Trade Republic and smart brokers convince in depot comparison with a clear price structure and favorable conditions. Both providers are among the cheapest brokers in Germany. But which one is better for whom? In this article "Smartbroker vs Trade Republic” let's compare features and prices of the two brokers. In addition, Experiences from around 100 user reviews viewed and analyzed. The comparison of the stock portfolios of Smartbroker and Trade Republic was after objective criteria accomplished.

Also interesting: In a similar article we have justTRADE compared to Trade Republic.

Smartbroker vs Trade Republic at a glance

What you can learn here

- Smartbroker vs Trade Republic at a glance

- Smartbroker vs Trade Republic: How did the brokers compare?

- Smartbroker vs Trade Republic: Summary table of how it was compared

- The comparison of Smartbroker vs Trade Republic

- 1. Custody Fees

- Trade Republic: No custody fee for securities accounts

- 2. Trade Offer

- 3. Trading Places

- 4. Savings Plans

- 5. Foreign Currency Accounts

- 6. Available Order Types

- 7. The trading interface

- 8. Deposit Protection

- 9. Account/depot opening

- 10. Securities Loan & Withholding Tax

- 11. Broker Spreads and Stability

- 12. Who has the better service?

- In the Smartbroker vs Trade Republic comparison, Smartbroker wins

- Smartbroker and Trade Republic have different target groups

- Smartbroker vs Trade Republic: FAQ

Smartbroker is very versatile and therefore a real one all-rounder. The broker offers a very large variety of trading opportunities on favorable terms. With this, Smartbroker offers a very good combination. The broker also proved itself in the trading-intensive year 2020. The drawback is the usability of the broker: the Smartbroker makes an old-fashioned impression. Trade Republic is much easier to use in comparison.

Trade Republic, on the other hand, is for ETF and share savings plans very suitable. But the broker also offers a good entry-level offer for stock and ETF investors. Besides the low fees, the biggest plus is the easy access via an app.

If you only need a smartphone app for banking, you get it Trade Republic *an unbeatably cheap depot. On the other hand, if you value a fully-fledged broker, you should go to the smart broker* grasp. Smartbroker wins the comparison, namely with almost all defined criteria. In addition to a large offer for ETF savers and traders, the broker also impressed with a stable system during the trading-intensive days in March and April 2020. For small depots or as a second depot Trade Republic* but well suited in this comparison test despite the setback suffered.

|

|

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

Smartbroker vs Trade Republic: How did the brokers compare?

for comparison 12 criteria Are defined. These are: Custody fees, trading offer, trading places, savings plans, foreign currency accounts, order types, interface

Deposit protection, opening process, securities lending, stability and spreads and the service of the brokers.

Since the deposit guarantee only applies to the clearing account and not applies to the depot itself, I mention this point in the comparison test but do not rate it. Likewise, the interface or the user interface is a matter of taste. Therefore also the User interface not rated. I have all the other criteria with me 10 % each rated equally.

You can find them all here Criteria of the comparison test by Smartbroker and Trade Republic in an overview:

Smartbroker vs Trade Republic: Summary table of how it was compared

| number | What was compared? | rating | Who won? |

|---|---|---|---|

| #1 | custody fees | Weight: 10 % | Winner: Tie |

| #2 | trade offer | Weight: 10 % | Winner: smart broker* |

| #3 | trading places | Weight: 10 % | Winner: smart broker* |

| #4 | savings plans | Weight: 10 % | Winner: Trade Republic* |

| #5 | foreign currency accounts | Weight: 10 % | Winner: smart broker* |

| #6 | order types | Weight: 10 % | Winner: smart broker* |

| #7 | interface | Weight: 10 % | Winner: Trade Republic* |

| #8 | deposit insurance | Weight: 0 % | Winner: No rating, as for a clearing account |

| #9 | opening process | Weight: 10 % | Winner: Trade Republic* |

| #10 | Securities Loan | Weight: 10 % | Winner: smart broker* |

| #11 | Stability and Spreads | Weight: 10 % | Winner: smart broker* |

| #12 | service | Weight: 10 % | Winner: Tie |

Smartbroker is an old hand...

smart broker only started at the end of 2019, but actually a "old hand" in the broker market. Because behind Smartbroker stands wallstreet-online Capital AG. In addition, the custodian bank is the Münchener Bank. The DAB Bank is also a brand of BNP Paribas, which also includes the consor bank* heard.

