If you have one negative Schufa entry it is not easy to get a loan for a car - most car dealers as well as banks often refuse customers with negative Schufa listing. However, even in difficult cases there are ways and possibilities to buy a car on installments without a bank despite negative Schufa.

If you're wondering "where can I buy a car with negative Schufa?" the dealerships are your dream car, Auto Scheldt, Auto Center Rheydt, H+P Car Rental, Auto Center Hessen, Honda Hettstedt and Autohaus Süd (Austria) to name. At these dealerships you can buy a car with negative Schufa on installments. Often, older vehicles from the dealership's own inventory are offered for sale. Legally, all providers are installment plan, which is why the car can be confiscated again if there is a delay in installment payments. Often, therefore, a Car loan without Schufa the better alternative.

What you can learn here

- Option 1: Buy car at the dealership on installments despite negative Schufa.

- Option 2: Buy car in installments despite negative Schufa via a loan.

- 7 car dealerships where you can buy a car on installments despite negative Schufa

- 1st Lower Saxony: Your dream car

- 2. north Rhine Westphalia: Auto Scheldt - Car dealer without Schufa financing from NRW.

- 3rd North Rhine-Westphalia: Eurocar MG/ Autocentrum Rheydt - Car dealer without Schufa financing from NRW.

- 4th Saxony: H+P Car Hire

- 5th Hesse: Auto Center Hessen in Frankfurt

- 6th Saxony-Anhalt: Honda Hettstedt

- 7th Austria: Autohaus Süd in Linz

- Buy a car on installments despite negative Schufa: Prefer cheap used cars

- Buy a car in installments without a down payment and Schufa

- Buy a car on installments without an employment contract

- Buy a car on installments without a bank

- Buy a car privately on installments

- Installment purchase through a car dealership has two major disadvantages

- Alternative: Loans despite negative credit bureau from banks and credit intermediaries

- Conclusion: Buy a car on installments despite negative credit bureau

Option 1: car at the car dealership buy on installments despite negative credit bureau

| Offerer | Where to buy a car in installments despite negative Schufa |

|---|---|

| Honda Hettstedt | Yes |

| your dream car | Yes |

| Auto Scheldt | Yes |

| H+P car rental | Yes, but rates higher than €500 must be affordable |

| Auto Center Rheydt | Yes, as long as you have at least 1 year of employment with 750 € net. |

| Hesse Auto Center | Yes |

| Car Dealership South (Amax Motors) | Yes |

When searching for car dealerships that despite negative Schufa entries. Grant credits noticed that there are two different types of car dealer financing gives. The most common are car dealerships that work with banks to finance their customers' cars. Here, the car dealership only mediates the customer to the bank. The bank is solely responsible for checking and approving the loan. It is therefore often difficult to get an installment purchase approved with this model despite negative credit bureau. Because a negative Schufa entry is a direct exclusion criterion for many banks. However, we were also able to find some car dealerships that provide the loan for the car themselves. This allows these car dealerships to grant loans based on more flexible criteria. People with negative Schufa entries have a realistic chance of getting a loan from these houses.

Duration

The installment purchase through the car dealership is a financing with 12 to 36 months Term. The car dealerships mentioned in the linked article finance the vehicles themselves. In doing so, they apply different criteria than the ubiquitous Schufa information for bank loans. The car is purchased directly from the dealership with an installment purchase without a bank. A down payment of 25 % is usual, which corresponds to 500 € or more depending upon vehicle price. The concept is therefore quite close to the installment purchase of the car despite negative Schufa.

It does not work without a deposit

What the car dealerships generally refused to do was buy the car on installments without deposit and Schufa. To protect yourself, all car dealerships required a deposit of 15 % or more necessary. On the other hand, some car dealerships did not see a problem if customers did not have a permanent job. Instead, the car dealers even advertise that you can buy the car in installments without an employment contract. Because even without an employment contract, buying a car on installments is possible, provided it is a cheaper used car. An alternative to buying a car on installments despite negative credit bureau is the Car loan without Schufa This includes banks from Germany and abroad. especially the Sigma Bench* from Liechtenstein is known for credit bureau-free loans. In many cases, credit intermediaries like bon credit*, but find better deals than the expensive non-Schufa loan from Sigma Bank.

