On April 30, 2022, the cooperation between Telefónica (o2) and Comdirect Bank on o2 banking came to an end. With comdirect as a financially strong partner, things are looking up this time. Existing customers keep their account. Nothing will change in terms of account number and cards either. New customers can use the o2 checking account but no longer open.

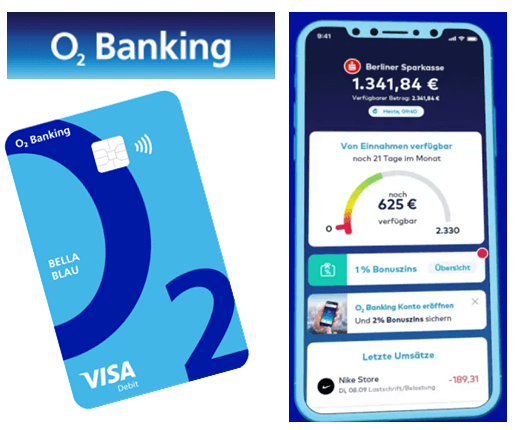

The account is from O2 banking at a Free current account without incoming salary with conditions. The account offers a free VISA debit card as well as one free giro card (EC card). With this you can free cash worldwide take off. You can also deposit cash at Commerzbank free of charge. O's bank account2 supports both Apple Pay as well as Google Pay. Another plus of the O2 Banking account is that you as O2Customer 2 % can earn interest. The O2 Banking account will be at the comdirect managed. Formerly O worked2 with Fidor Bank. The user interface, on the other hand, comes from O2. Unfortunately, as of February 2021, the account is no longer unconditionally free. Now you have a rough overview of what the current account of O2 offers. Now let's look at the O2 Current account in the banking test in more detail.

O2 Current account: No longer free for everyone since February 2021

The current account from o2 will no longer be unconditionally free from February 2021. After all, the first 6 months after opening are not affected. After 6 months, you must meet one of the following conditions to keep the account free:

- EITHER 700 euros monthly minimum income OR

- 3 payments via Apple Pay or Google Pay per month – with the bank card (Visa debit card) OR

- 1 trade/1 securities savings plan execution per month OR

- you're under 28 years old and student, pupil, trainee or intern

If you do not meet any of the conditions, o2 and comdirect current accounts cost €4.95 per month. The Girokonto from o2 and comdirect was compared with the Free checking account with no minimum deposit devalued due to the deterioration in conditions.

For whom the O2 bank account is appropriate

The O2 Banking account is suitable for users with an affinity for smartphones. All banking runs entirely via the app. Customers do not have to rely on a reasonable banking infrastructure as is the case with other smartphone accounts. Because essentially the O2 banking account comdirect account with app from O2and other perks such as the 2 % credit interest.

This is how you can use the O2 Withdraw cash from bank accounts abroad free of charge. Since you with the account itself withdraw worldwide free of charge (up to 3x/ a year), it is also very suitable for travel and vacations. The O2 In addition to many options for withdrawing money, a banking account also offers the option of depositing cash via Commerzbank. It also supports Apple and Google Pay, which also increases the day-to-day value of the account.

Are you already O2-Landline- or O2-Mobile customer? Then you have at O2 Banking slight advantages, because you receive 2 percent bonus interest on your balance. To do this, you must have a monthly receipt of money and spend 500 euros on the comdirect account integrated into the o2 Money app. If you have an account other than the O2 account in the O2 Integrate Money App, you can get 1 percent bonus interest. Which is really a lot these days...

For whom the O2 bank account is not suitable

If you value bank branches and personal customer service, the O2 Banking account not right for you. You can use the Commerzbank branches to deposit cash, but a personal conversation in a bank branch is not possible. O2 Banking sees itself as a direct bank fully digital processes.

Due to the changes that have been in force since February 2021, the account is only suitable as a secondary account with restrictions. Nevertheless, in 2021 there will still be free checking accounts without a minimum deposit that you listed here find.

