Robo advisors invest customer money in a broad range of funds after a risk assessment. I explain how they work and what investors should consider when it comes to digital investments.

Expensive help with investing is a thing of the past thanks to digitization: Robo Advisors find the right portfolio for an investor using algorithms. I explain what to look out for and how robo advisors work.

Digital investment: How much robot is there?

What you can learn here

- Digital investment: How much robot is there?

- And explained in a little more detail? What does the software do?

- So customers do not receive an individual portfolio, but one off the shelf?

- How is the questionnaire structured?

- Digital investment: where is the money?

- How much money do I have to invest if I want to use a robo advisor?

- Digital investment with robo advisors: advantages

- Digital investment with robo advisors: disadvantages

- What is important when choosing a robo advisor?

- How does the return on the digital helpers differ?

- How long have robo advisors been around?

- How many robo advisors are there in Germany in 2020?

- Forecast on the subject of digital investment by a "robo

The name robo advisor is a bit misleading. The software, known as a robo advisor, helps with the risk classification and then selects a preconfigured portfolio. The software then takes over the management of the portfolio for the investor. A clear interface makes it possible to track what is happening with the money.

And explained in a little more detail? What does the software do?

The robo advisor uses a questionnaire to ask the investor about their motivation and goals as well as their risk tolerance. He then selects a portfolio that suits the risk appetite. Robo advisors usually use index funds, typically ETF, for this. These are broadly diversified and therefore without additional cluster risk. A big advantage over investing in individual stocks. ETFs are also very cheap. After the portfolio is created, the robo advisor manages the portfolio. To do this, he keeps the weighting of the ETFs stable, which makes smaller activities of the robo permanently necessary.

So customers do not receive an individual portfolio, but one off the shelf?

Most robo advisors offer preconfigured portfolios. Some providers have five portfolios in their repertoire, others boast 20. However, more is not necessarily better. Rather, it is important that the portfolios match the risk appetite of the investor. This can be represented sufficiently well even with a small number.

How is the questionnaire structured?

The questionnaire to determine the type of investor includes around 10-15 questions, depending on the provider. These questions are primarily about risk appetite of the investor, taking into account the overall financial situation of the investor and the Goals, that are to be achieved with the investment. So if you have your investment goal your why know, there is a high probability that you will be successful in the long term because your goal intrinsically motivates you.

risk appetite is a measure of how much risk an investor should take. The higher and more secure the income, the higher the total assets and the lower the fixed obligations, the more risk an investor can take. Objectively speaking, civil servants with a secure job until they retire and a property that has been paid for can take a very high risk, even if this rarely happens in practice. As with any financial investment, more risk also means a higher expected return with a robo advisor. So: How does risk feel to you? Can you sleep soundly when your portfolio 20 % falls in value? The overall situation must always be considered. If a move or the purchase of a new car is imminent, this must be included in the planning.

Digital investment: where is the money?

The money is in the custody account of the robo advisor’s partner bank. In case of Quirion* stores the fund balance at the bank of the same founder Quirin. The provider Growney works with the Sutor Bank together. world invest has teamed up with the big bank BNP Paribas allied, which is better known in Germany under its subsidiary Consorsbank. money that the provider Oscar is managed by the German Baader Bank kept in the depot.

How much money do I have to invest if I want to use a robo advisor?

The minimum deposit depends on the provider. at Quirion it is 1,000 euros, at Growney can even start at one Minimum deposit of one euro be started. The savings plan rate is already starting at Growney one euro. This makes the provider highly recommended, especially for young investors, as there are no entry hurdles. At the provider world invest the investment is possible from a minimum amount of 500 euros. Other providers and their conditions are in the tabel listed for the Robo Advisor comparison.