Only for customers from the surrounding area

The disadvantage of financing from a car dealership is that car dealerships only grant loans to customers from the surrounding area. In NRW we found 2 car dealerships without a Schufa query, but none in Bavaria or Rhineland-Palatinate. It is therefore not possible for many interested parties to buy a car in installments despite a negative credit bureau at the car dealership because of their place of residence.

Option 2: car over despite negative credit bureau a loan buy on installments

|

An alternative to finance a car with a negative credit bureau is a Car loan without Schufa. Special banks and credit intermediaries are requested for financing. These banks also give one Credit despite negative credit bureau entries, which is why the financing of your car is often also in very difficult cases still succeeds. If you are interested in a Car loan despite negative credit bureau from bon credit* or a comparable provider decides, you are not tied to a specific car dealership. Because as soon as the loan is in your account, you can choose your dream car. If your credit rating is at least mediocre, you can get a cheaper loan Smava* under consideration.

Other alternatives to the Used car financing despite negative credit bureau can be found in the linked article. There you will also find out how you can still finance a used car despite the rejection of the loan.

Car dealership and car loan - 2 options to buy a car in installments despite negative credit bureau in comparison

Directly at the dealership: Buy a car on installments despite negative credit bureau

- If the car dealership passes on the loan to the bank, a good credit rating is required

- German banks must check creditworthiness (legal requirement e.g. §505a BGB)

- Therefore, no award with negative Credit bureau possible

- A Buying a car in installments despite a negative credit bureau is only possible with certain car dealerships who provide the financing themselves

- Locally limited. Only available in some German regions (e.g. NRW)

- You are tied to the car dealership and have to buy a vehicle there that may be a little more expensive

- You must pay a deposit of at least 15-20 %

Few car dealerships offer car purchase on installments despite negative Schufa. There is no car dealership where you can buy a car on installments without a down payment and Schufa. At least a down payment of 15 % is required. Often, a down payment of 50 % or more is required for an installment purchase without a bank.

Car loan without Schufa: Buy a car on installments despite negative credit bureau

- Banks and intermediaries like bon credit*, are specialized in lending with bad creditworthiness and negative credit bureau

- Lending possible even with bad credit bureau

- Available throughout Germany

- No commitment to special car dealerships

- Buying a car in installments without a down payment and Schufa: 100 % financing is possible

- Credit with negative credit bureau possible independently of the car dealership. In addition, you can use a car loan to buy the car in installments without a down payment and Schufa.

7 car dealerships where you can buy a car on installments despite negative Schufa

Almost all car dealerships in Germany do not grant the loan to their customers themselves. Instead, German car dealerships usually work with various banks and credit institutions. Accordingly, the car dealership has no influence on whether the loan is granted or not despite negative credit bureau. The decision about a loan is almost always made by the bank. Since almost all German banks in Germany have a Schufa connection, it is practically impossible to grant a loan with negative entries in the Schufa.

However there are also a few car dealerships in Germany that take care of the processing of the loan themselves. This is often a kind of hire purchase. The dealership keeps the registration document and a spare key for the car. The borrower pays off the car with a rent. However, if the tenant defaults on payment, the car dealership will collect the car again. If you are wondering where you can buy a car in installments despite negative credit bureau, the following list can probably help you.

You are looking for a car dealership where you Buy a car on installments despite negative credit bureau can? – The car dealerships your dream car in Niedersachsen, automobile scolded and the car center Rheydt in NRW, the H+P car rental in Saxony and Honda Hettstedt in Saxony-Anhalt a Installment purchase despite negative Schufa at. In particular, your dream car, Auto Scheldt and Autocentrum Rheydt only require small down payments of between €350 and €1,200. However, they are Interest rates and fees are often higher when buying in installments without a credit bureau than financing through one Car loan without Schufa. This is due to the stricter regulation of banks and credit intermediaries.