Deposit and withdraw cash at O2 banking

Cash availability is at the O2 Checking account very good. So you can not only in Germany and the euro zone withdraw money for free, you can also Foreign currencies worldwide free of charge at all VISA machines take off. However, free withdrawals with the Visa card are limited to three cash withdrawals per month. In Germany, you can use the account’s girocard to withdraw cash free of charge from the Cash Group. Be careful not to use the Visa card here. Otherwise, €9.90 in fees apply.

In contrast to many other direct banks, you can use the O2 account you even deposit money into the account for free. You can use a Commerzbank branch three times a year for this. A point that convinced in the o2 banking test. Because many other free checking accounts do not offer a deposit option.

In the test: Cash in and out at O2 banking

1. 🇩🇪 & 🇪🇺: unlimited withdraw money for free ✅

2. Worldwide 🌍 3 times a year Worldwide withdraw money for free ✅

3. 3 times a year Deposit money at Commerzbank for free ✅

o2money.comdirect.de

costs at the O2 banking account

Costs will be incurred if the cards are used incorrectly. Please refer Deposit and withdraw cash.

O2 Banking Test: Bonus Interest!

Are you already O2 -Landline- or O2-Mobile customer? Then connect the O2 Money app with your payroll account. In return, you will receive 2 % bonus interest if it is your O2 Banking account trades. But even if you use another account as a salary account and integrate it into the o2 Money App, you will receive bonus interest of 1 %. Compared to others checking accounts that is a very good rate!

The security at the O2 banking account

The partner bank comdirect has been offering secure online banking for many years. It is protected by your Face ID/face recognition or Touch ID/fingerprint and your password.

In addition, that applies Banking via smartphone apps as more secure, than using banking through a browser. Apps are self-contained systems. All data is encrypted and transmitted to the app and the bank server without going through the web browser. Banking apps are therefore recommended. If you observe the following points, you can further increase security

How to increase security in smartphone banking:

- Do not use any public or third-party WiFi networks for online banking ✅

- Carry out updates on the operating system ✅

- Do not save or photograph access data on your cell phone ✅

- Protect smartphone with password ✅

- Disable Bluetooth when not in use. Bluetooth is a vulnerability that allows malicious software to be installed. ✅

The O2 Money app

The o2 Money app, which has been available since October 2020, is available free of charge from the Apple App Store or Google Play.

So2 Customer, when using the app, you will receive 1 percent interest if you open any salary account with O2e Money connect. If, on the other hand, your O2 uses the account as a salary account and with the O2 Money App you even get 2 percent interest.

What the O2 Money app can

- Monthly budget: View the remaining monthly budget with a tap. So you know immediately how much you can still afford this month. This also includes future payments and cash receipts.

- budget book: With the budget book you can keep track of what you have spent your money on.

- Contract overview: The app automatically recognizes your payments for rent, gas, electricity, insurance and many other contracts. TheO2 Money App then groups the payments into clear categories.

What the O2 Money App can not

At the end of 2020, there were some technical problems with the connection of third-party accounts when the app was launched. These were through a software update fixed it. Still, the app isn't flawless. Although numerous bookings are automatically recognized and assigned, this is currently not possible Move bookings to another category, or the category to rename (e.g. instead of “Household” the category “Saving and Investing”). There are still technical problems when logging in with a fingerprint sensor. Registration does not always work. According to O2 will at one software update worked to fix these issues.

O2 Banking conditions in the test

Let's first look at the conditions of the O2 Banking accounts, as shown in the current account comparison without incoming salary. It is easy to see that the O2 Banking account compared to other checking accounts very good conditions offers and the met most of the criteria. I would like to go into this briefly in the following, but first take a look for yourself Evaluation of the conditions of O2 banking at:

[sp_easyaccordion id="7561″]Fees and Income

With the limitations described, the o2 current account still has no account management fee or basic fee. A receipt of money (wage, salary) is not necessary. The O2 Account is free even without receipt of money. The interest rate is 6.5 % in the favorable range. O2 Customers can also get 2 % credit interest, which is a rarity in 2021. Unfortunately sweetened O2 not opening with a bonus.

cards

At the O2 checking account, you will receive both a Visa debit card and a Girocard.

Cash

With the O2 You get a banking current account Free cash worldwide. You can use all VISA machines for this purpose. In addition, three times a year you can use the Commerzbank deposit money.