There experienced teams behind the new one Smartbroker brand the broker offers a svery wide commercial offer. Smartbroker also convinces with one cheap price model. Because trades on Xetra or Tradegate only cost €4 flat (exception: Xetra €4.00 + exchange fees). Smartbroker also offers over 540 ETF savings plans, 255 of which are free of charge. Next we look at the background of Trade Republic.

..Trade Republic, on the other hand, is a start-up

Trade Republic was started by three guys who knew each other from university: Christian Hecker, Thomas Pischke and Marco Cancellieri. Her vision was that Stock trading completely free and mobile to offer. The broker Trade Republic has in contrast to the Smartbroker no established infrastructure: the apartment by Trade Republic completely redeveloped.

Securities trading belongs on the cell phone and commissions are a thing of the past.

Trade Republic motto

The three founders have been building the Handy Broker since 2015. Consequently, there is no desktop version of Trade Republic. Whether this is an advantage or disadvantage is in the eye of the beholder. However, trading is always easier and faster with it. After this brief introduction, let's get down to business!

The comparison of Smartbroker vs Trade Republic

1. Custody Fees

in the Test by Smartbroker and Trade Republic let's look at the first Comparison of custody fees. Both offer free depots. Dividends from Germany and abroad also end up in your account with both of them free of charge. There are minor differences in currency conversion. This means the conversion of dividends into euros. If the company pays them in another currency. When converting USD → EUR, Trade Republic is slightly cheaper. Smartbroker is ahead when it comes to registering registered shares. The Berlin broker charges 1.40 euros less for this. For most, however, this shouldn't be a major difference.

Trade Republic: No custody fee for securities accounts

Another positive thing to note is that Trade Republic no custody fee for custody accounts raises. With the Smartbroker, this is the case if the cash balance is too high.

smart broker: 1; Trade Republic: 1

✔️ free depot ✔️ Foreign dividends: free ✔️ Registration of registered shares: €0.60 per item ✔️ Premium or discount currency conversion USD → EUR: 0.003 ✔️ Limit and order changes for free ✔️ Clearing account: free** ** If the cash ratio in relation to the deposit is greater than 15%, a negative interest rate of -0.50% pa will be charged To the provider: Smartbroker.de | ✔️ free depot ✔️ Foreign dividends: free ✔️ Registration of registered shares: 2 € per item* ✔️ Premium or discount currency conversion USD → EUR: 0.014 ✔️ Limit and order changes not possible. Workaround: Delete and create a new one ✔️ Clearing account: free with no strings attached *poss. plus third-party expenses To the provider: TradeRepublic.com |

2. Trade Offer

Next, let's look at the trading offering from Smartbroker and Trade Republic. Trade Republic is narrowly positioned here. Because the broker only offers you trading at Lang & Schwarz. Nevertheless, with Trade Republic you can choose between 7,800 different stocks and over 300 ETFs.

Smartbroker is completely different: Here you can buy your shares and ETFs on all German stock exchanges. You can also trade international stocks on the home stock exchange at Smartbroker.

Smartbroker has a much better selection of stocks and ETFs than Trade Republic. wikifolios can also be traded via Smartbroker, which gives the broker another plus point in the trading offer category. In the next point we will go back to the trading places.

smart broker: 2; Trade Republic: 1

✔️ 7,300 shares ✔️ 1,500 ETFs ✔️ Certificates (investment certificates), leverage products, warrants ✔️ wikifolios ✔️ Bonds To the provider: Smartbroker.de | ✔️ 7,800 shares ✔️ 300 ETFs ✔️ 40,000 certificates (investment certificates), leverage products, warrants ✗ No wikifolios ✔️ Bonds To the provider: TradeRepublic.com |

You are interested in investing with a Lombard loan. in the Securities loan comparison you can find the best providers in comparison

3. Trading Places

When it comes to trading venues, Trade Republic doesn't stand a chance against Smartbroker. smart broker is via the existing infrastructure of BNP Paribas connected to all German stock exchanges. Foreign stocks can at smart broker also at theirs home exchanges traded. this is in Canada, United States and Europe possible.