1. Lower Saxony: Your dream car

Your dream car is a car dealership based in Lower Saxony that finances cars despite negative credit bureau. The provider is aimed at people who need or want to finance a vehicle with poor creditworthiness. In addition to pensioners and the unemployed, this also includes business founders or people with exhausted credit limits. However, you should be sure that you can pay the monthly maintenance for the car. Because if there is a delay in the monthly payment, the dealership will have the car picked up within a week. With your dream car, 20 % of the purchase price are usually due as a deposit. But there is also the possibility to pay only 15 % if money is tight. The installment purchase despite negative credit bureau can be completed for a maximum of 24 months. For the installment purchase, the provider charges 10 % interest.

Serious impression, excellent customer feedback

The employees and the manager of the car dealership Your Dream Car from Lower Saxony always made a friendly and open-minded impression on the phone. The ratings of the car dealership on the relevant portals also speak for a reputable provider who finances vehicles with poor credit ratings. Your dream car received 4.8 out of a possible 5 stars at Autoscout24 and a recommendation rate of 98 %. As with all car dealerships Loans to low-income people such as Hartz IV recipients or min-jobbers, the prices of the vehicles are somewhat higher.

conditions Buy car on installments without bank: Your dream car

- Monthly rate: 100 to 300 €

- Duration: 24 Months

- down payment: 350 to 1,200 €

- Interest charges: 10 %

- Vendor Notes: The interest is slightly more expensive than financing via bon credit*, where 2 of 3 customers 8.29% pa eff. received (see provider page).

The exact conditions for buying a car from IhrTraumauto despite negative credit bureau rates depend on the model. However, the interest rates are fixed. You can find conditions on the provider's website.

address: Your dream car GmbH, Bundesstr. 2a, 30989 Gehrden OT Ditterke

2. North Rhine-Westphalia: Auto Scheldt - car dealer without Schufa financing from NRW

Auto Scheldt from Wuppertal has been selling cars for over 20 years. For people with a low credit rating, the car dealership offers financing despite negative credit bureau. As with the other providers, a down payment must first be made. The remaining amount will then be deducted. Only people residing in North Rhine-Westphalia are accepted. Auto-Scheldt is one of the best-known car dealers who offer financing without Schufa in NRW. The down payment is around 20 to 25 % of the vehicle price for hire purchase. The down payment is €500 to €700 for most cars. Most vehicles have a monthly rate of between €150 and €180 per month. The term is often between 12 and 24 months.

conditions Buy car on installments without bank: Car Scheldt

- Monthly rate: 150 to 180 €

- Duration: 12 to 24 months

- down payment: 500 to 700 €

- Interest charges: not known

- Vendor Notes: The exact conditions for buying a car from Auto Scheldt despite negative credit bureau rates depend on the model. For the available vehicle models, you can find more detailed information on the dealer's website.

address: Auto Scheldt GmbH, Bocksledde 34, 42283 Wuppertal

3. North Rhine-Westphalia: Eurocar MG/ Autocentrum Rheydt - car dealer without Schufa financing from NRW

The Autocentrum Rheydt in Mönchengladbach finances inexpensive cars even if they have a negative credit bureau or a poor credit rating. In addition to Auto Scheldt, Eurocar MG is the second car dealer to offer financing without Schufa financing in NRW. If you're wondering "Where can I buy a car with a negative Schufa?" and live near Mönchengladbach, you could find what you're looking for at the Autocentrum Rheydt. The dealership is willing to finance up to €4,000 of the purchase price. The dealership requires a 25 % deposit. The remaining price of the vehicle is financed by the dealership for a maximum of 12 months. For customers with a poor credit rating, the car dealership has older vehicles that are priced between 2,000 and 4,000 euros.

conditions Buy a car on installments without a bank: Eurocar MG/ Autocentrum Rheydt

- Monthly Rate: about 200 €

- Duration: 12 months

- down payment: 750 €

- Interest and Fees: The installment payment will be compensated with a fee of 300 €. With a loan amount of €3,000, this corresponds to over 30 % interest in 12 months.

