Like several alternative depot providers Smartbroker offers one Securities Loan at. What conditions at Smartbroker Securities Loan are offered and what you Smart broker Lombard loan, as the securities loan is also called, should pay attention to. The short version: With the Smartbroker securities loan you can use all tradable securities maximum 80 % for 2.25 % interest lend. Papers related to the bank itself are an exception. the Granting a line of credit is free of charge with Smartbroker. This means that interest is only due on the loan amount actually used. In addition, the Smartbroker securities loan not earmarked and there is no securities lending through the bank! Small shortcoming with Smartbroker securities loan: Although securities are deposited as collateral, Smartbroker does one Schufa query before the loan is granted.

Attention: Smartbroker securities credit is temporarily suspended. This information has now been officially confirmed by Smartbroker. When and if there will be a resumption of the Smartbroker securities loan is currently unknown. The reason for this is the partner bank DAB BNP Paribas. This rejects since February 2022 all applications for Securities loans since. However, credit lines that have already been approved are not affected. If you are looking for a cheap securities loan, we recommend taking a look at the Securities loan comparison.

The sudden shutdown of the securities loan in connection with the non-transparent communication about it (information on the conclusion of a securities loan can still be viewed on the Smartbroker website) does not reflect well on the Smartbroker. Rather, the matter is reminiscent of the miserably failed smartphone app, which was announced for 2021 and is still not available.

Smartbroker securities loan: Nothing works without collateral

What you can learn here

- Smartbroker securities loan: Nothing works without collateral

- Smartbroker Lombard loan: Loan amount

- Smartbroker Lombard loan: costs

- At Smartbroker, the securities loan is not earmarked

- Collateral at the Smartbroker securities loan

- Smartbroker securities loan: no securities lending of your papers!

- Smartbroker securities loan: All advantages and disadvantages

- Smartbroker securities loan: Is the securities loan a recommendation?

- Apply for Smartbroker securities loan

- Smartbroker securities loan and SCHUFA

- Other securities loan providers

A securities loan is basically no different from other types of loans. In exchange for one security a loan of a certain amount is granted. In the case of securities lending pledged the provider the deposited securities.

| Smartbroker securities loan & custody account in bullet points |

✔️ Securities loan: 2.25 % interest |

✔️ free depot |

✔️ Trade stocks and ETFs from €0 |

✔️ Free ETF savings plans |

Smartbroker Lombard loan: Loan amount

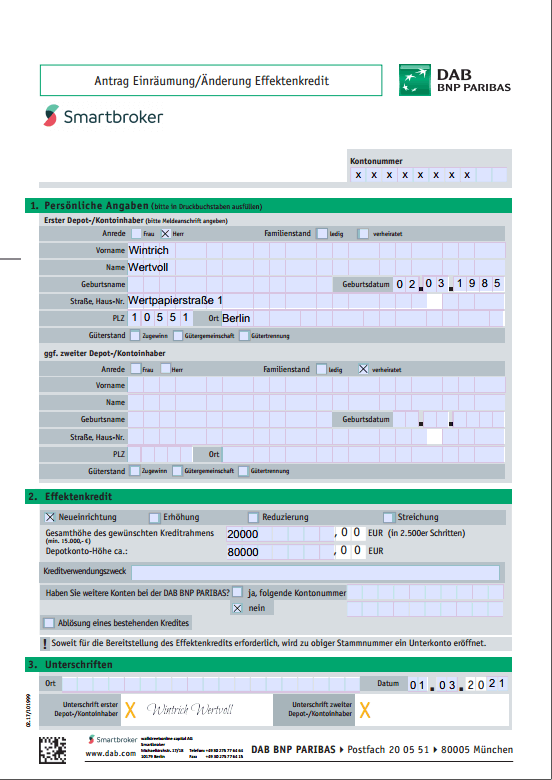

You can take the Lombard loan from Smartbroker 15.000 € use the minimum amount. Smartbroker grants the loan in 2,500 steps. The amount of the securities loan depends on the deposit value that can be lent against. In principle, there is no upper limit for the securities loan. From a loan amount of 500,000 euros, however, Smartbroker has one beforehand individual exam your creditworthiness and your financial situation in general.

