Marital splitting and other consequences of marriage: inheritance, will, alimony, hospitalization. Are the advantages of marriage obvious? After all, the number of marriages in Germany has been on the rise again since 2003: Konto-Kredit-Vergleich.de sheds light on the tax and legal advantages of marriage. Are married people given preferential treatment in Germany? And how does the marital splitting system actually work?

NGDPhotoworks

What you can learn here

- How does spousal splitting work?

- At what point is spousal splitting worthwhile?

- What is the tax bracket for spousal splitting?

- Who benefits from spousal splitting?

- What are the disadvantages of spousal splitting?

- Why was spousal splitting introduced?

- Children without marriage: What to consider in the case of cohabiting children

- Deduction of childcare costs - an advantage in marriage?

- What about maintenance payments for unmarried & married couples

- Health Insurance and Hospitalization: Differences in Married vs. Unmarried Couples

- Living together unmarried: do we need a will?

- In addition to spouse splitting, married partners benefit from high tax allowances and widow's pensions

- Conclusion: How does spousal splitting work and what advantages does it offer?

How does spousal splitting work?

With spousal splitting, both incomes are first added together. The sum is then halved again and the tax is now calculated on the basis of the halved (and rounded down) amount. Subsequently, the calculated tax is doubled again. This tax is then payable by both spouses, half each.

At what point is spousal splitting worthwhile?

If both partners earn a similar amount, your tax burden is about the same as for married couples. The advantage of marriage increases as the two salaries spread.

Accordingly, the advantage of spousal splitting is greatest when the total earnings come from one partner alone. If both earn the same amount, however, the spousal splitting is not worthwhile at all. But even if both partners are already taxed at the maximum rate of 42 %, spousal splitting is not worthwhile.

A simple example: In the case of an unmarried couple, the two partners earn 70,000 and 30,000 euros gross annual salary. Due to the joint assessment as a married couple, the couple can earn approx. Save 3000 euros in taxes per year.

Reason is that Splitting tariff for spouses, which is also below Spouse splitting is known. As the example clearly shows, this can save a considerable amount of tax.

This is due to the way the calculation is made: The incomes of both partners are first added together and then halved. From this halved income (i.e. 50,000 euros in the example), the tax office determines the income tax, which is then doubled again.

This shifts income from a high marginal tax rate to a lower marginal tax rate. This is because the percentage tax rate also increases with income.

The graphic below from Wikipedia illustrates the effect. Couples benefit from spouse splitting the more, the more different their incomes are.

What is the tax bracket for spousal splitting?

In the case of spousal splitting, the tax class combination is 3/5, whereby the partner with the higher income has the lower tax class 3 and the partner with the lower income has the higher tax class 5.

Who benefits from spousal splitting?

The higher the income difference, the greater the tax advantage of the marital splitting. Couples with very unequal incomes therefore benefit the most. Couples with similar incomes benefit only very little or not at all.

What are the disadvantages of spousal splitting?

The complicated spousal splitting system means that for many, work is less worthwhile for the partner with lower earnings. This is because the partner with a lower income pays a higher tax.

Why was spousal splitting introduced?

Marital splitting was introduced in 1957. The law is still in force. At that time, spousal splitting was intended to solve the following problems through its mode of operation of joint assessment

- if both spouses worked, individual taxation led to a disadvantage for spouses due to tax progression.

- Marital splitting was thus intended to relieve spouses of the disadvantages of progressive taxation in the case of joint assessment

- In addition, farmers and foresters could gain progression advantages by hiring the spouse, which was to be avoided

Children without marriage: What to consider in the case of cohabiting children

First of all, there will be no tax changes for couples with one or more children. Finally, unmarried couples can also be exempt from tax family benefits benefit in full. In concrete terms, this means that the child allowance, for example, is split 50:50 between the two partners. In 2022, the child allowance will be €8,388 including the care allowance. This is made up as follows:

| Year | Child allowance | Education allowance | total |

|---|---|---|---|

| 2022 | 5.460 Euro | 2.928 Euro | 8.388 Euro |

| 2021 | 5.460 Euro | 2.928 Euro | 8.388 Euro |

| 2020 | 5.172 Euro | 2.640 Euro | 7.812 Euro |

| 2019 | 4.980 Euro | 2.640 Euro | 7.620 Euro |

Alternatively, there is the child benefit of currently 219 euros per child for 2022.