- Vendor Notes: The interest is considerably more expensive than financing via bon credit*, where 2 of 3 customers 8.29% pa eff. received (see provider page).

The exact conditions for buying a car from Eurocar MG/ Autocentrum Rheydt despite negative credit bureau rates depend on the model. For the available vehicle models, you can find more detailed information on the dealer's website.

address: Autocentrum Rheydt, Dahlener Str. 308, 41239 Mönchengladbach

4. Saxony: H+P car rental

The provider H+P Autovermietung from Chemnitz also offers the car installment purchase of despite negative Schufa. In addition to cars, the program also includes vans. The car dealer finances despite negative Schufa especially vehicles of companies and self-employed. Also the strict requirements of the GDP guideline for vehicles of the pharmaceutical industry can be fulfilled. An installment purchase of the Cars without Schufa and down payment, on the other hand, is not possible. Because as a deposit is always due 20 % from the purchase price.

H+P car rental vehicles are compared to Auto Scheldt or Eurocar MG much more expensive and better quality. The term of the installment purchase is often 24 or 36 months. A deposit of between €3,000 and €8,000 or 20 % of the purchase price is due for the vehicles. This means that the prices are significantly higher than those offered by other providers. However, the cars are not comparable either. Depending on the model, the monthly installments bear interest of between 6.5 and 10 %. This results in monthly installments of 500 to 1000 € per month. This makes it clear that the dealer does not contact people with low income, as do the other providers in the list. Here would be one Loan for low income a better alternative.

H+P Car Rental is a premium provider from the Installment purchase despite Schufa Entry. The provider is not suitable for people with low income.

conditions Buy car on installments without bank: H+P car rental:

- Monthly rate: 500 to 1000 €

- Duration: 24 to 36 months

- down payment: 3,000 to 8,000 €

- Interest charges: Between 6.5 to 10 %

- Note to the seller: Interest is slightly more expensive than financing bon credit*, where 2 of 3 customers 8.29% pa eff. received (see provider page).

The exact conditions for buying a car from H+P despite negative credit bureau on installments depend on the model. You can find these on the provider's website.

addressH+P Autovermietung GmbH, Hainstraße 139, 09130 Chemnitz, Germany

5. Hesse: Auto Center Hessen in Frankfurt

Hessen Auto Center in Frankfurt is a large used car dealer in Frankfurt am Main. The car dealer has over 150 used cars in its inventory. In addition to traditional financing through a bank, the dealership also offers a car installment plan. With the installment plan you can Car on installments without bank buy directly from the dealership. The following conditions apply to the car installment purchase without bank at Autohaus Center Hessen:

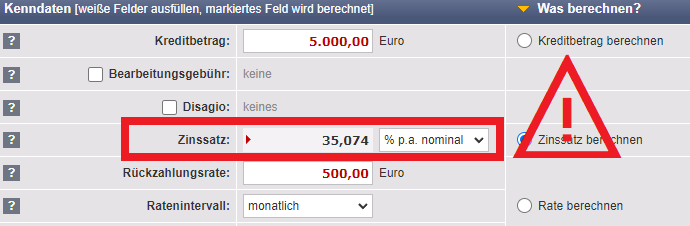

conditions Buy car on installments without bank: Auto Center Hesse

- Monthly rate: 200 to 500 €

- Duration: max. 12 months

- down payment: at least 1.600 € or 40 % of the purchase price.

- Interest charges: approx. 35 %

- Note to the seller: the Interest rates are significantly more expensive than financing via bon credit*, where 2 of 3 customers 8.29% pa eff. received (see provider page).

Interest rates would be calculated using a loan calculator based on information provided on the provider's website.