Smartbroker Lombard loan: costs

A big advantage of Smartbroker Lombard loan: The interest on the securities loan only accrues when you use the line of credit. Therefore, in contrast to DeGiro, no interest is due when the credit line is granted.

Thus the deployment of the Lombard loan at Smartbroker free of charge.

Furthermore, you do not have to fully exhaust the credit line granted. Because the provider calculates the interest for the Lombard loan only for the credit used. So not for the entire credit line, such as with DeGiro.

At Smartbroker, the securities loan is not earmarked

In contrast to some other providers, the securities loan is included smart broker not tied to the purchase of securities. Thus, the borrowed money can also be used for other purposes such as buying a property or similar (see Mr Money Mustache).

An interesting way to use the Smartbroker securities loan is to increase the down payment on your property. This makes sense if you don't want to close your deposit for the purchase of a property. For example, you can turn 90 % financing into 100 % financing. Despite the current environment of low interest rates, it is likely that you will builder for the increase from eg 90 to 100 % more interest than the 2.25 % have to pay at the Smartbroker securities loan.

Collateral at the Smartbroker securities loan

Securities that are already in your custody account serve as collateral for the securities loan. Shares you can do up to 70 % loan.

Bonds, funds, certificates and Precious metals seven up to 80 %. You can find an overview of the loan-to-value limits at Smartbroker here in the securities forum.

All securities that can be traded via Smartbroker can be used as collateral for the securities loan. However, there is one exception: securities related to BNP Paribas or DAB cannot be used as collateral with a Lombard loan.

Good to know: If you buy more securities with the securities loan, you can also use these as collateral for a second securities loan, for example.

Since securities fluctuate greatly in value, the available loan amount is always related to the current price. Therefore, if the value of the securities lent against falls, the loan-to-value limits can suddenly be exceeded. The broker can then demand additional collateral at short notice or even sell the securities.

Smartbroker securities loan: no securities lending of your papers!

Another advantage of the Smartbroker securities loan: With Smartbroker there is no securities lending. This gives investors better protection. This is because there is no risk that the opposing party will no longer be able to return the securities. Other securities lending providers lend investors' securities on, creating an additional risk. For me, the exclusion of securities lending is an important point. Because I don't want to take any further (hidden) risks when lending a securities account as a loan.

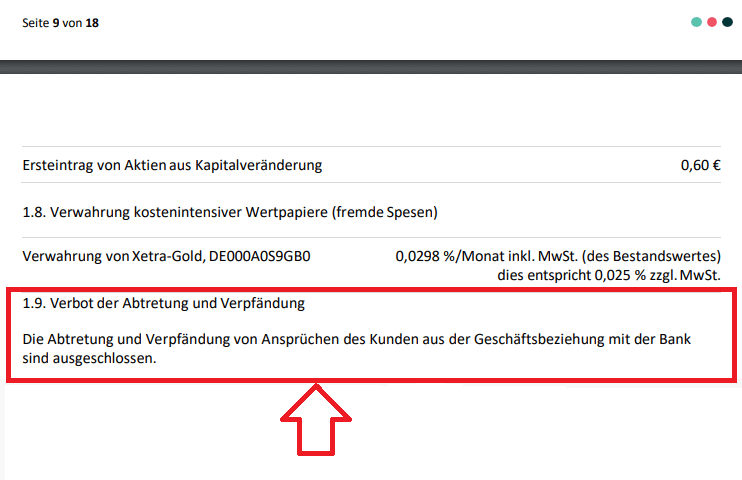

The exclusion of securities lending at Smartbroker is regulated in item 1.9 of the List of Prices and Services. Literally it says there "The Assignment and pledging of claims of the customer arising from the business relationship with the bank are excluded". In other words, the bank may not lend the customer's property to third parties. Very good!

Smartbroker securities loan: All advantages and disadvantages

|

|

|

|

|

|

|

Smartbroker securities loan: Is the securities loan a recommendation?

