If you want to buy a motorcycle, the question of motorcycle financing often comes up. In the article "What is the best way to finance a motorcycle?" we show you some unknown (and probably also some known) options that are open to you when it comes to motorcycle financing. The question of how to finance a motorcycle comes with a weighing of the pros and cons between Buy cash, lease or finance namely not yet answered. We found 7 ways to finance a motorcycle.

What is the best way to finance a motorcycle? - Often you finance a motorcycle on best with a Car loan for motorcycles. Here the Vehicle title at the bank deposited and you will receive the money even before the purchase. Due to the security the car loan best interest conditions and you can additionally benefit from the Cash discount benefit.

What you can learn here

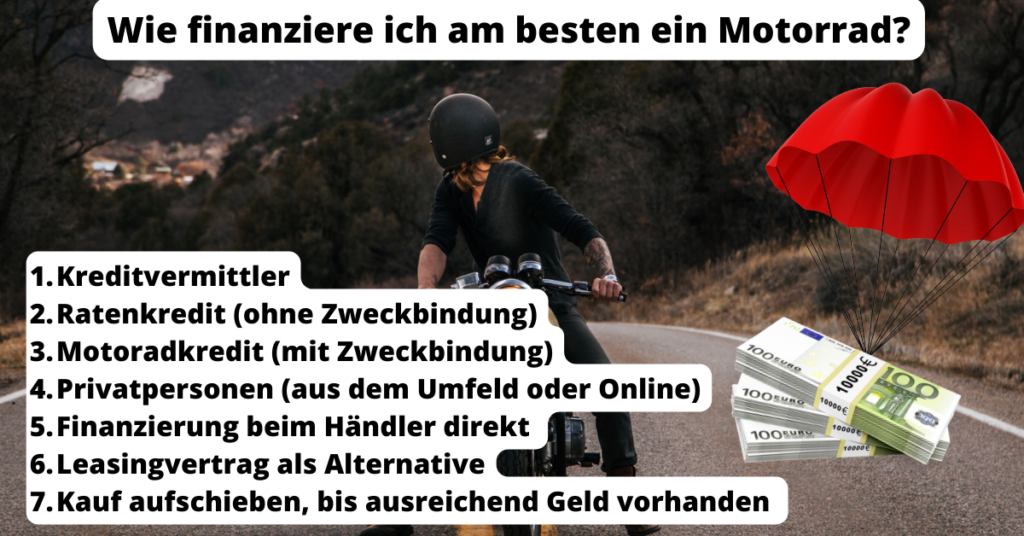

What is the best way to finance a motorcycle - 7 ways to finance a motorcycle.

With the current motorcycle prices [1], it doesn't matter whether it's a new or used motorcycle goes: Often the price for the motorcycle cannot be raised immediately and it has to be financed. There are numerous options when it comes to motorcycle financing.

Here are 7 ways to finance a motorcycle, some of which you probably haven't heard of yet. Since only financing through the dealer requires a down payment, for most bike financing you'll need no exorbitant sums on the account:

- credit intermediary

- Installment loan (without earmarking)

- Motorbike loan (earmarked)

- Private individuals (from the surrounding area or online)

- Financing directly from the dealer

- Lease contract as an alternative

- Postpone purchase until sufficient funds are available

All financing options for your bike have advantages and disadvantages. We will go into this in more detail in the next chapters.

credit intermediary

Loan brokers work with several banks and thus compare numerous loan offers for you at once. Therefore, it seems obvious to consider them when asking "What's the best way to finance a motorcycle?". After all, credit brokers work without any upfront or additional costs.

The rumor that multiple inquiries from loan brokers will affect your Schufa score is not true. If you only request the loan to compare terms, your Schufa rating will remain as it was.

Suitable for any credit rating

Credit intermediaries also have the advantage that they Loan for your motorcycle based on your credit rating able to offer. did you know that Banks only grant loans in a very narrow credit rating range? A table on which Schufa rating SWK, Smava*, bon credit* and numerous other banks and intermediaries grant a loan, you will find in the article "Which bank grants credit with bad creditworthiness?

