|

|

| To the provider: justTRADE.com | To the provider: TradeRepublic.com |

With the discount brokers JustTRADE and Trade Republic Investing on the capital markets has become somewhat easier. Two of the recently introduced first mobile commission-free app and web services in Germany. In the article Smartbroker vs Trade Republic (test & experiences) we have already compared 2 newcomers with each other. Here it goes in a similar style. Because mobile brokers enjoy Google search queries and also in the depot comparison growing popularity. Therefore, in this article, we leave the two brokers JustTRADE vs Trade Republic compete against each other.

With the apps from the providers Trade Republic and Justtrade, investors can buy and sell on the stock exchange. Stocks, Exchange Traded Funds (ETF) and derivatives can be traded via the mobile app and the web interface.

Free brokers like JustTRADE or Trade Republic originate in the USA

Based on Robinhood's US-operated business model, both JustTRADE and Trade Republic hope to attract new customers. You hope this with a user-friendly app and free action to reach.

These fintech investment platforms have partnered with traditional banking systems in Germany such as Solaris Bank, HSBC, Sutor Bank and Citi Bank. These two broker startups raised large amounts of funds from investors. As a result, both have been able to develop a product that they can bring to the market cheap price able to offer. In principle, they hit him in the same vein as smart broker*.

The business model of discount brokers like JustTRADE or Trade Republic

The question people usually ask is how these companies pay their bills. After all, the brokers earn nothing from free trading. The main point of this question is what this article is aiming for in the next few lines.

For starters, both start-ups combine innovation and an extreme range of products locally and internationally to stay afloat. These innovations have helped investors register and invest in the stock market faster. It also has this younger generation easier to invest. With Fintech Apps and web-based services, today the genre of people investing in stocks, bonds, ETFs and derivatives has changed.

These startups have disrupted an already static market, forcing traditional brokers to innovate if they want to keep attracting clients. The use of technology has enabled Justtrade and the Republic of Commerce to gain a market share that is exclusive to them. The investors using the app are looking for something that traditional brokers don't offer yet.

In many other countries they adopt the same model. For example, we talked about how successful Robinhood was in the US market. It was the pioneer program in the US before sneaking into Europe. In Europe, the first pioneers were free brokers Flatex* and Degiro.

However, many people are still skeptical about the business model of Justtrade and the Republic of Commerce. Because of this, you may want to know the best alternative based on many parameters to assess. While individual settings can affect a user's choices, there are parameters where both apps or services perform better.

JustTRADE vs Trade Republic: Individual Stocks

At Trade Republic you pay one euro for the order, but you can also trade small sums, which simply does not work with Justtrade. For example, the minimum order volume for Justtrade is €500, while that for the Republic of Commerce is zero euros. However, Justtrade does not charge a fee for executing the order if the threshold of €500 is exceeded.

Trade Republic is therefore primarily intended for small orders. You should be prepared to pay the flat fee of €1 for each transaction.

The Republic of Commerce wins in this category. The flexibility to execute any transaction amount for a flat transaction fee is revolutionary. Coupled with savings from ETFs, this is brilliant.

