This article presents 6 ways how you can deposit money at ING. For smaller amounts I recommend the deposit at stores like DM, Rossmann and some more. For amounts above 1000 euros, the deposit is required at the Travel bank most unproblematic. Bring your bank card and proof of origin of the money. If you live in a big city such as Berlin, Frankfurt or Stuttgart, you can also use one of the few ING deposit machines use.

Deposit ING money: 6 ways

What you can learn here

- Deposit ING money: 6 ways

- 1) Travel bank (recommended method from 1,000 euros cash).

- 2) Deposit cash at stores such as Rewe, Penny, DM and Rossmann (recommended for smaller amounts).

- 3) ING ATMs with deposit function in major cities.

- 4) With a secondary account

- 5) Deposit money with a cash transfer at ING.

- 6) Deposit cash with another account of a friend or relative at ING.

- Deposit ING money: 6 options at a glance

- Who is ING's partner bank – Reisebank?

- Where is the nearest ING partner branch?

- Deposit money at the Reisebank counter

- ING cash deposit at the travel bank: necessary documents

- What amount can I deposit at Reisebank as an ING customer?

- Trick: Cash deposit on ING account over 25,000 euros

- Can I also deposit my money at a third-party bank?

- Is it possible to deposit coins into an ING account?

- Conclusion on depositing money at ING

1) Travel bank (recommended method from 1,000 euros cash).

- fees: 7.50 euros per 5,000 euros or part thereof.

- Deposit limitMaximum 25,000 euros per day. From 2,500 euros you must declare the origin of the money. Several deposits can be made in a row.

ING offers its customers a fee-based cash service through cooperation with Reisebank. For each €5,000 or part thereof, Reisebank charges a service fee of €7.50 for the deposit to your ING account*. The travel bank does not accept coins - so you have to change the small change beforehand if necessary.

Reisebank operates a branch network of around 100 branches in Germany. Most of the branches are located at train stations. But there are 2 more ways to deposit cash for free at ING, which you will learn about in the following sections.

Reisebank offers you a convenient online search of its branches. This allows you to find a branch near you quickly and easily. As an ING customer, you can deposit cash there for 7.50 euros per 5,000 euros or part thereof.

> Link: Reisebank branch search (opens in new tab)">>> Link: Reisebank branch search

2) Deposit cash at stores such as Rewe, Penny, DM and Rossmann (recommended for smaller amounts).

- fees: 1,5 %

- Deposit limitMinimum 50 euros and maximum 999.99 euros per day. Daily limit: 5,000 euros and annual limit: 25,000 euros.

You can deposit cash not only at ATMs, but also at certain stores. With ING Bank, for example, you can deposit cash at over 12,500 branches of Rewe, Penny, DM and Rossmann. To do this, you need the ING "Banking to go" app and your checking account. You select the amount in the app and generate a barcode. Then, within four hours, you go to the checkout at one of these stores, present the code, and deposit the cash. You can choose between 50 € and 999,99 € deposit. This method is not suitable for depositing small change. You can find the stores that offer this service on the ING website. However, ING charges you a fee of 1.5% of the deposited amount for this service.

