Investors follow the news before a stock market crash with queasy stomachs. The question "When is the next stock market crash?" is in the air. Because nobody wants to see numerous leading indices collapse by more than 30 percent or more within a few days. In addition, stock market corrections are also becoming faster due to the faster flow of information. With a loss of 32 percent in just under three weeks, the Dax suffered in the corona crisis, for example the fastest slump of its existence.

Nevertheless - or precisely because of this - such a rapid stock market crash also offers many opportunities. With this correction, many top-tier companies became real bargainsn. 'Cause bear markets end when it can't get any worse or nobody expects it (No, nobody!). Therefore, here are some advantages of a stock market crash that should encourage you to persevere!

When is the next stock market crash?

What you can learn here

- When is the next stock market crash?

- The advantages of the stock market crash - Because the question "When is the next stock market crash?" is unanswerable

- Advantage #1: More humility

- Advantage #2: Time to invest the cash reserves in the market when the question "When is the next stock market crash?" is not only being discussed by crash prophets

- Advantage #3: Become more realistic

- Advantage #4: Due to the stock market crash, you can try to be less obsessed with money

- Advantage #5: There are not only discount battles on the stock exchange

- Advantage #6 no infrastructure overload

- Advantage #7: Interest rates will be further reduced - use the opportunity for refinancing

- Advantage #8: Fortunes adjust when the big boys get it wrong on the question, "When's the next stock market crash?"

- Conclusion: stock market crashes are a great opportunity - whether you have answered the question "When is the next stock market crash?" correctly or not

The question remains how the waiting investor can predict the stock market crash. Should we wait for the stock market crash? How do you recognize him? And especially, when is the next stock market crash?

When is the next stock market crash?

The most important finding in the stock market crash: Nobody knows when the next stock market crash will come. Maybe it will crack tomorrow, early or in 5 or 15 years. Nevertheless, these forecasts steer you through seeded long-term investing doubt away. Therefore, forecasts about the question of when the crash will come counterproductive.

When the next stock market crash doesn't really matter

In addition, it also makes no sense to wait until after the next slump before investing in the financial markets. Because the probability in which waiting to miss big wins, is way too big.

Still benefit

But how do you survive a crash without severe financial injuries? The most important quality is perseverance, which should be appealed to with the advantages described above! Investing for ten years or more greatly reduces the risk of real losses. For example, the S&P500 has returned more than NINE OUT OF TEN ten-year periods since 1928.

But also one Stock Savings Plan helps. If you invest a certain amount in the stock market every month, you will never get in near the high point. Therefore, possible losses in a crash do not fully affect that Brokerage account through.

What also helps is diversification. Because only those who diversify massively reduce the risks. In addition, you do not have to forego returns through diversification. Thanks to the easy availability of ETFs on major stock indices, very well diversified portfolios can also be created with smaller assets.

The advantages of the stock market crash - Because the question "When is the next stock market crash?" is unanswerable

Advantage #1: More humility

Losing money humiliates us all quickly. Capital gains are fleeting and we should learn to deal with them. The crisis offers us the chance to practice more humility. We can learn to be thankful for the things we have and learn to appreciate them more. Responding humbly to defeat shows that you won't let yourself down.

Advantage #2: Time to invest the cash reserves in the market when the question "When is the next stock market crash?" is not only being discussed by crash prophets

A stock market correction makes it easier for you to invest your money in stocks. Especially for long-term oriented investors who are still at the beginning of building up a portfolio, a serious crisis can be a good opportunity to further increase the portfolio at a reasonable price.

When shares in quality companies correct significantly above their fair value, good opportunities often arise! In the long run, it pays off to buy something cheaper now. It is advisable to shoot your powder step by step and not to rush into anything. After all, nobody knows how long the corona crisis will last.

So it would be a mistake to stay away from the stock markets now. It would also be a mistake to make overzealous hamster purchases. Be careful and critical!

Advantage #3: Become more realistic

When everything is going well, we tend to forget our risk tolerance. Investors regularly estimate their risk tolerance to be higher than it actually is (source: Handelsblatt). Then, when the market corrects, we only realize how painful the loss feels.