Score: Trade Repulic:1 JustTRADE: 0

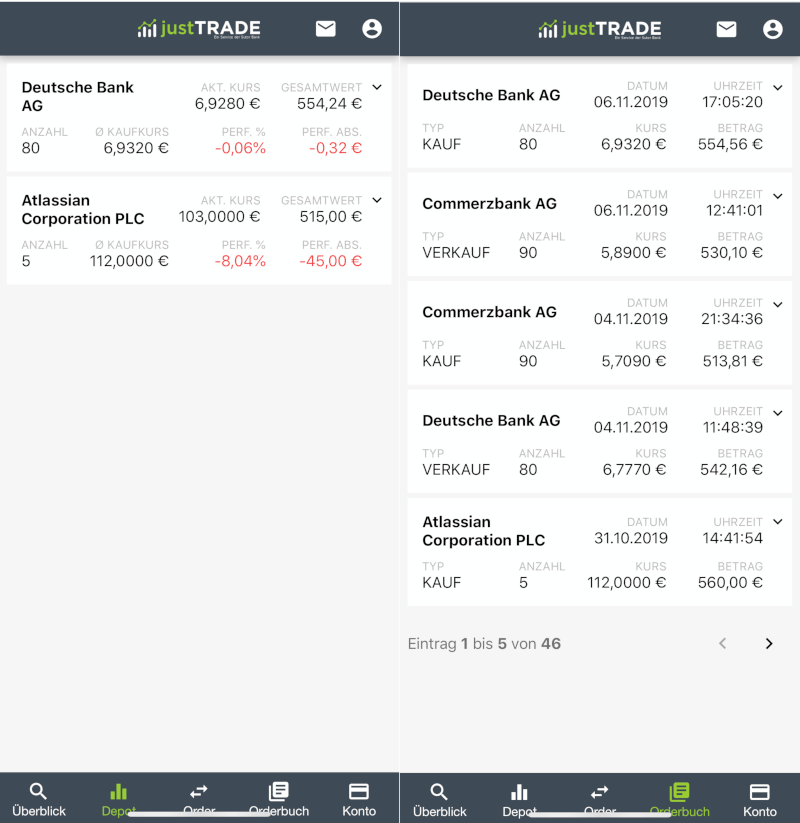

The JustTRADE vs Trade Republic trading platform

Trade Republic only has a mobile platform while Justtrade has a Web interface and a mobile platform has. A web interface is a clear advantage. This makes it easier for investors to keep track of things. Justtrade is therefore taking a step in the right direction with the additional web interface.

JustTRADE wins in this category. Trade Republic suffers from the limitations of a mobile-only platform. With justTrade you have a better overview of your orders through the desktop. This way you can possibly make wiser decisions.

Score: Trade Republic:1 JustTRADE: 1

Savings plans on stocks

Both fintech companies offer a wide range of stocks in Germany and other parts of the world. Trade Republic now also offers the possibility to create savings plans for individual shares. Here can 1,000 individual shares be saved. The savings plan can be set up from as little as 10 euros. This makes Trade Republic the first German broker to permanently offer free share savings plans.

JustTRADE, on the other hand, does not yet offer a savings plan, but says it has something in the pipeline. If you want a share savings plan, you should better use Trade Republic.

Score: Trade Republic:1 JustTRADE: 2

Does Trade Republic or JustTRADE have the edge in ETF trading?

This means that there is now another alternative for long-term investments in addition to the existing 300 or more ETF savings plans at Trade Republic. "With our expanded range, we are once again making a decisive contribution to increasing the German to democratize the capital market", explains Christian Hecker, one of the founders of Trade Republic

The commercial republic offers a good 300 ETFs. However, investors can Trade Republic on iShares products only access. On the other hand, Justtrade offers access to ETFs from Amundi, Luxor, Vanguard and many others. There is a total of justTRADE over 1000 ETFS. However, Trade Republic offers the automatic investment via a savings plan. Just Trade is still working on a savings plan offer.

Even if iShares certainly has good and cheap ETFs on offer, Justtrade is ahead in the ETFs category. Firstly, the provider JustTRADE has more ETFs in total and secondly, you can diversify better with different providers.

Score: Trade Republic:1 JustTRADE: 3

Questions and answers about justTRADE or Trade Republic

Does JustTRADE offer savings plans?

justTRADE currently does not offer any savings plans

When does Smartbroker execute savings plans?

Smartbroker savings plans can be executed on the 1st and 15th of each month. The repetition can be selected monthly, bimonthly, quarterly and semi-annually. Smartbroker executes the savings plans throughout the day. This happens more and more in the morning hours at 9:15.

Where are the savings plans implemented at Smartbroker?

OTC at Lang & Schwarz.

What is an alternative to Trade Republic?

Justtrade is ahead in our test and an alternative to Trade Republic. But the Smartbroker also has a larger range of functions compared to Trade Republic and could therefore be more suitable for you. More about alternative brokers on Trade Republic.

What deposit insurance does Trade Republic offer?

Trade Republic offers the statutory deposit guarantee of 100,000 euros. This only applies to credit balances on the clearing account. Securities are protected as special assets. See also the Security section

What is the singleweed protection at justTRADE?

justTRADE offers deposit insurance of EUR 1.3 million. You can find out more about deposit insurance in the Security section.

Does justTRADE have negative interest rates?

justTRADE calculates a negative interest rate of 0.5 % annually. With an amount of 10,000 euros on the clearing account, this corresponds to around 4 euros per month. However, if the money is only in the clearing account for a few days, the amount is negligibly small.

Other investment products such as certificates, warrants or derivatives

Derivatives, which are considered a risky asset class for someone with no exchange trading experience, are tradable on both Trade Republic and Justtrade. While the Republic of Commerce offers 40,000 derivatives in this regard, JustTRADE offers 500,000 and more.

|

|

| To the provider: TradeRepublic.com |

It is therefore clear that JustTRADE is also taking the lead in this category.

Score: Trade Republic:1 JustTRADE: 4

On which trading platforms you can trade with JustTRADE and Trade Republic

Any stocks, ETFs and other securities representing companies must be bought or sold on a specific trading venue. What used to be a hall in which securities could be offered for sale to others are now electronic trading systems. Trade Republic uses only one partner to process securities transactions. LS Exchange is an official partner of Trade Republic and handles the company's transactions between 7:30 a.m. and 11:00 p.m.

