I often read that you can create an ETF savings plan and then just let it run for 30 years. But is that really possible? I'll do a quick fact check.

the illusion

What you can learn here

Set it up once and just let it run for 30 years. That doesn't work with an ETF savings plan any more than it does with any other project. Projects always have to be readjusted. Mostly it is because I have changed boundary conditions. Nothing else is the task of politics: constant readjustment, so that the people are kept happy

Look in the rear view mirror ⏮️

The world of ETFs is also subject to constant change, particularly as a result of technical progress. First, let's take a look in the rear-view mirror:

The actual breakthrough of ETFs in Germany took place around the turn of the millennium. Before that, funds could only be bought through fund companies such as Deka – at astronomical fees. ETFs have been approved in Germany since around 2000. It took another four years, until 2004, before specialized ETFs on real estate, gold and emerging markets became available. Over the years, the world of ETFs expanded very quickly and there was a real boom. In the period between 2000 and 2007, there was a hundredfold increase in investments in ETFs.

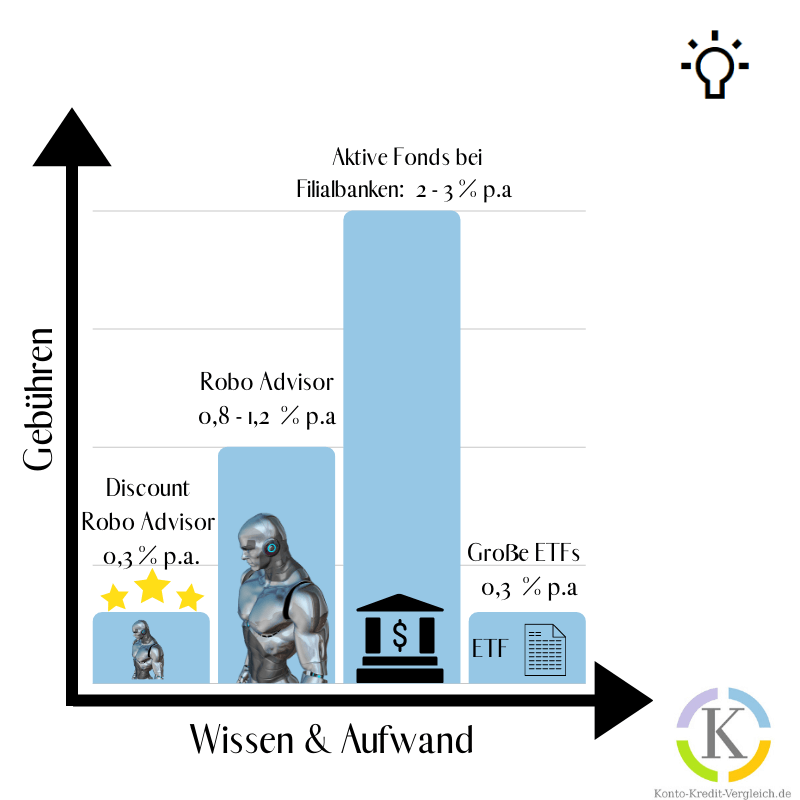

The cost of ETFs before the 2008 financial crisis compared to today's offerings was enormous: there were hefty front-end loads in the three to five percent range. Even today, there are still such expensive actively managed equity funds. However, they generate at most a frown among informed investors today. The ETF costs have fallen to a tenth in 10 years. ETFs today are as low as 0.3 % fees. Large ETFs often only incur costs of just 0.1 %.

Situation of ETFs today ⏭️

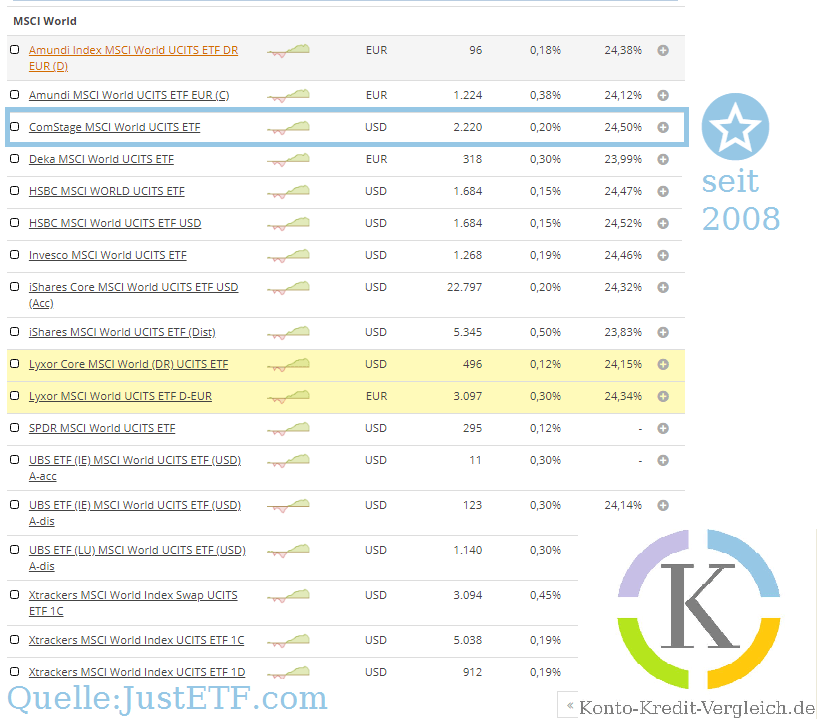

In February 2020, let's take a look at the list of ETFs on the MSCI World Index at justETF. 18 ETFs on the MSCI World are available here. None of these 18 ETFs existed in 2000. The oldest ETF is the ComStage MSCI World UCITS ETF which has been available in Germany since 2008. Many of the ETFs on this list are only a few years old. Especially in 2018 & 2019 numerous ETFs were added.

