I've been following this regularly lately Corona dashboard of Hopkins University. The creators have recently revised the presentation here and you can now easily follow the progress of the Coronvirus in all sorts of countries. While some countries such as South Korea and Germany appear to be on the right track, others such as the US and Brazil may have the worst yet to come. After all, the number of daily new infections over the past weekend has remained constant for the time being. Nevertheless, after more than 40 % slumps in the Dax from 13,795 points to 8255 points, we in Germany have now clearly slipped into a review. This is not a nice experience for any of us, and since we want to get out of this situation as soon as possible and get back to work as normal, I've pulled together some data showing how long bear markets have lasted in the past.

Now that we know which passive income streams are the best, how to be sovereign in a crisis stays and which ones Benefits that can be drawn from the corona crisis – next is what duration bear markets have had in the past. So you know what to expect.

The good first: The duration of bear markets was a manageable year and a half. Often it was only a few months.

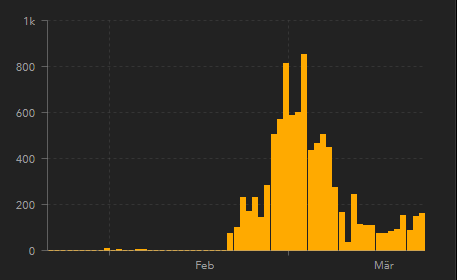

Daily new corona infections worldwide. Source: Hopkins University

First step done? ⇾ Plateau in new infections

What you can learn here

The data is still relatively fresh, but last weekend we managed to ensure that new infections with the corona virus remained constant worldwide. This corresponds to a growth rate of 1.0. This is an important step because even if the number of newly infected people continues to rise sharply, the data suggests that the exponential growth seems to have been broken. That cannot be said for sure at the moment, since two days of plateau are not enough for that. The plateau could also be explained by the fact that fewer people go to the doctor at the weekend and get a diagnosis. But one thing is clear: for the first time since the beginning of the global pandemic, the trend is developing in a more positive direction.

>> You can read here which details you as an investor should know in the corona crisis. <<

The duration of bear markets is 18 months - a bull market lasts 5.5 times as long!

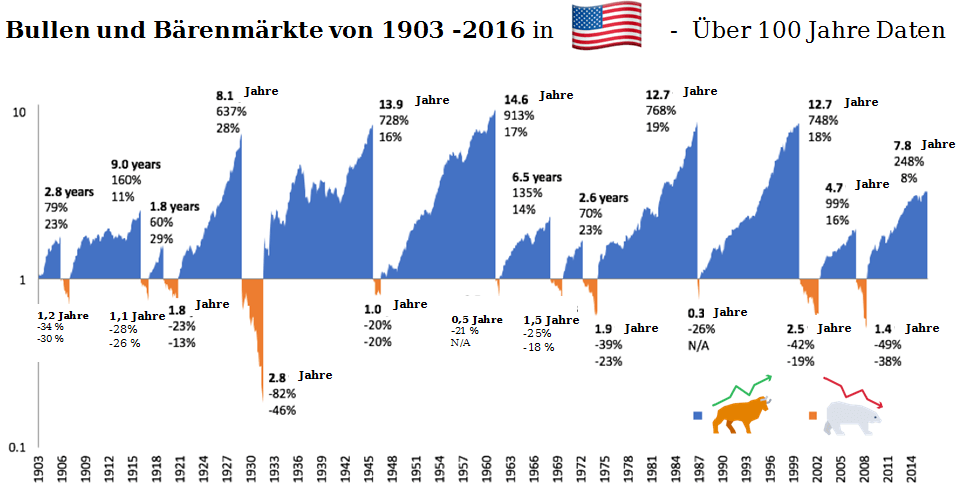

A reaction with panic and fear would be just as negligent in the current situation as indifference. So let's stick to the facts. Let's look at the US heavyweight - the S&P 500: The shortest bear market in the more than 100-year history lasted a little longer than three months. That was the crisis in 1987. Long crises were the world economic crisis in 1929 with 2.8 years and the bursting of the dot-com bubble in 2000 with 2.5 years. In the following representation of J.Sibers shows the bull and bear markets of the world's oldest stock market - the USA.