Additional Services

O2 offers both Apple Pay and Google Pay as a smartphone banking solution. The account can be opened without a printer and paperwork, but fully digitally via video identification. While with the O2 Fidor account was still possible, the Girokonto without SCHUFA query, this is possible with the O2 comdirect account no longer possible. A SCHUFA query is made and O2 Banking reserves the right to reject the opening if the SCHUFA entry is negative. The o2 banking current account has numerous evaluation functions in the app O2Money. In this way, evaluations of the household book or the monthly budget can be run. It can also see how many contracts you have running. In the video you can see the essential features of the O2 Money app.

Brokerage account & cash account are from O2 Partner Comdirect available if you want a complete package. However, the interest from the comdirect call money account is 0 %, which is why the offer actually makes little sense. The Comdirect depot could be more exciting. In addition to cheap trading fees, it offers many free savings plans and the possibility to use it as a child depot to open.

Will at O2 Banking made a SCHUFA request?

In the early days, O2 Banking a free checking account without SCHUFA query. That is no longer the case. To open the account, the provider submits a request to SCHUFA. If you have a negative SCHUFA entry, O2 Banking probably not agree to the opening of the current account.

For everyone who has a negative SCHUFA entry, a Credit based account the provider open bank * or Tomorrow* a good alternative. The providers refrain from a credit check. It is therefore possible there without any problems free checking account despite negative SCHUFA entry to get.

Alternatives to the O2 Banking checking account

The best alternative to O2banking is this free checking account N26 bank. The account is unconditionally free, completely smartphone based and including MasterCard. Even though N26 does not offer 2 % bonus interest, the bank convinces with a stable and good app. For all those who want a free Account without SCHUFA query, the Free accounts from the open bank * or Tomorrow* the best alternative to O2 banking

Conclusion to the O2 Banking checking account

The account is from O2 banking for a very good one Free current account without incoming salary. Hence the O2 Banking current account comparison Free checking accounts with no minimum deposit currently first place. And not without reason. So the account offers a free VISA debit card. With this you can free cash worldwide take off. You can also do this three times a year at Commerzbank Deposit cash for free.

O's bank account2 supports both Apple Pay as well as Google Pay. Another plus of the O2 Banking account is that you as O2 customer 2 % interest can get. The app drew negative attention in the test. Many points have already been corrected, but the o2 Money App still suffers from teething problems. Other negative points with the O2 Banking current account are that foreign currency cannot be raised indefinitely free of charge and the lack of an opening bonus.

To the provider:o2money.comdirect.de

O2 Banking FAQs

The following questions interested others about the o2 banking test.

Who is new partner of O2 banking?

The new partner of O2 Banking is comdirect. O2 Banking has ended its partnership with Fidorbank

Is there an o2 banking app for the PC?

No, banking is only possible via the app

What are the advantages and disadvantages of the o2 banking account compared to other current accounts?

✔️ unconditionally free checking account

✔️ No minimum deposit

✔️ Free VISA debit card

✔️ Free giro card (EC card)

✔️ Withdraw free cash worldwide

✔️ Free cash deposits at Commerzbank

✔️ Apple and Google Pay

✔️ up to 2 % interest

❌ no opening bonus

❌ Outside of Germany, free withdrawals are limited to 3 times a month

❌ App still with teething problems (fixing promised by the provider)

Is O2 banking for free?

The account of O2 Banking is free even without a salary. To your O2 Banking account includes a free Visa debit card as well as a girocard.

Is used at the O2 banking did comdirect obtain SCHUFA information?

Yes, your creditworthiness will be checked when you open it.

What are alternatives to the O2 banking Account?

The best alternative to O2banking is this free checking account N26 bank. The account is unconditionally free, completely smartphone based and including MasterCard. Even if the N26 does not offer 2 % bonus interest, the bank convinces with a stable and good app. For everyone who is looking for a free account without a SCHUFA query, these are Free accounts from the open bank * or Tomorrow*the best alternative to O2 banking

How do I reach customer service?

You can contact the customer service on 04106 - 708 25 08. Please have your access data ready. You can find further contact options on the contact page of O2 banking