But one thing in advance: Most banks reject the request for a motorcycle loan if there are the smallest anomalies in the Schufa or in the case of suspicious payment transactions. Little things are enough for this, which often seem flimsy or are simply wrong. Drastic errors like this also happen with the Schufa

Also with Schufa problems

If you - like many people in Germany - have problems with the Schufa information, it is better to go directly to a credit broker for motorcycle financing. Credit intermediaries first ask various regular banks for a loan for you. These are banks that you know and from which you would probably ask for credit anyway. In addition, credit intermediaries also ask for motorcycle financing from some other lenders that are not well known and some of which cannot be requested directly.

The article "Which bank gives credit despite negative credit bureau?” gives a good overview of your options, a Credit for your motorcycle obtainable in more difficult cases. The good thing about the banks and credit intermediaries listed there is that they can also grant loans to people with better credit ratings. They just don't jump off so quickly if their credit rating is bad.

... And without collateral ...

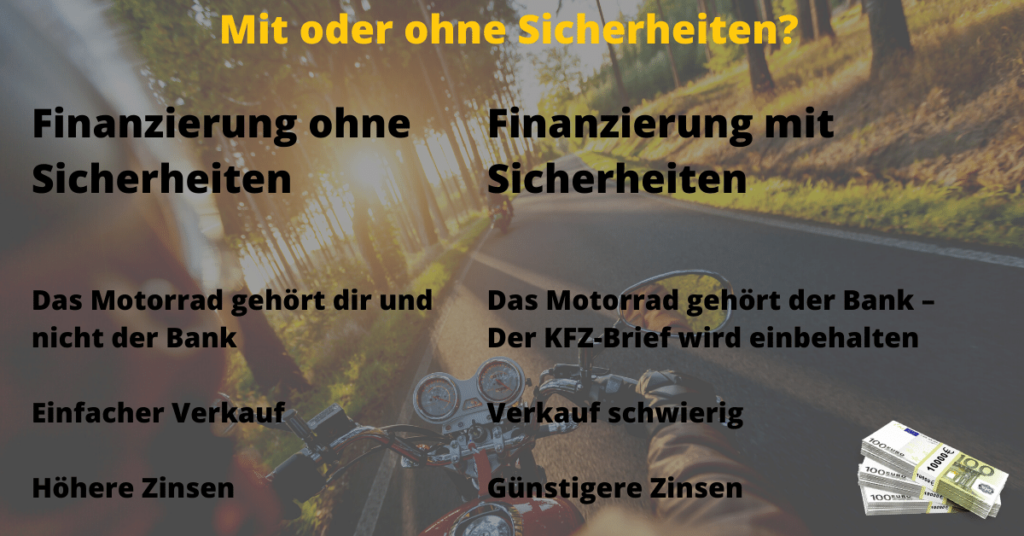

Credit intermediaries often work with banks, who do not need the motorcycle as security. A fixed income of more than 1,200 euros net is therefore usually necessary to get a loan approved for a motorcycle in the middle price segment.

Credit intermediaries often go alternative ways when financing the motorcycle. That's the only reason why they can even take people with bad credit grant a motorcycle loan without depositing a security. So the motorcycle belongs directly and solely to you and not to the bank. This is a huge advantage when selling, as you can easily get rid of the bike.

It goes without saying that loans to people with bad credit ratings or negative Schufa are not without disadvantages. The interest rates for these loans are slightly higher.

However, it is highly recommended to have an offer from a credit broker up your sleeve. Because these offers are a safe haven when lending for your motorcycle, as almost everyone gets them.

You can always get other comparative offers, but if you have to pick up and pay for your bike promptly from a private person, you often do not have the time to make individual loan inquiries to numerous banks.

Where to really get a loan despite negative Schufa, we took a closer look.

Credit intermediary - The best option for those who decide on the spur of the moment

Loans from credit intermediaries are the most unproblematic motorcycle financing. These loans are disbursed to almost anyone very quickly and without depositing any collateral. They are therefore particularly suitable for spontaneous buyers who want to pick up the motorcycle immediately. In addition, credit intermediaries offer people with poor credit ratings due to negative Schufa entries an opportunity to still get a motorcycle loan.

Installment loan (without earmarking)

Another option is to apply for an installment loan without earmarking at a bank (e.g. your house bank or online). However, this usually requires a good credit rating. If your Schufa rating is class C or worse, the installment loan without earmarking will probably be rejected.

Furthermore, due to the lack of security Installment loan without earmarking a regular and fixed income is mandatory.