With the Smartbroker securities loan you can use all tradable securities maximum 80 % for 2.25 % interest lend. Papers related to the bank itself are an exception. the Granting a line of credit is free of charge with Smartbroker. This means that interest is only due on the loan amount actually used. In addition, the Smartbroker securities loan not earmarked. Although securities are deposited as collateral, Smartbroker does one Schufa query before the loan was granted, which I didn't like that much. On the other hand, I liked the fact that the bank does not lend securities. This makes the risk of the securities loan more predictable

Due to the low interest rates from Smartbroker and the favorable conditions as well as the easy application, the Smartbroker securities loan is a recommendation. An alternative is the securities loan from DeGiro, which will be discussed in another article.

Apply for Smartbroker securities loan

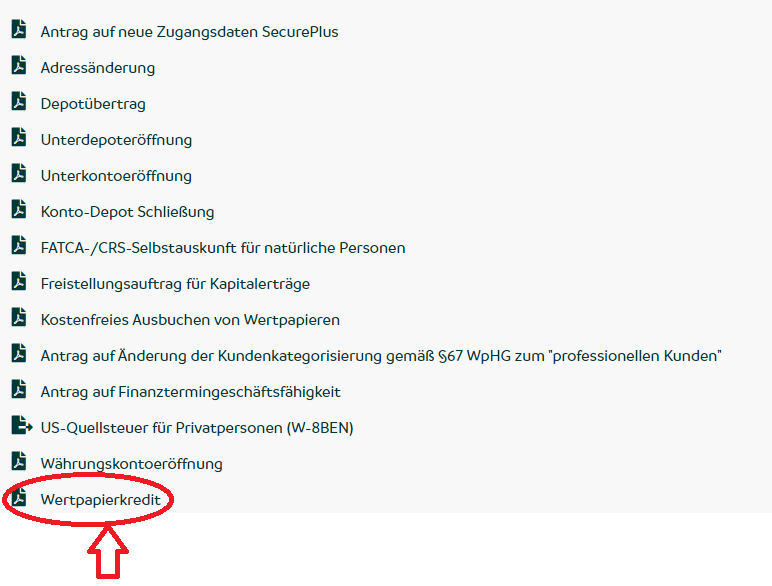

The securities loan can be made by any customer of smart broker be requested. The prerequisite is, of course, that sufficient securities are stored in the securities account. To apply, you must have a corresponding Form to complete. You can find this in form center on the online broker's website. Alternatively, you can also request the securities loan from Smartbroker customer service by e-mail.

When you arrive in the Smartbroker form center, you will find the form for Application for a securities loan at the bottom.

After you fill out the form filled out, you must sign it and send it to Smartbroker by email or post. You will then normally receive a loan offer within a week from Smartbroker.

As soon as the loan offer is available, you have one month to sign the contract. After the deadline, the offer expires. You must then submit a new application. If the signed loan agreement has been received by the Smartbroker, the Lombard loan is available to you.

Smartbroker securities loan and SCHUFA

Smartbroker asks them creditworthiness at the Schufa or a comparable provider before setting up a Lombard loan at. will be one line of credit set up, Smartbroker reports the setup back to the Schufa. If, on the other hand, you only open a Smartbroker securities account without using the securities loan, kan entry in the SCHUFA file.

A Schufa entry takes place as soon as a credit line is set up and made available.

Smartbroker when asked whether and when a SCHUFA entry will be made for the securities loan.

There are still providers who offer securities loans without a SCHUFA check. These include onvista bank, comdirect and S Broker. If you want to find out more about securities loans and their conditions, you should go to the Securities loan comparison look once.

More info:Smartbroker.de

Other securities loan providers

If you are considering boosting your portfolio with a securities loan, you should not spend money on fees that are too high. With an interest rate of 2.25 %, Smartbroker already offers a comparatively cheap offer. Nevertheless, there are other providers who offer better conditions. Therefore, I have compared numerous depot providers with each other and my results in this one Securities loan comparison summarized. If you are looking for a cheap stock portfolio, you will find a good overview in the Securities account comparison.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

2 thoughts on “Smartbroker Wertpapierkredit: Was du beachten solltest!”

Comments are closed.