To buy a car on installments without a bank at Auto-Center Hessen is much more expensive than an alternative financing via bon credit*

| Audi example 3.500 Euro Fianncing; 12 months | |

|---|---|

| Cash price | 6.900 € |

| down payment | 3.500 € |

| Installment | 350 € |

| Number of rates | 12 |

| Total | 7.700 € |

| Example BMW 5.000 Euro Fianncing; 12 months | |

|---|---|

| Cash price | 9.900 € |

| down payment | 4.900 € |

| Installment | 500 € |

| Number of rates | 12 |

| Total | 10.900 € |

addressHessen Auto Center, Borsigallee 2, 60388 Frankfurt, Germany

6. Saxony-Anhalt: Honda Hettstedt

In Hettstedt, about 40 km north-west of Halle, the Honda Hettstedt car dealership offers hire purchase without Schufa. Interested parties will receive one Long-term lease with later purchase option. The replacement of the car from the long-term rental contract is possible, but not mandatory. If the circumstances change, the rental agreement can also be terminated with a notice period of 3 months. Honda Hettstedt is also aimed at the unemployed or people with poor credit ratings. However, the loan installments plus vehicle maintenance and fuel costs must be affordable from disposable income. The car dealership finances cars within a radius of 50 km from Hettstedt despite negative credit bureau. This also includes the cities of Magdeburg and Halle.

conditions: Honda Hettstedt

- Unfortunately, there are no conditions on the part of the provider published for hire purchase despite negative credit bureau.

address: Autocenter Hettstedt, Ritteröder Straße Gewerbering 2, 06333 Hettstedt

7. Austria: Car dealership south in Linz

Autohaus Süd is an Austrian car dealership in Linz which offers car purchase even with bad credit rating such as negative Schufa or KSV entries. However, the Linz car dealership offers no car installment purchase without bank an. The dealership simply says that they have experience with customers with poor credit ratings and can therefore arrange financing.

conditions Buy a car on installments without a bank: Car dealership south

- Unfortunately, there are no conditions on the part of the provider published for hire purchase despite negative credit bureau.

address: Autohaus Süd, Wiener Straße 459, 4030 Linz Austria

Buy a car on installments despite negative credit bureau: Prefer cheap used cars

If you want to buy a car in installments despite negative credit bureau, you should try to keep the further financial burden as small as possible. Therefore, it is advisable to refrain from new cars with high performance. These aggravate your financial situation considerably due to the high installment payments. It is better to focus your search on cheap and reliable used cars.

If you want to buy a car in installments despite negative credit bureau, small cars with a mileage of 50,000 to 100,000km and a vehicle age of three to eight years recommended.

In the post "Which car with 1000 euros net?" you'll find 11 affordable and reliable used cars that fit even a small budget. A cheap car insurance further lowers your monthly burden and you should be careful not to overpay. Thanks to my last insurance comparison, I save about 30 % of the cost of insurance - with the same insurance performance, mind you.

Buy a car in installments without a down payment and Schufa

We are not aware of any car dealership where you can buy a Car without Schufa can buy on installments and in addition does not require a down payment. Instead, all car dealers require a down payment of 20 % of the purchase price or more. For cheap used cars, the down payment is therefore less than 1,000 euros. If you can not or do not want to pay this money, there are the following alternatives to buy a car without a down payment and Schufa on installments:

- To avoid the down payment you can Car loan without Schufa and creditworthiness at Receipt credit* Requests. In many cases, voucher credit finances the full purchase price of the car. After you have received the credit from Bon-kredit on your account, you buy any car and start paying back the installments the following month.

- If you don't have the money for the down payment, you can Auto subscription despite negative credit bureau To fall back on. provider like Finn* already offer some cars in the subscription model for monthly installments under €300, despite negative credit bureau. All costs are already included in this and a deposit is not required.

- Another alternative is a Car leasing without Schufa to inquire. Here, often only a deposit of 10 % of the purchase price is due. However, prices start at the Leasing without Schufa often only at € 10,000. Thus, the down payment in buzzer is not less than the installment purchase without Schufa.

Buy a car on installments without an employment contract

Buying a car without an employment contract is at Honda Hettstedt, your dream car and probably also at Auto Scheldt possible. The dealers IhrTraumauto and Honda Hettstedt are even aimed directly at unemployment benefit I and II recipients and top-ups. At Auto Scheldt there is no such information on the website, but the low vehicle prices suggest that it should be possible to buy a car on installments without an employment contract.

the H+P car rental is also aimed at the self-employed, which is why, in a stricter sense, the car can also be bought in installments without an employment contract. However, it should be noted at H+P that the cheapest vehicles are only available from around €500 a month. Therefore, although no employment contract is required here, a corresponding income is required.