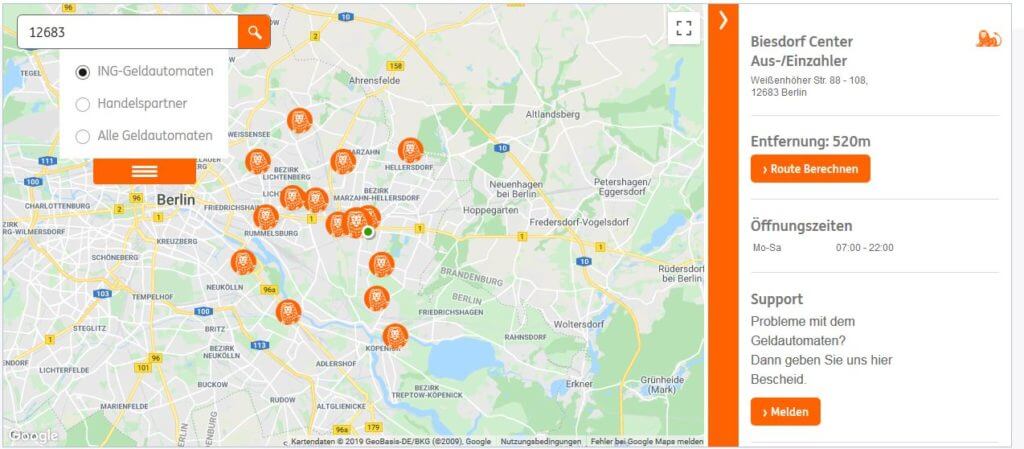

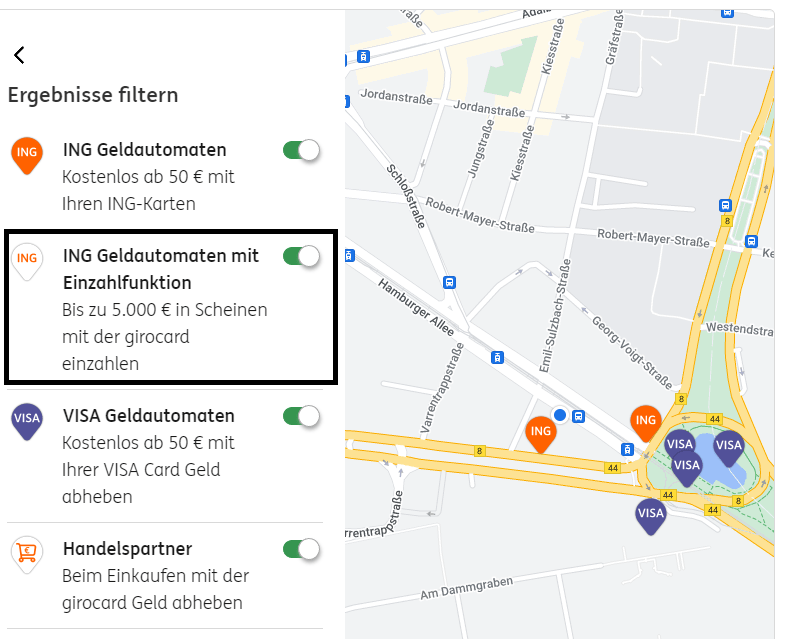

3) ING ATMs with deposit function in major cities.

- fees: Free of charge.

- Deposit limit: Maximum 5,000 euros per day. There is also an annual limit of 25,000 euros. From 2,500 euros, you must declare the origin of the money.

