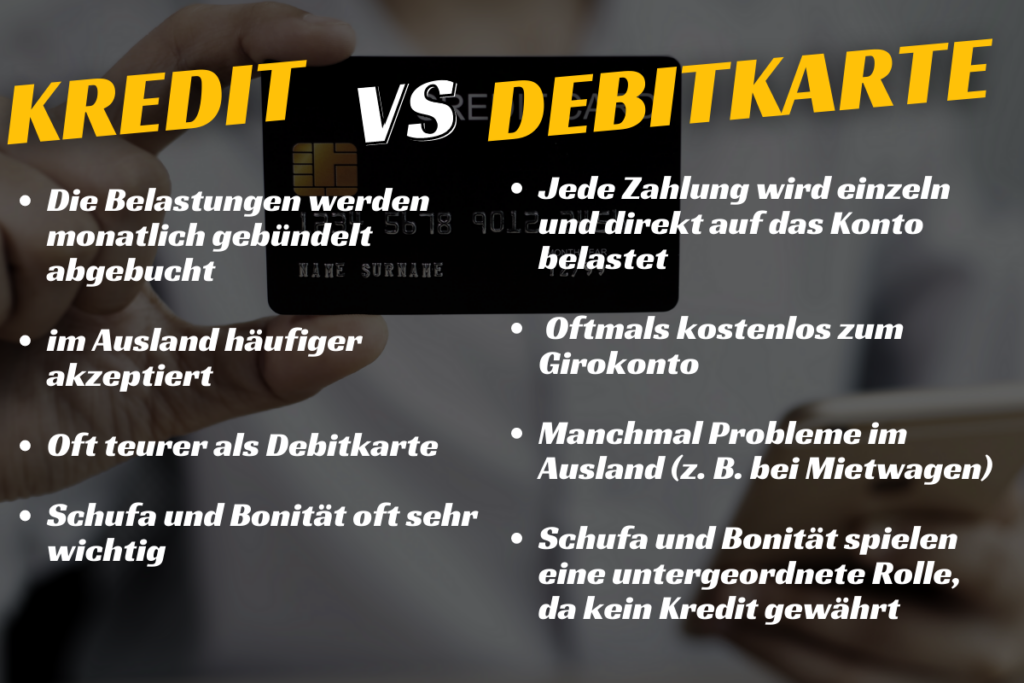

Debit vs credit card: With a debit card, a payment results in a direct charge to the account. With a credit card, on the other hand, the charges are not debited individually but in bundles on a monthly basis.

Credit and debit cards are an essential part of our lives today. We rely on them to make purchases online, in stores or over the phone - in short, for almost every conceivable transaction we can use a card. But not everyone is familiar with the differences between these two types of cards and their respective advantages and disadvantages. If you've always wanted to know how credit or debit cards work, or what the advantages and disadvantages of the two types of cards are, this article on debit vs credit card is for you.

Debit vs credit card briefly explained

What you can learn here

- Debit vs credit card briefly explained

- Debit vs credit card: how do you know which card you have?

- Debit vs credit card: advantages of credit cards

- Debit vs Credit Card: Disadvantages of credit cards

- Debit vs credit card: advantages of debit cards

- Debit vs Credit Card: Disadvantages of debit cards

- Recommendation: Bank Norwegian*

With a debit card, a payment results in a direct debit to the account. With a credit card, on the other hand, the charges are not debited individually, but in bundles on a monthly basis. In general, credit cards are accepted more often abroad than debit cards. However, credit cards are often more expensive than debit cards, which are often free to use. checking account issued. For credit cards you often have to pay a little extra.

Debit vs credit card: how do you know which card you have?

| Differences in | Credit card | Debit card |

|---|---|---|

| Debit | Collective debit of all sales of a month at the end of the month | Debit takes place individually and a few days after use |

| Deposit | The credit card can be pre-charged to make a deposit for rental cars | Deposits cannot be pre-loaded on the card. This can lead to problems with rental cars abroad. |

| fees | Only some Credit cards are free of charge | often free of charge to Girokonto |

| Overdraft | The card can be used up to the card limit. | The card can be used up to the Girokonto's overdraft limit. |

| Schufa | Always with Schufa query | Without Schufa query if no dispo is requested |

| Appearance | Often higher quality appearance with imprint "Credit". | Simple visual design appearance with imprint "Debit". |

Although the plastic cards look amazingly similar at first glance, there are some significant differences between credit and debit cards.

