Is it possible to invest in ETFs without any prior knowledge? Yes, say numerous robo advisors, i.e. fully digitized investment helpers. To make this possible, numerous start-ups in the financial sector, so-called FinTechs, have been founded since 2013 and written some clever software. This should make it possible for a wide range of people - even without knowledge of stocks - to build up a simple, transparent and high-yield investment. One Stock investment with Growney you can set up with just a few clicks of the mouse and without any prior knowledge of the stock market. In addition, I will guide you through a self-test to determine your risk tolerance. You can then email the result to yourself as a PDF.

Unsure about investing?

What you can learn here

Are you unsure about your investment and don't know how best to approach the topic?

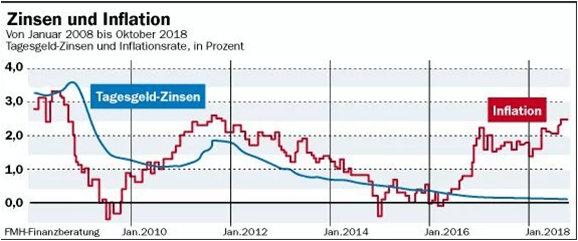

One of the biggest mistakes in investing is not wanting to take risks. But, without risk, there is meager interest on the Tagesgeldkonto and the money will sooner or later be taken from the Inflation eaten up.

You can easily see this from the graphic shown. The red curve is the inflation within Germany, the blue the call money interest. If the blue curve now falls below the red one, your money in the account loses value. The longer such a situation lasts, the less you can buy with the money afterwards.

The more you are willing to take risks, the more opportunities there are. In no way does this mean that you should simply take maximum risk in order to maximize your return. That would just be reckless and stupid.

Instead, opportunity and risk should always be in a balanced relationship, which is optimally tailored to your needs.

Who is a robo advisor suitable for?

... And... How can he help me to successfully master the challenges described at the beginning? Basically, a robo advisor is nothing more than a service provider for you. The software was written to save you work, stress and time and thus maybe make your life a little more pleasant.

A robo advisor is therefore suitable for you if you don't want to worry about your investment or don't have the time or nerves for it. Finally, the provider puts together a portfolio for you that suits your risk profile and takes care of the administration (picture risk).

More precisely, a robo advisor is suitable for you if you would like support with one or more of the following points

- Determining your risk tolerance.

- Behind this are questions like: "What risk are you willing to take?", or "What is your investment horizon and how would you react if your portfolio collapses by 15 or more percent due to a downturn?" With Growney you can calculate the approx. 10 questions comprehensive questionnaire here to complete. Other providers have similar questionnaires

- Assistance in putting together a suitable asset allocation according to your risk profile

- Support for the technical implementation including regular rebalancing

- Support during stock market downturns. Especially for newcomers to the stock market, stock market downturns can lead to hasty selling decisions due to strong emotions, which is a real return killer in the long run.

- Last but not least a robo advisor is still suitable for people who want their tax returns to be largely automated. For the tax it is sufficient to deposit an exemption order. Distributions from the ETFs are then tax-free up to an allowance of EUR 801 for singles or EUR 1,602 for married couples. This amount is also called the savings allowance and you can also use it for ETFs or other securities.

- Of course, the exempt amount does not increase just because you have other investments in addition to a Rob Advisor. Then you have to split it up.

- Above the allowance, the bank automatically deducts 25 % tax and you don't have to worry about it.

- By the way: There is a way that you have to pay less tax even above the saver's allowance. At least if you only have a low income. how to do that you can read here.

Robo Advisor and Movers #In ETFs invest without prior knowledge

In principle, a robo advisor is similar to many things in life.

You often have a cheap version that requires more work, time, and patience. Next a medium version and finally the premium version.

For example, when moving to a new apartment, you can either ask a friend with a station wagon to help drive things to the new apartment (show station wagon)... you could rent a van, which would save time and work there fewer trips between the old and new apartment would be necessary, ... or you could outsource the entire move to a moving company, which would mean that you would have almost no work but would have to spend significantly more money than with the first two variants.

In the case of investing, the cheapest option is to buy ETFs yourself, for example, and manage the investment yourself. The most expensive variant are actively managed funds managed by well-paid managers. And robo advisors…that's the middle ground. Significantly cheaper than actively managed funds, but slightly more expensive than a self-managed ETF portfolio. One Pros and cons list of ETFs You can find it here if you need more information about it.

So the choice for or against a robo advisor depends on your preferences. For people who want an easy investment and prefer to invest their energy in other things than ETF and broker comparisons, a robo advisor can be an interesting alternative.

Self-test: Invest in ETFs without prior knowledge

Finally, I recommend Growney's free investment check to try. Since the recommendations are free and you don't have to open an account to take the test, you can't lose much.

Have fun trying see you next time!