Trade Republic is only on Long & Black connected. The offer is therefore limited. However, it is a myth that higher spreads have to be paid at L&S while XETRA is open. The courses are usually only marginally different. However – and this is the decisive factor – it can Trade Republic happen that multi-day stop orders below market value to be executed. This is on high spreads in the morning and evening attributed. This means that stop orders are executed outside of Xetra opening hours due to price fluctuations. The point of trading venues clearly goes to Smartbroker.

smart broker: 3; Trade Republic: 1

✔️ Xetra, Tradegate, gettex, LS Exchange, Quotrix ✔️ Euwax, Frankfurt certificates ✔️ Parquet exchanges Germany ✔️ Buy foreign stocks on home exchanges in: USA, Canada & Europe ✔️ OTC trading with 15 issuers (3 premium issuers) | ✔️ Only trading possible on LS Exchange ✗ No trading via real exchange ✗ No purchase of foreign stocks on home exchanges |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

4. Savings Plans

Smartbroker has approx. 600 ETFs as a savings plan on offer. Even savings plans on Xetra and Euwax Gold are possible. Trade Republic also offers all 1,500 tradable ETFs as a savings plan. These include ETFs from iShares, Lyxor, Amundi, Xtrackers, Wisdom Tree and numerous individual stocks.

Trade Republic savings plans are free. Almost half of the 600 Smartbroker savings plans are also free. For the rest, the fees for savings plans are volume-dependent. There are 0.20 percent of the savings rate per execution. The minimum fee is EUR 0.80. Even if the smart broker Savings plans are among the cheapest savings plans for savers from 75 euros per month, the point goes to Trade Republic.

Both providers run savings plans via Lang & Schwarz. Smartbroker usually around 9:15, Trade Republic distributed throughout the day. the Smartbroker has a minimum savings rate of 25 euros under the usual 50 euros per month. Maximum are at smart broker however Savings plans up to 3,000 euros possible. at Trade Republic are also Savings plans are available from 25 euros and can even go up to 5,000 euros to be set.

smart broker: 3; Trade Republic: 2

✔️ 540 ETF savings plans ✔️ including 255 free ETF savings plans ✔️ The rest is cheap: 0.20 % (at least 0.80 euros) per version ✔️ Established ETFs: Amundi, iShares, Lyxor, comstage, BNP Paribas, Xtrackers, Vanguard, SPDR, UBS, HSBC, Invesco, DEKA, etc. ✔️ Savings plan possible from 25 euros to 3,000 euros per version ✔️ Savings plan execution: monthly, bimonthly, quarterly and semi-annually possible ✔️ Savings plans on shares possible | ✔️ 1500 ETF savings plans ✔️ all savings plans for free ✔️ Savings plans on shares possible ✔️ Established ETFs: Amundi, iShares, Lyxor, Xtrackers, Wisdom Tree ✔️ Savings plan possible from 25 euros to 5,000 euros per version ✔️ Savings plan execution: monthly or quarterly on the 2nd or 16th |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

5. Foreign Currency Accounts

At Smartbroker you can buy international stocks at the respective trade home exchanges. If you want, you can smart broker also a foreign currency account furnish. The form for foreign currency accounts can be requested directly from the broker by email to service@smartbroker.de. The provider Trade Republic, on the other hand, does not offer any foreign currency accounts.

smart broker: 4; Trade Republic: 2

6. Available Order Types

Both brokers can accept common orders such as Market Limit and stop loss depict. However, offers smart broker also dynamic orders which are not available with the app-based broker Trade Republic. To the dynamic orders belong: Trailing Stop Loss and One Cancels Other.