Of course, on both cards are the 16 digit card numberthe validity period and the name of the cardholder. But already the check digit and the signature field are not present on all cards.

The decisive clue, however, is the inconspicuous imprint "Debit" or "Creditwhich can be found on the front or back of the card, depending on the credit institution. This small feature makes it possible to identify the type of card very easily. So you know exactly what you have in your wallet or the Credit card cases has stuck.

Debit vs credit card: advantages of credit cards

Credit cards are a convenient and secure option to pay cashless. They offer many advantages that are worth considering. Credit cards make it possible to make purchases worldwide without cash.

With a credit card you can also pay abroad and does not have to exchange cash. This is especially convenient for vacationers and business travelers.

Credit cards also offer the advantage of Short-term credit. If you can't pay a bill right away, a credit card can help. One gets a certain period of time to complete the payment.

It's also much easier to monitor what you spend and where you spend your money with a credit card. Many cards offer detailed reports on all transactions, making it easier to track and manage your spending habits.

Debit vs Credit Card: Disadvantages of credit cards

There are also some disadvantages that should be considered. One of the biggest disadvantages is that credit cards have a Enable high indebtedness. If you are not careful with the card, it can easily happen that you spend more money than you have.

Interest rates on credit card debt tend to be higher than other types of debt, which means it becomes more difficult to repay. In addition, it can be difficult to keep track of your spending and avoid going overdrawn on your card.

Another disadvantage of credit cards is the fact that they are often fees charge. These fees can apply to any type of transaction and vary depending on the provider. Some providers also charge annual fees or fees for withdrawing cash from ATMs. It is therefore always worthwhile, different offers to compare and find out what fees may apply.

In addition, with credit cards there is always the possibility of misuse or theft. Therefore, it is important to protect your card carefully and to have all the necessary Security measures to take.

Debit vs credit card: advantages of debit cards

Debit cards also include classic bank cards, which you usually get free of charge with your account. They are easy to obtain and enable cashless payments. With a debit card, you can pay both domestically and abroad. When paying, the Amount deducted directly from the account.

One advantage of the debit card is that it is often included in a flat-rate package for the checking account is included and does not require any annual fees. Some banks also offer additional functions such as the purchase of goods or services online or by telephone.

In addition, with a debit card you can Withdraw cash from ATM and transfer money without paying any fees. This way you can manage your money more efficiently and save time and effort when paying bills.

Debit vs Credit Card: Disadvantages of debit cards

Debit cards have many advantages, but there are also a few disadvantages to consider. One of the disadvantages is that you can only use the Spend money that is available on the account. For example, if you use the Account limit reached you cannot make any further expenditures with the debit card. As a result, there is a certain risk that you will no longer be able to make necessary expenditures.

Some banks charge fees for money transfers or debit card payments. That is why you should use the Banks conditions as well as compare the payment methods offered before opening your account.

Although debit cards also have drawbacks, for many people in Germany they are the first choicewhen it comes to cashless payment.