At the Auto Center Rheydt However, it is not possible to carry out an installment purchase without an employment contract. The provider requires "1-year permanent position or fixed-term contract for 1 year" and a net income of at least €750 per month.

| Buy a car on installments without an employment contract | |

|---|---|

| Honda Hettstedt | Yes |

| your dream car | Yes |

| Auto Scheldt | Yes |

| H+P car rental | Yes, but rates higher than €500 must be affordable |

| Auto Center Rheydt | No, at least 1 year's employment and €750 net required |

| Hesse Auto Center | No, permanent employment necessary |

| Car Dealership South (Amax Motors) | No, permanent employment necessary |

Buy a car on installments without an employment contract alternative

An alternative to buying a car without an employment contract is the Loan for low income, making you independent of the car dealer.

Buy a car on installments without a bank

Buying a car without a bank on installments is at Honda Hettstedt, your dream car, car scoldt, H+P car rental at the Auto Center Rheydt possible. Buying a car in installments without a bank makes sense with negative credit bureau entries and a poor credit rating. If you are concerned about your mobility, there are other options available to you to quickly become mobile again. Which includes Auto loans without Schufa from bon credit* with which you make yourself independent of the car dealer. These car loans will be paid out to your account before you buy the car, even if the credit bureau entries are negative.

You can then use it to buy any car you want. It would then even be possible to buy a car privately on installments, since the bank doesn't care whether you buy the car from a dealer or a private individual. Other alternatives for negative credit bureau and little money are Car subscriptions without Schufa or that Car leasing without Schufa. Especially at Finn* one has specialized in cheap subscription complete packages including maintenance and service and offers these from 300 € per month despite negative credit bureau. The service is therefore a real alternative for people with a bad credit bureau to buying in installments without a bank.

| Buy a car on installments without a bank | |

|---|---|

| Finn* – Auto subscription despite negative credit bureau already from 300 € monthly | Yes, but not a purchase |

| Honda Hettstedt | Yes |

| your dream car | Yes |

| Auto Scheldt | Yes |

| H+P car rental | Yes |

| Auto Center Rheydt | Yes |

| Car Center Hesse | Yes |

| Car Dealership South (Amax Motors) | Yes |

Buy a car privately on installments

Buying a car privately in installments is usually not possible in this way. Private individuals do not have the necessary knowledge or infrastructure to carry out an installment purchase. There can be exceptions if the buyer and seller have known each other personally for a long time, but there are also many pitfalls that can damage a relationship in the long term. Buying a car privately in installments is therefore actually only possible with a car loan. Many loan providers like bon credit* offer the Car loan without Schufa and creditworthiness at. Since the registration certificate part II (vehicle registration document) is not deposited with the bank, it is common for the loan to be paid out before the car is bought. This means that the money paid out can also be used to buy a car privately in installments.