✔️ Classic static order types available ✔️ Market orders ✔️ Limit orders ✔️ Stop Loss Orders ✔️ Dynamic order types also available ✔️ Trailing Stop Loss ✔️ One Cancels Other | ✔️ Classic static order types available ✔️ Market orders ✔️ Limit orders ✔️ Stop Loss Orders ✗ Dynamic order types not available |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

smart broker: 5; Trade Republic: 2

7. The trading interface

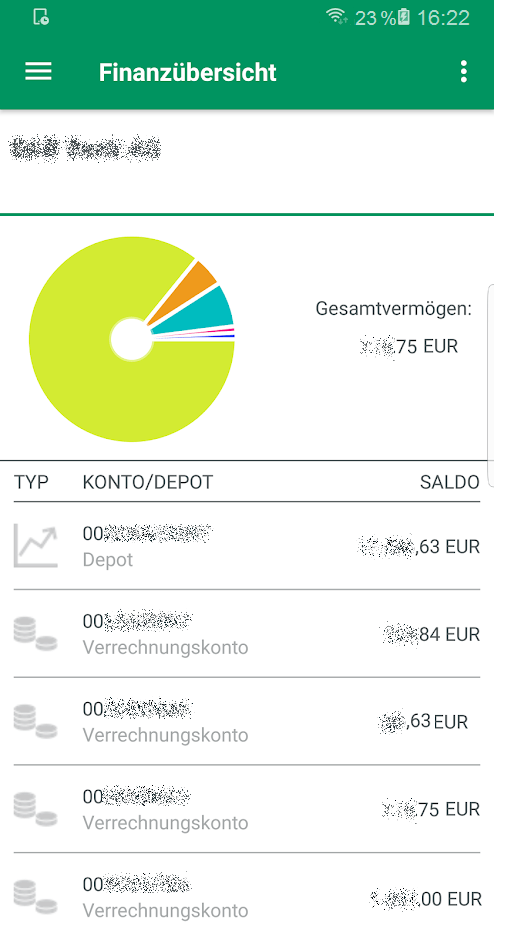

smart broker offers a web-based interface at. Access to your depot is therefore ideally via a PC. Trade Republic, on the other hand, swears by the app. Desktop access is not available here. Smartbroker looks old-fashioned compared to Trade Republic.

smart broker: 5; Trade Republic: 3

[sp_easyaccordion id="6353″]

Has Smartbroker planned an app?

smart broker has the release of a app planned. But "a bit of mobile banking“ is too already possible today with Smartbroker. About the App "DAB B2B end customers" you can log into your Smartbroker depot and get information about Depot inventory, clearing account and order orders see. However, can no orders be abandoned, which is why the DAB app cannot replace desktop access. The app DAB B2B end customers is available for Android and iOS. Until the Smartbroker app is available early next year, the point of mobile trading will clearly go to the class leader in this category: Trade Republic*. With the DAB app, Smartbroker has “just look, don't do" possible.

8. Deposit Protection

securities belong to special assets. The deposit guarantee, on the other hand, applies to that clearing account. Therefore, for deposit insurance also takes place No value. the deposit insurance only protects Amounts of money in the clearing account. Nevertheless, Smartbroker clearly performs better here. Smartbroker secures the deposits well above the legal deposit guarantee limit of €100,000. The deposits at Trade Republic are insured up to an amount of 100,000 euros. The deposits at Smartbroker, on the other hand, are 1,200 times more secure.

✔️ Statutory deposit insurance: €100,000 per customer ✔️ Voluntary deposit insurance: €120 million per customer | ✔️ Statutory deposit insurance: €100,000 per customer ✗ No further voluntary deposit insurance |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

9. Account/depot opening

With Smartbroker you can manage your depot both via

- VideoIdent as well

- PostIdent

open. In the past, the broker was heavily overloaded and there were sometimes waiting times of 3-4 weeks when opening a depot. Smartbroker seems to have this under control. The broker currently promises to open the depot in 3 days. A Smartbroker depot can also be used as a Junior Depot be opened, which is not possible with Trade Republic.