However, you can only claim one of the two options: Either the child allowance or the child benefit.

The tax authorities automatically determine the more favorable option for you. However, both variants are the same in that marriage does not change the amounts. Unmarried persons are also entitled to them.

There is no need to pay attention to the family allowance with regard to the child allowance, the education allowance and the child benefit. The money is paid to both married and unmarried parents and is taken into account for tax purposes.

Deduction of childcare costs - an advantage in marriage?

Both unmarried and married couples enjoy tax benefits on childcare costs. Childcare costs include costs for:

- day care centers

- a hoard

- another care facility

- but also care at home by childminders or an au pair

You can claim up to two-thirds of the costs, but no more than 4,000 euros per year and child. Due to the rising marginal tax rate, the effect is more favorable for the partner with the higher income, ie the repayment is larger.

Therefore caution is called for here: When the partner with the low income concludes the care contract, the partner with the higher income can no longer claim the costs. If, in extreme cases, one partner has no income at all and concludes the care contract, no costs can be claimed.

What about maintenance payments for unmarried & married couples

In the case of an unmarried couple, the partner who is obliged to pay maintenance can claim the costs incurred as extraordinary expenses in the income tax return. This is also possible for couples living together.

In contrast to marriage, unmarried couples are no longer entitled to maintenance payments after a possible separation. Even if one of the two has reduced or even given up the number of hours at work due to childcare. On the other hand, spouses are obliged to pay maintenance to one another. If one of the two is affected by a job loss, for example, the partner must step in first before the tax authorities do it. This is not the case for unmarried people.

Exception: What would a rule be without an exception? If the unmarried couple has a child under the age of three and then separates, the situation is the same as in a divorced marriage. This means that the partner with a job has to pay child support to the non-working partner who took care of the child.

Health Insurance and Hospitalization: Differences in Married vs. Unmarried Couples

In marriage, one partner with statutory health insurance can insure the other at no additional cost. At least if they don't have a job that requires health insurance. This option does not exist for unmarried couples.

In the hospital, the partner only receives information if it is the spouse or if there is a power of attorney. Even if couples have been living together for a long time but do not have mutual power of attorney, the hospital usually does not provide any information.

Living together unmarried: do we need a will?