Digital investment with robo advisors: advantages

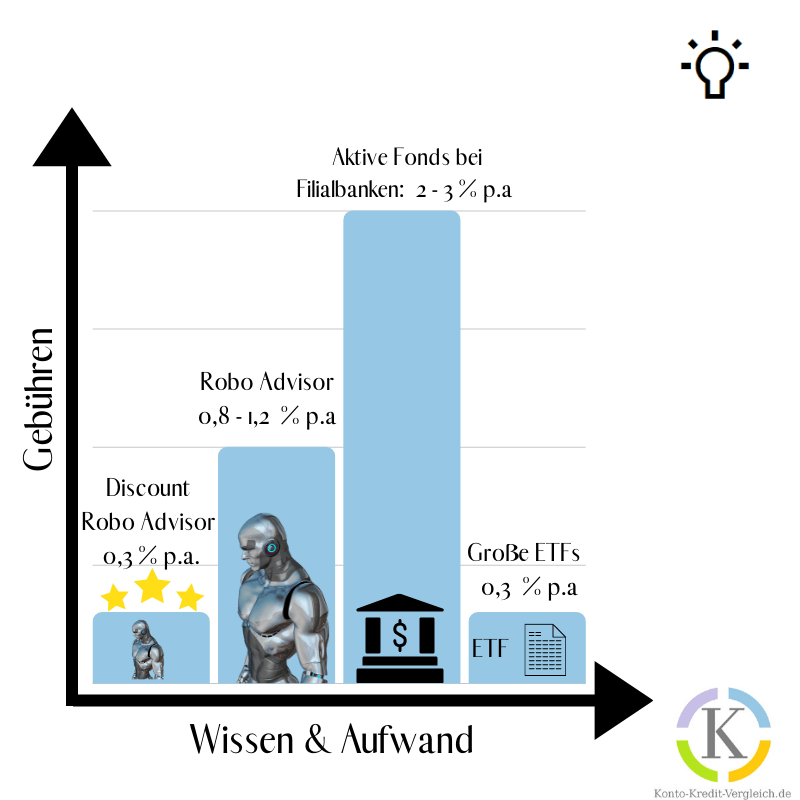

The risk-adjusted portfolios directly implement the basic principles of a successful investment. First Invest in diversified funds, avoiding unnecessary risks. Second the overall risk is adjusted to the investor's risk tolerance and financial background. This means that risk-averse investors, i.e. people who shy away from major losses, receive a portfolio with a higher proportion of bonds that sags less in times of crisis. Of the third point is the cost advantage of robo advisors compared to classic actively managed portfolios, which often charge more than two percent fees. Discount robo advisors are now even on par with direct purchases of ETFs. at Quirion* this is already the case for the first 10,000 euros. Quirion creates these without a Robo Advisor fee.

Digital investment with robo advisors: disadvantages

Robo advisors are particularly suitable for the first steps on the capital market. Here you support investors who have yet to develop a feeling for their risk tolerance and who do not know or do not want to deal with the management and rebalancing of the portfolio. Experienced investors who do not need any support can save a few euros in costs by investing directly in ETFs. Exception: The discount model from Quirion* that for the first 10,000 euros is on par even with low-cost ETFs.

What is important when choosing a robo advisor?

I have robo advisors who implement the basics of successful investment well here listed. You can find other providers in the cost comparison table (in addition to any bonus payments) here. Most robo advisors have solved the customer's way to his depot elegantly and conveniently with easy-to-understand questions.

By the way: the topic of digital investment with robo advisors is discussed in the following advice article treated in detail.

How does the return on the digital helpers differ?

There are numerous circulating on the internet Real money testing which compare the performance of different providers and rank the robos according to performance. However, apples are often compared with pears here. A portfolio X from provider A may have a higher return than portfolio Y from provider B. However, such a simple comparison completely ignores the risk aspect. The higher-yielding portfolio may be exposed to significantly greater fluctuations, which has not yet had an impact in the (usually rather short) comparative period.

A decision for or against a provider should therefore not be made dependent on short-term yield differences in the decimal range. It is more promising to rely on a provider from the top 5 group and also to consider other aspects. In particular, fees and their structure as well as the structure of the investor area on the website/app are important. If you don't get along with the provider, switching providers is easy. The new provider may even tempt you with a switching bonus. VisualVest* offers eg a 50 Euro voucher and a fee waiver for the first 4 months. The code for the voucher is Thank you very much.

How long have robo advisors been around?

The first providers such as Wealthfront and Betterment emerged in 2008 on the east (Betterment) and west coast (Wealthfront) of the USA. Since then the scene has been booming. Statista expects the investment volume to triple in the next three years. However, the currently managed assets are still small compared to the total fund assets. However, this is not an additional risk for investors since the robo advisors invest in large funds. Robo advisors have been around in Germany since 2013. Quirion* was one of the first and celebrates its 7th anniversary in 2020.

How many robo advisors are there in Germany in 2020?

In 2020 there are about 30 robo advisors in Germany. Providers can be actively or passively selected based on the investment strategy (What is that?) differentiate. Providers who pursue a passive investment strategy are e.g Quirion*, Growney* or world invest. Active providers are for example Robin*, Liquid* or VisualVest*. Some of these providers are independent like Scalable, white box* and moneyfarm*. Other robos have been developed by banks. Robin* has been developed by Deutsche Bank, Cominvest by Comdirect or the Quirinbank with the digital investment Quirion*.

Forecast on the subject of digital investment by a "robo

My forecast is that digital investments will benefit from further economies of scale over the next few years due to the imminent strong increase in fixed assets. This will further reduce fees in the long term. Currently there Quirion* sets the pace in terms of price and has completely abolished the robo advisor fees of up to 10,000 euros. A few years will show how many providers will survive the price war. In any case, investors are currently being ensnared by robo advisors. For example, offers VisualVest*, a 50 Euro voucher and a fee waiver for the first 4 months. The code is Thank you very much.

_____

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you.