JustTRADE, on the other hand, uses two platforms viz Quotrix and LS Exchange. Over-the-counter trading at justTRADE is handled by institutes such as UBS, Citi and Vontobel. JustTRADE can therefore offer its investors several options to carry out transactions. It is important to note that LS Exchange and Quotrix are both connected to the Hamburg and Düsseldorf exchanges.

|

|

| To the provider: justTRADE.com | To the provider: TradeRepublic.com |

Score: Trade Republic:1 JustTRADE: 5

JustTRADE vs Trade Republic: Available order types

Both brokers can accept common orders such as Market Limit and stop loss depict. However, offers JustTRADE also dynamic orders which are not available at Trade Republic. To the dynamic orders belong: Trailing Stop Loss and One Cancels Other.

Since dynamic orders offer more possibilities, the point goes to justTRADE. If you're not quite sure what the terms One Cances Other or Trailing Stop Loss are, you can read about the definitions here.

[sp_easyaccordion id="4639″]Score: Trade Republic:1 JustTRADE: 6

Comparison of fees and costs at JustTRADE vs Trade Republic

With both Trade Republic and justTRADE, it doesn't cost much to keep a securities account. However, additional fees must be paid for certain special services: E.g. to register registered shares or for an invitation to a general meeting.

order costs

At Trade Republic, order execution is €1 per transaction. With JustTRADE, on the other hand, order execution is free of charge. Registering shares costs €2 at Trade Republic and €1 at Just Trade.

Negative interest at Justtrade

A negative point with JustTRADE is that negative interest is incurred for the clearing account. JustTRADE calculates 0.5 % per year. There are no annual interest expenses to shell out with Trade Republic.

Costs for the invitation to the general meeting

The Republic of Commerce charges €25 for an invitation to a general meeting, while justTRADE would charge you €15.

When it comes to fees, it depends heavily on what the investor wants. Both have different fees for each transaction. What works best for the investor in this category is what they should be aiming for over the long term.

It can be said that Trade Republic is aimed more at smaller investors and justTRADE seems to be better suited for larger volumes. At least as long as the money is not in the clearing account, but is invested.

|

|

| To the provider: justTRADE.com | To the provider: TradeRepublic.com |

Score:Trade Republic:2 JustTRADE: 7

Are there differences in security?

Both fintechs work together with traditional banks. Although Trade Republic has a banking license, account management and securities processing remain with Solarisbank. The JustTRADE works together with the Sutor Bank, which also has many of the better interest rates money market accounts managed by Check24 or Zinspilot.

With justTRADE, the protection on the clearing account is better

The level of deposit protection differs between justTRADE and Trade Republic. The Republic of Commerce only offers the statutory deposit protection of €100,000. JustTRADE, on the other hand, has a protective shield of 1.3 million euros per customer.

It is also important to mention that the deposit insurance only for balances on the clearing account grabs. Securities are generally protected as special funds. Should the bank actually go bankrupt, the stored securities do not count towards the insolvency estate.

As special assets, securities do not fall under the protection against algae

If the Bank embezzled the securities not the deposit protection, but the investor protection. In contrast to the algae protection, this is only 20,000 euros. Deposit protection was increased in Europe after the financial crisis from 20,000 to 100,000 euros. The original maximum limit for investor protection, however, remained at 20,000 euros. Since investor protection is the relevant criterion, there are no formal differences between justTRADE and Trade Republic. So both get a point.

|

|

| To the provider: justTRADE.com | To the provider: TradeRepublic.com |

Score:Trade Republic:3 JustTRADE: 8

Easy registration

Trade Republic and justTRADE have made it very easy to register and start trading. There is no paperwork to be done with either broker.

In summary, Justtrade is the battle justTRADE vs Trade Republic and the winner is. However, it is still the responsibility of a savvy investor to know how to use both platforms to their advantage.

Conclusion on our comparison of JustTRADE vs Trade Republic

If you only need a smartphone app for banking, you get it Trade Republic *an unbeatably cheap depot. However, if we evaluate this comparison objectively according to our criteria, lies JustTRADE* clearly ahead and thus represents a viable alternative to Trade Republic. The broker convinces with several trading places as well as app and desktop access. JustTRADE offers active traders cheap access to the global stock market. justTRADE is not suitable for ETF savers due to the lack of savings plans. For Buy & Hold customers is Trade Republic * the better choice. Especially because 1,000 shares can be saved free of charge as a savings plan. Trade Republic also offers securities account transfers: a feature that is not (yet) available with justTRADE.

To the provider:

justTRADE.comTo the provider:

TradeRepublic.com

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

2 thoughts on “JustTRADE vs Trade Republic”