Further development of the ETF concept in the future

Just as the financial world has changed in recent years, it will do the same in the next 30 years. Perhaps even faster than before due to digitalization. My forecast is that the flow of money from ETFs into Robo Advisors will shift. Today, it still requires a small premium to be able to use the convenient service of the digital investment assistants. Experienced investors who do not need any support can save a few euros in costs by investing directly in ETFs.

But the trend is reversing. now exist Discount Robo Advisor who will reorganize the investment market just as the food discounters did in this sector in Germany between the 1970s and 1990s. The discount model from Quirion*, for the first 10,000 euros, is already (!) on a par with even inexpensive ETFs. In addition, the provider attracts customers by giving them the first savings rate of 50 euros.

For me, this is a clear sign that there is a tough price war in the robo advisor market. In the long term, this price war will lead to a price drop for robo advisors, while at the same time providers with more sophisticated features will compete for customers. In a few years, nobody will want to do without the additional comfort that providers offer. I also assume that other providers will join the Quirion experiment and that the additional costs for the service of the robo, which are still common today, will continue to melt away over the years.

Should I open an ETF savings plan today?

If you start building long-term wealth today, an ETF savings plan is still a good, cheap, and convenient solution. However, expect that over time you will make changes to the ETF selections you made today. ETFs may close. Tax laws are subject to change. So it may be that certain constructions that make sense today will have to be designed differently in the future.

Fees for the ETFs themselves are also forfeited

Since the turn of the year 2020 it has also been possible in Germany ETFs without any purchase fees. This works via rebates that brokers receive from trading partners. The provider Trade Republic* completely eliminates the savings plan fees. Even simple purchases of ETFs and individual shares only cost one euro each. That List of prices and services is only one page long. The provider does not use star texts for pages and is therefore very transparent. Opening a depot, placing orders and setting up savings plans is very easy. What is a great achievement for some, others see as a disadvantage: Trade Republic* can only be operated via Android or iOS devices (smartphones, tablets).

If you want to know more about the provider, I recommend you Trade Republic section in my unsparing depot comparison. There is also a good video about the smartphone broker by Thomas from Finanzfluss.

The video is embedded by Youtube and only loaded when the play button is clicked. The apply Google Privacy Policy.

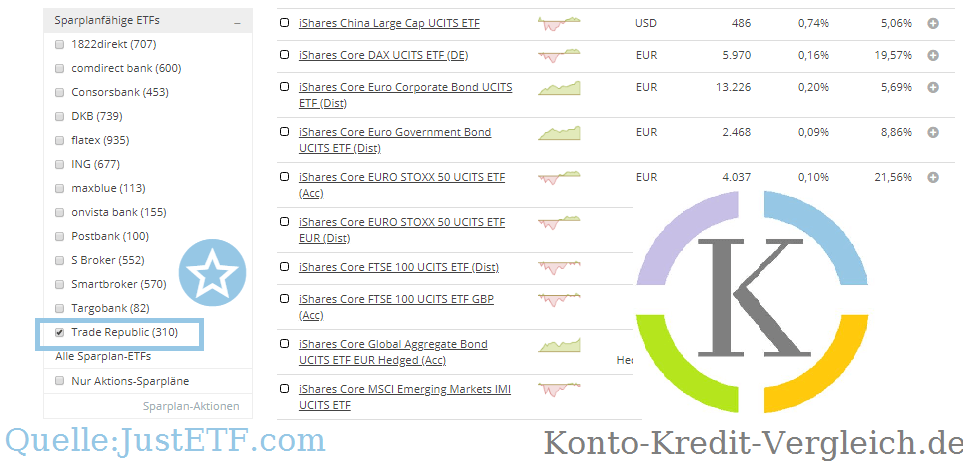

An easy way to find out which ETFs are available from different brokers is the ETF search by JustETF. If you click on the "Trade Republic" entry under "Eligible Savings Plan ETFs", you can see that the provider has a very good range of ETFs eligible for a savings plan with 310 ETFs.

Set up a 0 Euro ETF savings plan?

If you want to try the broker Trade Republic to set up a 0 Euro ETF savings plan, you can

Apply for the Trade Republic depot here! *

Alternatively, if you want to try the Smartbroker, you can

Apply for the Smart Broker depot here! *

If you want to know more about brokers: A lot has happened with the free securities accounts at the turn of the year 2020! I therefore rolled out the depot comparison again and took a close look at the providers. After the latest fee increase, I can only advise against the formerly so revolutionary Flatex….

Conclusion from the long-term ETF savings plan illusion

There is no such thing as a perfect investment product for all times. This includes ETFs and all other financial products in a broader sense. Trade Republic will certainly not remain the only almost free broker. So be aware that ETFs also require a certain amount of readjustment at regular intervals. Of course, the long-term illusion of ETF savings plans is by no means a reason not to start investing at all.

Links marked with * are affiliate links. For each sale through one of these links, I receive a small commission, which does not cost you anything extra.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

Cover picture: by GraphicMama team From Pixabay