Smartbroker has reduced the processing time for securities account applications since mid-May. The depot opening now takes a maximum of three days.

Message from Smartbroker dated July 8th, 2020

With Trade Republic it is still much easier: According to some information on the website or the app, you can open your depot in a few minutes.

smart broker: 5; Trade Republic: 4

10. Securities Loan & Withholding Tax

Both brokers automatically pay the withholding tax. However, Smartbroker can come up with another extra: Dem Securities Loan. Other names for the Securities Loan are securities loan or Lombard loan. A Lombard loan is a loan where Securities in the custody account as collateral to serve. for People who know what they are doing, can he Smartbroker Securities Loan a Yield turbo be.

The Smartbroker Securities Loan you get interest for 2.25 % pa. That's pretty cheap compared to many other brokers. 4-5 % are more common here. The securities loan has no upper limit with Smartbroker. However, the amount of the loan depends on the value of the deposit and the types of securities. The minimum amount is €15,000. If you don't know exactly what you're doing, you'd better stay away from it Purchase on margin to let. Finally it is a additional risk of buying shares on credit that should not be underestimated!

✔️ Withholding tax is automatically calculated and paid ✔️ Securities loan 2.25 % pa effective ✔️ The securities loan has no upper limit with Smartbroker. ✔️ The minimum amount is €15,000. | ✔️ Withholding tax is automatically calculated and paid ✗ No securities loan available |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

smart broker: 6; Trade Republic: 4

11. Broker Spreads and Stability

Another important point when comparing brokers is a reliable and stable trading system With low spreads. A point that I could not find in various other comparisons, but think it is very important. Finally, a good broker must be able to guarantee that trades also at the stop price executed, when the stock markets are hot, i.e. the trading volume increases sharply.

At this point is Trade Republic Unfortunately none paragon. It can be like that Trade Republic happen that Stop orders below market value to be executed. This is on high spreads attributed in the morning and evening. Smartbroker performs significantly better here with its established DAB system: The spreads are tighter, that Trading system works very reliably!

✔️ Stable trading system: no system weaknesses during the trade-intensive corona crisis ✔️ Tight spreads | ✔️ Trading system occasionally overloaded, positions are sold below the stop price ✗ Spreads larger, especially in the morning and evening |

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

smart broker: 7; Trade Republic: 4

12. Who has the better service?

Most brokers had during the slump in the period March to May 2020 much to do: The Demand for depots skyrocketed at. So also at Smartbroker. The broker was not prepared for this. That's why you had to Smartbroker problems with the to keep up with depot openings. The waiting time was back then between 4 and 6 weeks. That wasn't nice for many. And Smartbroker promptly got the receipt. Although the provider informed customers about this fact, there are various bad reviews for Smartbroker long waiting times when opening a depot. smart broker has here but meanwhile but heavily improved: Depot applications are now processed within a few days. The processing time is therefore absolutely within the usual range.

But also that Service for existing customers left in Q2 2020 left a lot to be desired due to Corona: Several reviews of poor customer service from March, April and May 2020 bear witness to this. A problem that has since improved. So writes in July 2020 a users excited: "Super fast support."

at Trade Republic are most of the testimonials about customer support except for a few isolated cases positive. The broker tries to fast response times within 24 hours. A goal that he apparently achieves most of the time! However, there are also people who had to wait longer than 24 hours for an answer from Trade Republic. However, similar to Smartbroker, most of the complaints date from the period from March to May 2020. During the months there was a sharp increase in demand for custody accounts.

smart broker: 8; Trade Republic: 5

In the Smartbroker vs Trade Republic comparison, Smartbroker wins

|

|

| To the provider: Smartbroker.de | To the provider: TradeRepublic.com |

Smartbroker is the clear winner in the Smartbroker vs Trade Republic comparison. So wins smart broker* With 8:5 points against Trade Republic. Finally, Smartbroker has a very good offer for ETF savers as well as traders. In addition, trade in derivatives possible. smart broker also offers Wikifolios which can be traded for as little as one euro at the Lang & Schwarz trading venue. In addition, about many stock exchanges traded. even one Securities Loan is aviable. Behind Smartbroker is a depot with the long-established DAB BNP Paribas (e.g. also Consorsbank), whereby Smartbroker also has a serious and confidence-inspiring impression awakened.