We also tend to pay more attention to our money when times are tough. Our attention to money is often driven by fear because we fear losing everything.

By aligning our investments with our risk tolerance and financial goals, we can better achieve our goals. The pain forces us to be more realistic about our true risk tolerance.

Advantage #4: Due to the stock market crash, you can try to be less obsessed with money

Losing a large amount of money tends to make people value more of the things that money has previously neglected them to do. If it feels pointless to get up in the morning and go to work for money, you may learn to value your partner, friends, family or relatives more again. Losing something important makes you cling more to things you still have. The effect is intensified by the spread of the corona epidemic and the media coverage. We all want to know that our loved ones are okay. That's why we call you more often and get in closer and closer contact with you more automatically.

Advantage #5: There are not only discount battles on the stock exchange

If the stock markets collapse, sooner or later the consequences will also be visible in the consumer world. Discounts you for the Buying a new car get, gain. Flight and train tickets are also becoming cheaper. If the crisis persists, influences on the real estate market are also conceivable. People who feel poorer simply spend less. If you are financially secure, you can use these discounts to your advantage.

Advantage #6 no infrastructure overload

Many areas of the German infrastructure are overloaded. Traffic jams on freeways, unrenovated bridges, sluggish broadband expansion. A crisis offers the state an opportunity to repair the infrastructure. On the one hand, this can secure employment and, on the other hand, the population will have an improved infrastructure at their disposal once the economy has recovered. A win-win situation.

Advantage #7: Interest rates will be further reduced - use the opportunity for refinancing

The central banks are also looking at the economic development in the times of the crash with increasing concern. As markets endured their worst trading week in years in late February 2020, the Fed began "printing" money on a massive scale to prop up the economy. Germany also promised the economy comprehensive help at the time. So there were short-term KfW loans without limits.

Advantage #8: Fortunes adjust when the big boys get it wrong on the question, "When's the next stock market crash?"

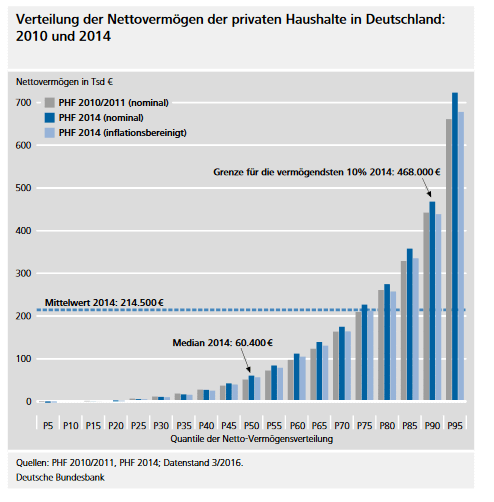

As in all other industrialized countries, German wealth is very unequally distributed. While the wealthiest top 10 % households have net assets of around half a million euros, the poorest 10 % households have no assets at all. Since wealthy households in particular own securities, the correction will lead to a narrowing of the wealth gap. As a result, the poorer ones do not receive more money, but the distribution is somewhat more even.

Conclusion: stock market crashes are a great opportunity - whether you have answered the question "When is the next stock market crash?" correctly or not

Perhaps the greatest benefit of a stock market crash is that the overheated stock market of recent years has an opportunity to cool down and companies are once again trading at their long-term average P/E ratios. This is a great opportunity for long-term investors, as they can now buy their favorite companies at 30 percent or more off. But to do this you have to take a risk and buy.

If you're afraid to take advantage of stock market crashes, you can outsource decisions to a robo-advisor. You can find the best robo advisors in a guide article on Robo advisor comparison.

Finally, the most important thing: Nobody knows when the next stock market crash will come. Maybe it will crack tomorrow, early or in 5 or 15 years. Just keep at it, then it fits - crash or not!

3 thoughts on “Wann kommt der nächste Börsencrash? – Vorteile der Dezimierung”