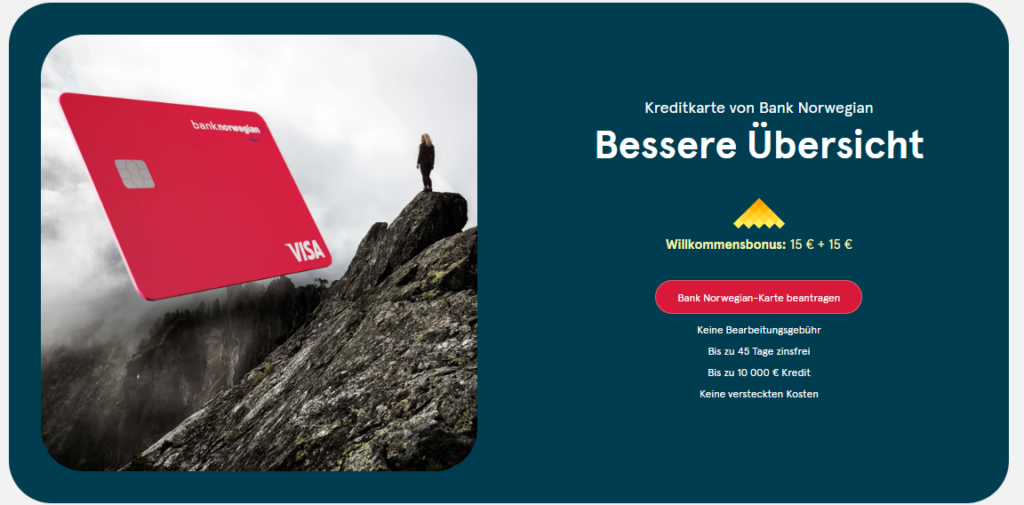

Recommendation: Bank Norwegian*

Bank Norwegian offers in Germany a free credit card which at first glance sounds too good to be true. But a closer look reveals that the card actually offers numerous advantages. For example, it does not charge any foreign currency fees and allows fee-free cash withdrawals at home and abroad. In addition, travel insurance is also included in the service package. But what's the catch? By default, you have to pay the bill for the card by the first of the following month. You will receive the bill on the 15th of the previous month, so you have about 2 weeks to pay. In order not to forget any bill, you should switch the card to automatic direct debit.

advantages

- Free credit cardThere is no basic fee. If you do not use the card, it remains free of charge. The application is also free of charge.

- Up to 45 days interest free

- Up to 10 000 € credit

- Award possible with poor credit rating

- 30 € bonus: When you sign up for the Bank Norwegian credit card, you will receive a total bonus of 30€. You will receive the first €15 directly when you sign up and the other €15 when you either make your first deposit or pay your first bill.

- Direct debit possible: Unlike other credit cards, Bank Norwegian now offers direct debit. You have to register for this after applying for the card.

- Comprehensive travel insurance: travel cancellation insurance (incl. interruption), travel health insurance, travel delay insurance, travel liability insurance, travel accident insurance and luggage insurance. The sums insured are also quite high, for example, per person can be up to 3,350€ and a total of maximum 6.700€ per trip are covered in the event of travel cancellation. In addition, not only the cardholder but also the immediate family (partner, children under 21) and up to three travel companions who are on a joint trip are also insured.

- No Girokonto change necessaryYou can use the card with any Girokonto. There is no need to move the account.

- Worldwide free cash withdrawals at Visa ATMs

- Intuitive App: Bank Norwegian offers an easy-to-use app for Android and iOS that allows you to manage your credit card.

- Wish pin: It is possible to set a desired PIN and use the credit card even at offline terminals.

- The credit card supports Apple Pay, Google Pay, Garmin Pay, and even Fitbit Pay.

Disadvantages

- High interestDue to the high double-digit interest rates, it quickly becomes expensive if you don't pay your bill on time. However, with an automatic direct debit, the interest can be avoided completely.

- Schufa: A Schufa query will occur, which may affect your score.

- 500 €/ 1,000 € withdrawal limit: Bank Norwegian allows fee-free cash withdrawals both domestically and abroad, but with certain limits. Within 24 hours, customers can withdraw up to €500 domestically and €1,000 abroad. Per week, the maximum is €1,500 domestically and €3,000 abroad.

- Cash at the counter expensive: Cash withdrawals at the counter incur high debit interest from the first day. It is therefore advisable to withdraw cash from an ATM to avoid unnecessary costs.

- No charge: Bank Norwegian does not officially allow money to be loaded onto the card for a longer period of time. However, it works, and so far proves to be inconsequential.

- Insurance coverage only from 50 %: For coverage to apply, at least 50% of transportation or travel expenses must be paid with the credit card. Although the regulation is a good compromise (other card providers require 100 %), you should make sure to reach the 50% mark.

- No insurance coverage from the age of 75

- Deductible from 70€ in the event of a claim (except for flight and baggage delays and travel accident insurance)

- A travel warning issued by the German Foreign Office cancels the insurance coverage

- Bank Norwegian has its registered office outside the European Union (in Norway)