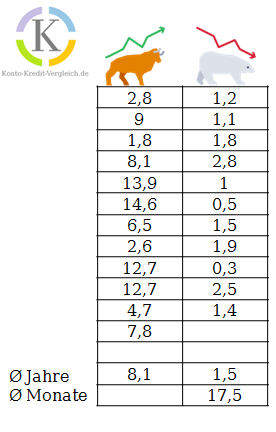

It's easy to see that historically, bull markets have always lasted significantly longer than bear markets. Since it might be interesting for you how long the bull and bear markets lasted on average, I have created a small table. This allows you to make an assessment of what you have to prepare for in the 2020 corona crisis.

#Over 100 years of data

The table shows that bear markets lasted about a year and a half, or 17.5 months, on a long-term average. In contrast, the bull markets ran for an average of 8.1 years. That's 5.5 times longer!

For those who if the cannons thunder want to buy cheaply, it's good to keep that in mind.

Stock market downturns in the US lasted about a year and a half. Sometimes it was only a few months.

We can derive this from over 100 years of historical data

The new bull market and the derivative

There will be a new bull market (). There is no doubt about it. My forecast is that this will start when the situation has stabilized somewhat. In any case, it will be before everything is in the towel and it is absolutely crystal clear that the situation is now easing. This is due to the fact that the markets always price in hopes and fears. In a way, stock markets behave like the first or second derivative of a function. As soon as a trend reversal in the situation is foreseeable, investors have hope or fear. This causes the markets to swing even before the situation has arisen.

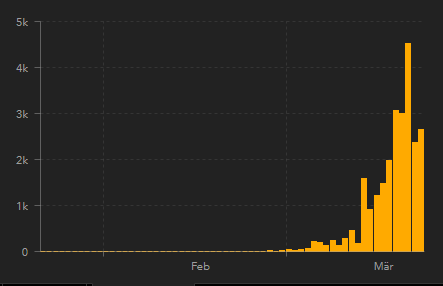

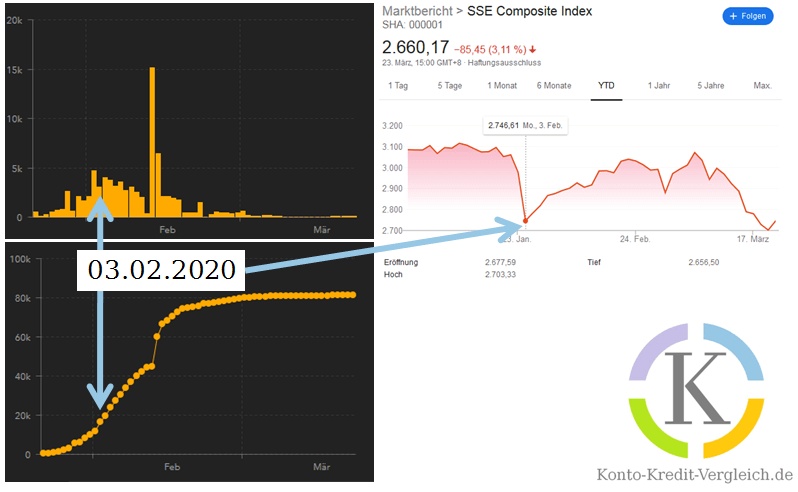

The Chinese market, represented by the Shanghai Composite (SSE), stopped falling as new coronavirus infections were just beginning to decline. At the time, it was by no means foreseeable with certainty whether they would decline permanently or rise again shortly thereafter. At that time, the cumulative number of cases was just beginning and numerous people were still infected with COVID-19. However, the lockdown was already having an effect and investors had hope that the situation would soon return to normal.

The following picture depicts the correlation: The stock markets were already beginning to recover when new infections fell minimally. The situation was by no means under control at that time.

Duration of Bear Markets: The Good News

Since the number of infections seems to have reached a plateau for the time being, it could be a short time before the stock markets recover. Finally we saw that it was similar in China! In the short term, however, high volatility is to be expected due to the panic situation. Another piece of good news from the past is that the sharper the slump, the faster the stock market recovery tended to be. And the setback in 2020 by more than a third has already washed itself out! In China, the virus spread was under control after three months. On 03/23 the Chinese government is easing curfews again.

Therefore, this crisis offers a mega opportunity and numerous advantages – not only financially. The prerequisites are staying power and being able to keep your feet still.

one further amendment

With this article I assume that Blog parade by Jürgen from the ETF blog on the topic "Private Wealth Creation in Corona Times". Articles by other authors can be found in the link on Jürgen's ETF blog.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.

Icons made by mynamepong from www.flaticon.com

1 thought on “Die Dauer von Bärenmärkten”