The fact that no security is deposited means that you enjoy greater independence. For example, you can sell your motorcycle during the term of the loan. With a dedicated loan, it is very difficult to sell the motorcycle, since the registration certificate part II (vehicle registration) is deposited with the bank and has to be redeemed first.

In order to get favorable conditions for the installment loan, a credit comparison definitely recommendable. In our sample calculation, we saved credit comparison 1.355 € for a motorcycle financing of 10.000 € and 8 years.

Installment loans without earmarking – The best option for flexible

Installment loans without earmarking are therefore the best financing option for you if you want to remain flexible.

Car loan for motorcycles (installment loan with earmarking)

This is financing in which the registration certificate part II (vehicle registration) is deposited with the bank as security.

With a motorcycle loan with earmarking, the motorcycle is used directly as security. This means that the bank can confiscate your motorcycle if you no longer pay the installments for the current motorcycle loan.

This reduces the risk of non-payment, because the bank already has the motorcycle as equivalent value. Therefore, earmarked loans are cheaper than non-restricted loans.

In addition, the motorcycle loan is earmarked with a minimum value. This means that the motorcycle must have a certain purchase price. Otherwise the bank will not finance it because the effort involved in storing part II of the registration certificate is too great.

In addition, mopeds, mopeds and light motorcycles as well as scooters up to 125 ccm cannot be financed with a motorcycle loan with earmarking anyway, as they do not have a registration certificate part II (vehicle registration document).

With many banks, the bank must be presented with the purchase contract after the purchase. With this, the bank wants to ensure that the earmarked loan is really used for the motorcycle purchase. As a rule, the banks then keep Part II of the registration certificate until the loan has been paid off in full. You can find an overview of which banks require the purchase contract and registration certificate Part II in the article: "Vehicle registration document as collateral for credit: use the car as security!“

Another formality: Actually, there is no special motorcycle loan or classic motorcycle financing. However, some banks offer to finance the motorcycle with a car loan with earmarking. The registration certificate part II (vehicle registration) for the motorcycle is deposited with the bank.

Installment loans with earmarking – The best option for the price-conscious

Installment loans with earmarking are not particularly flexible, but due to the security deposited, the interest rates are the cheapest with this financing.

credit from individuals

Another way to finance your motorcycle is to take out a loan from private individuals.

Private credit is also known as P2P credit. P2P means "peer-to-peer credit" and means a credit among "peer" private individuals. So there is no "higher-ranking institution" like a bank that simply prescribes the terms of the loan. This means that everything that is legal can also be agreed privately in the case of a loan.

The definition of the private loan already reveals its strength. The lender can decide for himself whether the Schufa plays a role or not. In most cases, private individuals will also grant a loan if the Schufa is negative and in return will ask for a slightly higher interest rate.

The personal loan can either be taken out directly in the personal environment or online marketplaces such as Auxiliary* are used to coordinate lending via a platform.

If you have the opportunity to take out the loan from a relative or acquaintance, you should be particularly conscientious about repaying the installments. Payment delays and disruptions can completely destroy the relationship in a short time.

Loan From Individuals - Do you have a rich uncle?

The private loan is often less formal and, if it comes from the family, usually cheap. But that's why you shouldn't abuse the lender's trust. Always pay back your installments on schedule so as not to destroy the relationship with the lender.

What is the best way to finance a motorcycle? – Financing directly from the dealer

Another alternative to cover your credit needs is the financing at the dealer directly. This is often particularly convenient. Because the offer for the financing and the motorcycle come from a single source from the dealer. Therefore, both are coordinated. The financing itself then runs through the bank, which is connected to the dealer.

Therefore, you do not have to coordinate the bank and the motorcycle dealer. Instead, you will receive the motorcycle and the financing together on the same day.

The dealer often submits several financing offers. These offers differ in terms of the term and the rate.

the Financing directly from the dealer often has low interest rates, since part II of the registration certificate is also deposited. In addition, the dealers have two reasons for you to sign: You then sell both the motorcycle and the loan at the same time.

This often pushes you to sign immediately. Of course you shouldn't do that. It makes sense to take the financing offer home with you and compare it with the offers from other banks online credit comparison to compare.

In the case of dealer financing, the monthly installments are also low and staged in a way that is effective in advertising. However, this advantage is often more than offset by a high closing rate at the end (“balloon payment”).

