Here we go: Trading for free is now also possible with Smartbroker! On May 18, 2020, the provider lowers the price as at the end of 2019 announced his fees. All securities at Gettex and all derivatives at Morgan Stanley, HSBC and Vontobel can be traded for EUR 0.00 per order. As a result, a free broker is available in Germany for the first time that offers a fully-fledged desktop interface.

“From now on customers can trade all securities at Gettex and all derivatives at Morgan Stanley, HSBC and Vontobel for EUR 0.00 per order. In addition, the trading fee for Lang & Schwarz is reduced to EUR 1.00 per order. These conditions apply from an order volume of EUR 500.00.”

Smartbroker notice of fee reduction on May 18th, 2020

Released in December 2019 SmartBroker* on the screen. Behind it stands wallstreet:online. If you don't know, it's a large finance and business portal.

It is a free depot where for 4 euros per order can be traded. In contrast to Trade-Republic, you can trade with Smartbroker on all German stock exchanges. There is also access to 18,000 funds with no front-end load.

Smartbroker offers this

What you can learn here

- No custody fees

- 4 EUR per order (commission-free trading is planned)

- Trading on all German stock exchanges

- 18,000 funds with no sales charge

- Free currency accounts

- Securities Loan from 2,25 % p.a.

- In cooperation with DAB (based in Germany with deposit insurance)

With Smartbroker you trade on all German stock exchanges, in direct trading via Lang&Schwarz and internationally on the respective home stock exchanges.

Smartbroker vs. Trade Republic – The free brokers in comparison

Significant advantage of Smartbrokers over Trade Republic* are the following three reasons:

- Trading possible via real exchange

- Trading via desktop PC possible

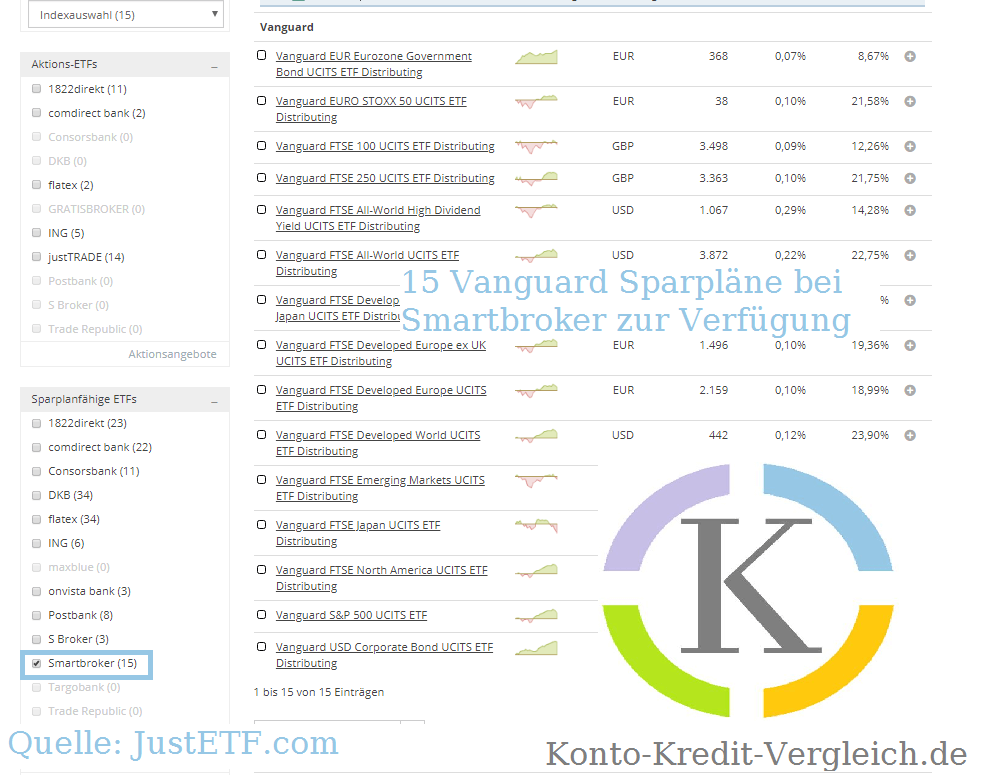

- The popular Vanguard funds are available in the savings plan

Free broker with many savings plans

Smartbroker has a comprehensive range of savings plans. In addition, these are relatively affordable at 0.20 % (at least 0.80 euros) per version, albeit other providers have slightly better offers here.

Here is what Smartbroker offers for ETF savers

- 604 savings plan eligible ETFs

- Established providers: Amundi, iShares, Lyxor, comstage, BNP Paribas, Xtrackers, Vanguard, SPDR, UBS, HSBC, Invesco, DEKA, etc.

- Particularly inexpensive: only 0.20 % (at least 0.80 euros) per version

- already possible from 25 euros per version

- Savings plan Execution: monthly, bimonthly, quarterly and semi-annually possible.

Free broker with reasonable ETF savings plan campaign

The provider goes after customers and offers 295 savings plan ETFs completely free at. This includes ETFs from providers Amundi, XTrackers, Lyxor and iShares. Too bad there are no Vanguard ETFs. If you want to save on Vanguard ETFs as cheaply as possible, the best thing to do is go to the DKB. In the DKB* Vanguard savings plans can already be implemented for a flat fee of 0.49 euros. With this, the provider shows once again that it can definitely stand up to the industry newcomers.

The disadvantage is that Smartbroker also charges penalty interest of 0.5 % on cash deposits. However, only if the cash quota is more than 15 % in relation to the deposit value. The quarterly average is taken as the basis. The penalty interest/custody fee is only charged on the part that is above the 15 % cash quota. New customers are exempt from the fee for the first three months.

You can find more exciting depots in the depot comparison

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️