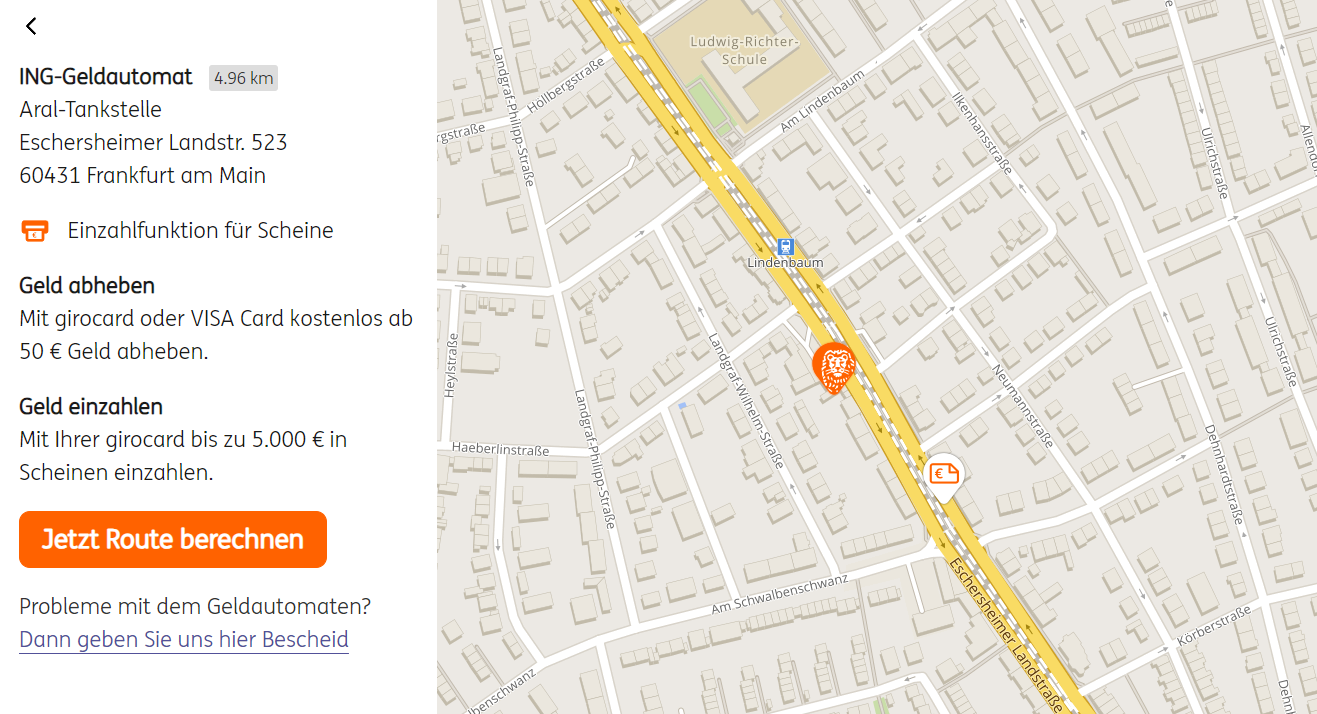

Cash deposits are also possible at some of ING's own ATMs. ING offers you a convenient online search for their deposit and withdrawal machines. This gives you the opportunity to find a branch near you quickly and easily. ATMs that offer free cash deposits are highlighted in search results.

Disadvantage: The ING machines with deposit function are rare and there are these only in larger cities such as Berlin, Frankfurt or Stuttgart.

You can also use the ING ATM locator to find cash deposit machines. All you have to do is tick the appropriate box in the search settings.

4) With a secondary account

- fees: Free of charge at Comdirect

- Deposit limit: depending on the bank.

Another way to save money on your ING account* deposit is to open a secondary account with Comdirect. Three deposits per year at Comdirect are free of charge at Commerzbank. From the fourth deposit per year, a fee of 1.90 euros is charged. The automatic deposit and withdrawal machine at the Commerzbank branch in Quickborn is free of charge.

5) Deposit money with a cash transfer at ING.

- fees: depending on bank

- Deposit limit: depending on bank

Some banks also offer cash transfers for non-customers. However, the conditions vary from bank to bank. Therefore, you should be careful with this option money to your ING account* should find out in advance whether this is also possible at the bank near you. Some savings banks in particular also offer cash transfers for non-customers.

However, the German Bank and Commerzbank used to accept cash deposits from non-customers and have since discontinued this service. However, during a search in August 2023, cash deposits for non-customers could no longer be found in either of the banks' price and service directories (see P+L Commerzbank, P+L Deutsche Bank ). Therefore, I assume that the cash transfer from Commerzbank and Deutsche Bank is now only available to their own customers.

6) Deposit cash with another account of a friend or relative at ING.

- fees: Depending on the bank

- Deposit limit: Depending on the bank

If you want to deposit money into your ING account, you can also ask acquaintances or relatives you know to deposit it into their account for you and then transfer it to you.

But be careful not to pay in too much money at once through other people, or there could be problems due to a gift.

An overview of the various allowances for gifting:

- up to 500,000 euros to spouses or registered partners

- up to 400,000 euros to children, stepchildren as well as grandchildren if their parents are already deceased

- up to 200,000 euros to grandchildren and great-grandchildren

- up to 20,000 euros to all other persons

Deposit ING money: 6 options at a glance

- Travel BankAs an ING customer, you can deposit cash via Reisebank AG for a fee. For every 5,000 euros or part thereof, you have to pay a deposit fee of 7.50 euros at Reisebank. For more than 2,500 euros cash, you must specify where the money comes from.