Smartbroker and Trade Republic have different target groups

The comparison of the two brokers smart broker and Trade Republic has shown that both brokers follow very different approaches. In comparison it becomes clear that to a good broker just heard much more than a cool app!

If mobile trading via app is important to you, Trade Republic is the right place for you. The numerous cheap shares and ETF savings plans in connection with the ease of use are also convincing at Trade Republic,

If you value a full-fledged broker, you'd better go to smart broker* grasp.

Trading on real stock exchanges, extensive range of savings plans, many extras such as foreign currency accounts, Wikifolios or Securities loans. When comparing the functionality Trade Republic has no chance against the Smartbroker

However, if you prefer one full broker you'd better go to smart broker grasp. That full commercial offer and the cheap prices are at smart broker simply convincing. In addition, so far no system weaknesses during the busy spring of 2020famous.

the Target group of the Smartbroker are Buy & Hold investor. But also trader the dynamic order options like "One cancels other" & "Trailing stop loss" appreciate. At the same time, the smart broker also considers an attractive offer ETF saver ready. This target group is likely to save in particular on the cheap Vanguard ETFs happy. By lending securities with the Smartbroker Lombarkredit, returns and risks can be leveraged. For fans of wikifolios the Smartbroker is also a good alternative.

Trade Republic offers, however, inexpensive Trading via app. With that you probably want a young one target group reach. Also the favorable fee structure fits the model. So can yourself Savings plans over 25 euros free of charge to be executed. Because of low barriers to entry is Trade Republic, especially for Beginners and smaller deposits interesting. The depot is also ideal due to the mobile access Second depot for gambling at!

Read more: In this article I introduce you Alternatives to Trade Republic in front.

To the provider:

Smartbroker.deTo the provider:

TradeRepublic.com

Smartbroker vs Trade Republic: FAQ

Can the two brokers be compared at all?

Smartbroker and Trade Republic have different target groups that they want to convince of your broker offer. While Smartbroker offers the full range for buy & hold investors, traders and savings plan investors, Trade Republic tries to convince the younger smartphone generation with a cheap depot with good usability. In this test I have defined 12 criteria to compare the two brokers despite the different approaches. After all, they both have one thing in common: a damn good offer for the appropriate target group!

For whom is Trade Republic still the better broker?

Trade Republic lost the comparison test against Smartbroker. However, Trade Republic is still worth a look - because the smartphone-savvy generation in particular loves Trade Republic for its good usability! In fact, the Trade Republic app looks tidy and modern - very different from the "DAB B2B end customer" app from Smartbroker. If you don't need all the additional functions of the Smartbroker, such as more order types (e.g. OCO) or more selection of ETFs, securities loans, opening as a junior depot, you can use Trade Republic without hesitation. Those who are satisfied with the smaller size of the mobile broker Trade Republic are probably even better off. After all, too many features can quickly become overwhelming.

Smartbroker doesn't even have an app and the web interface looks outdated - do you still recommend it?

In fact, the Smartbroker web interface is not necessarily what you would expect in 2021. The currently available app "DAB B2B Endkunden" is not really what you would expect from a modern broker. Nevertheless, the outdated web interface is not the criterion par excellence to evaluate a broker. With its outdated interface, the Smartbroker, for example, got through the busy trading days in March and April 2020 much better than the modern-looking Trade Republic, which was no longer able to process the rush of orders. So the Smartbroker backend is solid – after all, Smartbroker isn’t the first broker from BNP Paribas either.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

Title picture: Some icons are from monkik from www.flaticon.com

Pedestal: Icon of surang from www.flaticon.com; Boxing gloves in the title picture: Icon made by surang from www.flaticon.com

Take a look at the comments / ratings on trustpilot.com for both "brokers"...