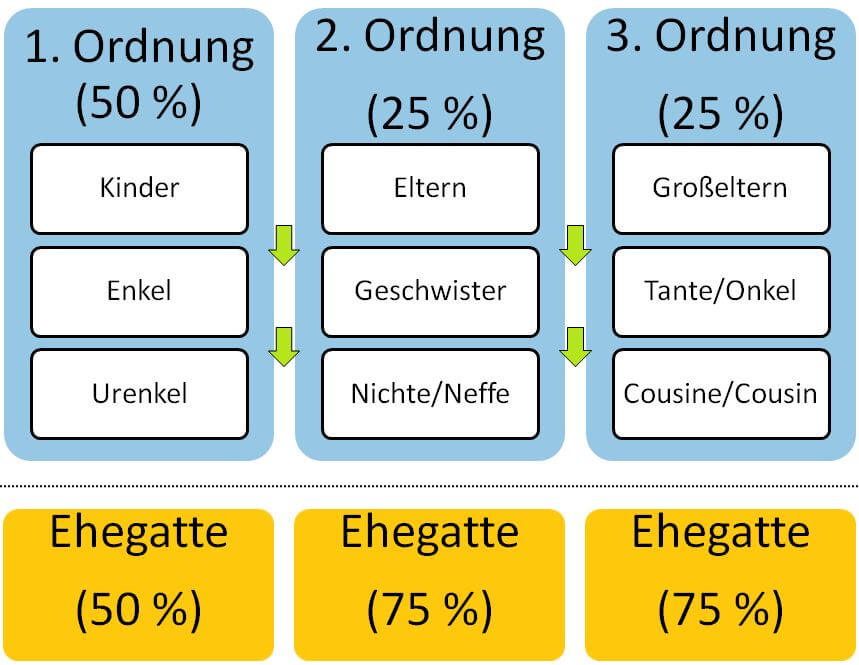

Spousal splitting is not the only benefit of marriage. Because the legal succession provides for inheritance only to blood relatives and spouses. Unmarried partners get nothing without a will – even after decades of living together. The graphic below illustrates the legal succession if there is no will. In the first order of succession are the direct descendants of the testator, who are provided with 50 % of the assets to be inherited in the case of a community of accrued gains. Grandchildren only inherit if there are no more children. Likewise, great-grandchildren only inherit if there are neither children nor grandchildren. This is illustrated by the arrows.

The second-order heirs come to an heir only if the first-order heirs do not exist. The heirs of the third order are next. The spouse shares the inheritance with the heirs of the first order with 50 % share and with the heirs of the second and third order with 75 % share. There are further rules for this, which are not shown here for the sake of simplicity.

In addition to spouse splitting, married partners benefit from high tax allowances and widow's pensions

Furthermore, married couples are entitled to the maximum possible tax allowance of 500,000 euros in the case of a gift or an inheritance. In a nutshell, this means that gift or inheritance taxes only have to be paid from an amount of half a million euros. And even if a tax is due, the state favors married couples. Depending on the amount, a tax rate of between 7 and 30 % is applied to the spouse. In the case of unmarried people, however, the Treasury takes more action. There will be 30 to 50% in taxes. The third advantage of marriage is the marital protection of surviving dependents. This means that if a spouse dies, the surviving dependent can receive a widow's or widower's pension. Unmarried couples do not have this privilege.

Conclusion: How does spousal splitting work and what advantages does it offer?

Spouse splitting

Due to this taxation procedure, married couples with large income differences are taxed less heavily. Since only one tax return is submitted together, one speaks at the splitting also of common disposition. Married couples can choose again each year whether they want to file a tax return together. In general, only married couples can be assessed together. Newly married and divorced spouses can choose in the wedding year whether they want to invest together. The same applies to divorced and also widowed partners in the year of the divorce or the partner's death.

Compensable privileges through alternative contracts

In order to get comparable privileges as married couples, unmarried couples can make a will and a health care proxy. Another possibility for security is a notarized partnership contract. Such a contract can regulate compensation payments in the event of a separation or maintenance payments. The partnership agreement can also specify what happens to a jointly rented or financed property in the event of a separation. Anyone who completes these documents has the same protection even without marriage. Marriage reduces the bureaucracy here, however, since you do not have to take care of things individually.

Certain privileges are reserved for spouses

These include, in particular, the higher tax allowances for gifts or inheritances. The lower tax rates above these allowances also count here. This disadvantage cannot be compensated for unmarried and single parents. clear advantage of marriage.

Advantages of unmarried partners

In marriage, much is regulated that would otherwise require alternative contracts. Likewise, spouses are still better off in terms of tax law (gift/inheritance). However, marriage also entails obligations that unmarried partners do not have. This means financial responsibility for the partner in the event of a job loss. The Treasury takes a back seat here in the order of priority, since the financial possibilities of the partner are examined and claimed first. So the advantages of marriage are not available entirely for free.

I am glad that this article on taxes was helpful to you. Please note: These are general tips that cannot replace an individual assessment. Please contact your tax advisor or, if necessary, the tax office responsible for you.