a drastic crisis with subsequent bank insolvency, they still belong to the investor and not as a bankruptcy estate be used with.

This also applies in the event of a collapse of the euro, which has been conjured up in some circles for years. The securities retain their value. If the euro really no longer exists, the company shares will simply be rewritten into another currency. No reason to panic.

Behavior in the financial crash: ETFs and savings plans

I would simply let broadly diversified equity ETFs continue to run in a crisis. Portfolios built up and saved over the long term also benefit from the cost-average effect. Large indices may also contain some "zombie companies" that hop on a crash. However, this effect should be diversified away through the breadth of the ETF.

Maintain high cash reserves in case of a crash

Often one reads or hears about the tip to save up higher cash reserves before the crash and then to be able to buy more cheaply if the worst comes to the worst. For example, you could only invest half of the capital and keep the other half as a cash reserve. If there is a stock market crash, you could invest the second half. If that doesn't happen, at least half of the capital has received dividends.

This sounds very simple, but is difficult to implement in practice. Among other things, because of the great panic caused by the media, friends and perhaps also announced short-time work at the workplace, it is emotionally very difficult to invest the remaining money now that everything is in pieces. So I would follow Warren Buffett's advice and don't accumulate excessive cash reserves, even in times when a crisis appears to be looming.

Is the crisis over?

Conclusion on behavior in the financial crash

From my point of view, good behavior in the financial crash would mean doing almost everything as usual. At least if you invest in broadly diversified ETFs. ETF savers who would like to benefit from this favorable opportunity should increase their savings plan. Of course, it doesn't hurt to check the existing ETFs and stocks from time to time.

Those who can tolerate more risk use financial crises to buy cheap quality stocks with good fundamentals. However, you should never drive yourself crazy about a crisis. Because usually it slowly starts to get better again when the views are at their blackest.

2 thoughts on “Verhalten im Finanzcrash – Wie verhalte ich mich richtig?”

Comments are closed.