The conditions with other lenders may be better, or at least more flexible. Because if you decide to finance it through the dealer bank, the vehicle registration document will be retained until the loan has been fully repaid. This also means that if sold during the term of the loan, the motorcycle must be redeemed from the loan for a prepayment penalty.

Dealers where you can get a Buy a car on installments despite negative credit bureau can be found in the linked article.

Financing directly from the dealer is cheap, but mostly rigid and with a high rate of fire

Financing directly from the dealer is particularly convenient and the monthly installments are low. However, there are often high closing rates and it is very difficult to sell the motorcycle during the term.

Leasing as an alternative for lazy people

Especially with more expensive purchases such as buying a motorcycle, it can also be worth considering leasing if you do not receive financing from a bank or do not want it for other reasons.

In contrast to financing, with motorcycle leasing you do not become the owner of the motorcycle (in legal terms only the owner. As with a rented apartment), but maintenance and repairs are taken over by the lessor.

However, since newer motorcycles are usually used here, a leasing contract is almost always more expensive than a direct purchase with financing.

Leasing: For the lazy

Motorbike leasing is for you if you don't want to deal with the technical side of the bike. Because the maintenance is taken over by the lessor.

Postpone credit needs until later

If the financing doesn't seem manageable, taking out additional credit is usually not a good idea. In this case, the best motorcycle financing is no financing at all and you should save some money to lower the loan rates. If you can raise 1/3 of the purchase price from your own funds, you can lower your loan rates quite a bit. If you cannot afford the financing, there is also the alternative of increasing the term within limits. This also leads to a reduction in the monthly burden. However, you will then pay off the loan for longer.

Finance or lease a motorcycle: Requirements you must meet

In order for you to be able to finance or lease a motorcycle, it is important to meet a few basic requirements. Based on the requested documents, the bank or the lessor will estimate in advance how likely it is that you will repay the installments. For this you usually have to submit the following documents:

- Copy of ID card

- Purchase agreement (for many earmarked loans)

- Payslips for the last three months

- For the self-employed, the statements for the last 12 months

To finance or lease a motorcycle, you must be at least 18 years old. You also need a German place of residence and a bank account in Germany.

A good credit rating and a fixed income are not mandatory for all motorcycle loans, but they make it much easier to take out a loan.

Conclusion on the question "What is the best way to finance a motorcycle?"

In conclusion, we review the multifaceted answers to the initial question "What is the best way to finance a motorcycle?" The following financing options exist:

- credit intermediary: Loans from credit intermediaries are the most unproblematic motorcycle financing. These loans are disbursed to almost anyone very quickly and without depositing any collateral. They are therefore particularly suitable for spontaneous buyers who want to pick up the motorcycle immediately. In addition, credit intermediaries offer people with poor credit ratings due to negative Schufa entries an opportunity to still get a motorcycle loan.

- Installment loans without earmarking are the best financing option for you if you want to remain flexible.

- Installment loans with earmarking are the best financing option for you if you want to finance your bike as cheaply as possible. I recommend the installment loan with earmarking to people who ask "What is the best way to finance a motorcycle?" because it offers favorable interest conditions and the possibility of a cash discount.

- Loans from private: Personal credit is often less formal and, if it comes from family members, cheap. But that's why you shouldn't abuse the lender's trust. Always pay back your installments on schedule so as not to destroy the relationship with the lender.

- Financing from dealer: Financing directly from the dealer is particularly convenient and the monthly installments are low. However, there are often high closing rates and it is very difficult to sell the motorcycle during the term.

- Leasing: Motorbike leasing is for you if you don't want to deal with the technical side of the bike. Because the maintenance is taken over by the lessorn.

- Put off: If the financing does not seem manageable, taking out additional credit is usually not a good idea. In this case, the best motorcycle financing is no financing at all and you should save some money to lower the loan rates.

The possibility show that significantly more financing options exist than my decision to finance initially suggests. The best thing to do is to confidently ask for several options in concrete terms and not let yourself be pressured into doing things quickly.

To answer the question "What is the best way to finance a motorcycle?" again: Installment loans with earmarking are often the best and most favorable financing option.

footnote

[1] As early as 2021, used motorcycles were more than 12 % more expensive than in 2019. This trend will continue in 2022 due to the tense market situation. See: https://www.motorradonline.de/ratgeber/used-motorraeder-become-teurer-prices-rise-by-12-percent