- Reisebank offers you over 100 branches in Germany

- In these branches you can buy amounts between 1.000 € and 25.000 € deposit

- With a simple trick you can also deposit over 25,000 euros through the travel bank

- Reisebank offers you over 100 branches in Germany

- ING ATMIn major cities such as Berlin, Frankfurt or Stuttgart, you can deposit 5,000 euros free of charge at ING ATMs with a deposit function. For amounts above 2,500 euros, you must specify where the money comes from.

- You can also deposit cash at stores like DM, or Rossmann for a fee

- Cash transferAlternatively, you can also deposit money to your ING account at some regional banks in your area for a fee (keyword: cash transfer).

- Another way to deposit money to your ING account free of charge is to open a secondary account: Deposit via a secondary account, for example at the savings bank or at the Comdirect.

- Account of an acquaintance: Deposit cash with another account of an acquaintance or relative at ING

Who is ING's partner bank – Reisebank?

The roots of the Reisebank go back to the Deutsche Verkehrs-Kredit Bank (DVKB), founded in 1923. The aim of this bank was the establishment and management of exchange offices in train stations. The locations have largely been preserved to this day, which explains why the Reisebank can be found at many train stations and now also at airports. Reisebank has been part of the Volksbanken Raiffeisenbanken cooperative financial group since 2004. The 100 branches of Reisebank are mainly located in the large metropolitan areas and in large cities.

Where is the nearest ING partner branch?

Reisebank is still mainly represented at larger train stations and airports. However, Reisebank branches can also be found in larger city centers or trade fair centers. In any case, think of your giro card or Iban number (For safety identity card or bring your passport). A little further up in the article you will find 2 links to the Reisebank and the next ING machine.

Deposit money at the Reisebank counter

If you want to deposit money into your ING account via the Reisebank, you are dependent on their opening hours. You can find details on the Reisebank website after you have chosen your location. After presenting your Girocard and identity card, your cash will be accepted by the Reisebank employee, counted and credited to your ING current account.

ING cash deposit at the travel bank: necessary documents

It is best and easiest if you next to your identity card or passport yours giro card can present. This way, the bank has all relevant data at its disposal immediately and there are no queries. However, it is also possible to deposit money only by presenting the IBAN. If you are depositing a larger amount, you should also have a Have proof with you where the money came from. If you have sold your old car, you should take the sales contract with you. If you are unsure, you can call the travel bank beforehand.

What amount can I deposit at Reisebank as an ING customer?

As an ING customer, the cash deposit via the travel bank is possible between the sums of money 1,000 euros and 25,000 euros. Coins are not accepted in this case. A deposit lower than 1,000 euros is also possible for a fee.

Trick: Cash deposit on ING account over 25,000 euros

If you want to deposit more than 25,000 euros for free, you can make several deposits. The number is not limited.

Can I also deposit my money at a third-party bank?

This is possible with a cash transfer. You can also transfer money free of charge to your account via Volks- and Raiffeisenbanken or Sparkassen. ING account* deposit. However, fees of around five to 15 euros per transaction apply.

Is it possible to deposit coins into an ING account?

You can no longer deposit coins at Reisebank (previously up to 50 coins were accepted). Please also note that ING itself does not accept cash by mail. ING cannot process it and will send it back to you.

Conclusion on depositing money at ING

"ING: Depositing money explained simply": that was the headline of this article. Let's now draw a conclusion. How easy is it to actually deposit cash as an ING customer? In the article, I showed three different ways to deposit cash at ING. For larger amounts, it is most practical for customers outside of major cities to use the travel bank for ING cash deposits. For small deposits, supermarkets near you are also suitable. If you want to invest more time, you can also open a second account, ask acquaintances or ask your local bank for a cash transfer.

Depositing money at ING is therefore possible, although not quite as convenient as with Sparkasse and Co. The strength of the bank lies in the very good cash availability with Girocard and Visacard (both free of charge) and good customer service as well as low overdraft interest. Another advantage of ING is that they lending extremely transparent and favorable conditions. Of course, customers enjoy this all the more when they first get a foot in the door of the bank, for example through the Opening a free checking account.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.