Installment purchase through a car dealership has two major disadvantages

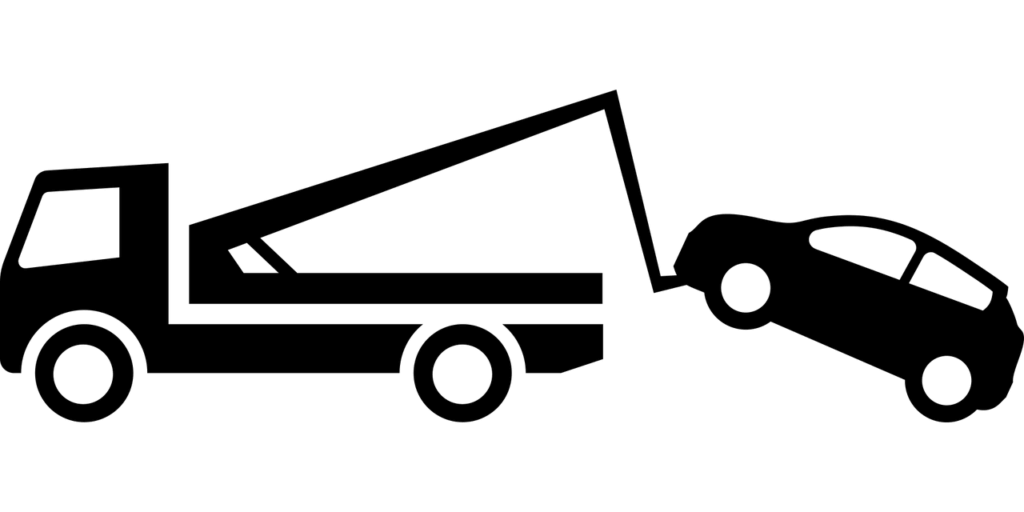

1. Disadvantage: Risk of collection of the car by debt collection

If the borrower defaults on an installment, car dealerships confiscate the car after a very short time. A debt collection agency picks up the car. The car dealerships can do that because legally it is only one long-term lease acts. That's how it is at the car dealership your dream car a maximum payment delay of only one week is granted. If you need longer to pay an installment, the dealership will have the car picked up with the second key. Also are all payments made so far are forfeited and there is no longer any claim to the car. If you want to finance your car through a car dealership despite negative credit bureau, you should never default on payment.

The dealership says:

If you are in arrears with an installment, we will give you a one-time opportunity to pay your installment within one week. If this does not happen, we will have the vehicle picked up by a collection agency. Your deposit and the installments paid up to that point have expired.

Car dealership Your dream car for dealing with the vehicle in the event of late payment

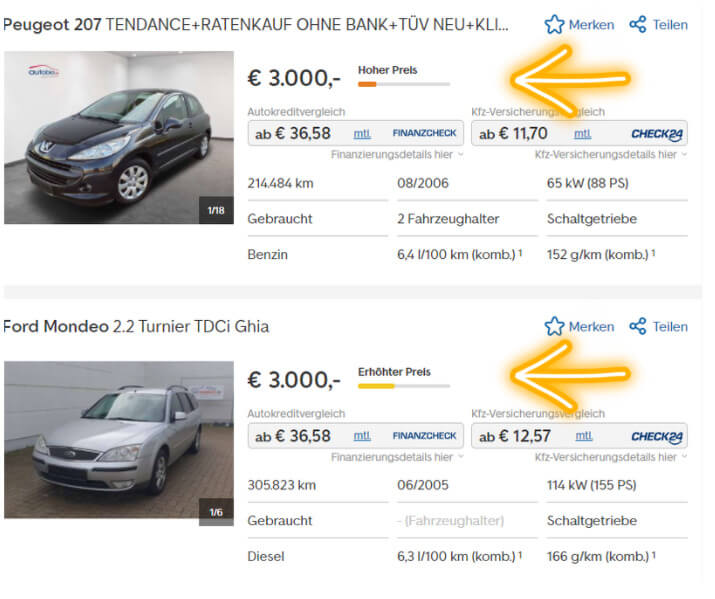

2. Disadvantage: High costs, little flexibility

Another disadvantage When financing through a car dealership lies in the very high costs and the inflexible modalities compared to one Car loan despite negative credit bureau. While the installment purchase is subject to interest rates of 10 percent and more from the car dealer despite negative Credit bureau, significantly lower interest rates of between 5 and 8 percent are often possible for loans even with negative Credit bureau. In addition, for cars that can be bought in installments despite negative credit bureau, the basic price is usually increased. This can be easily seen from the advertisements on the portals through the automatic price evaluation.

Due to the immediate collection of the car in the event of a slight delay in payment, car dealership financing is not recommended despite negative credit bureau. In addition, credit rates are well above those for conventional ones Loans despite negative credit bureau becomes due.

In the article "Which car bank finances despite negative Schufa?" we have noted that it is not easy to obtain a loan despite negative Schufa even from car banks. The only other options left are special banks and credit intermediaries to meet the credit needs.

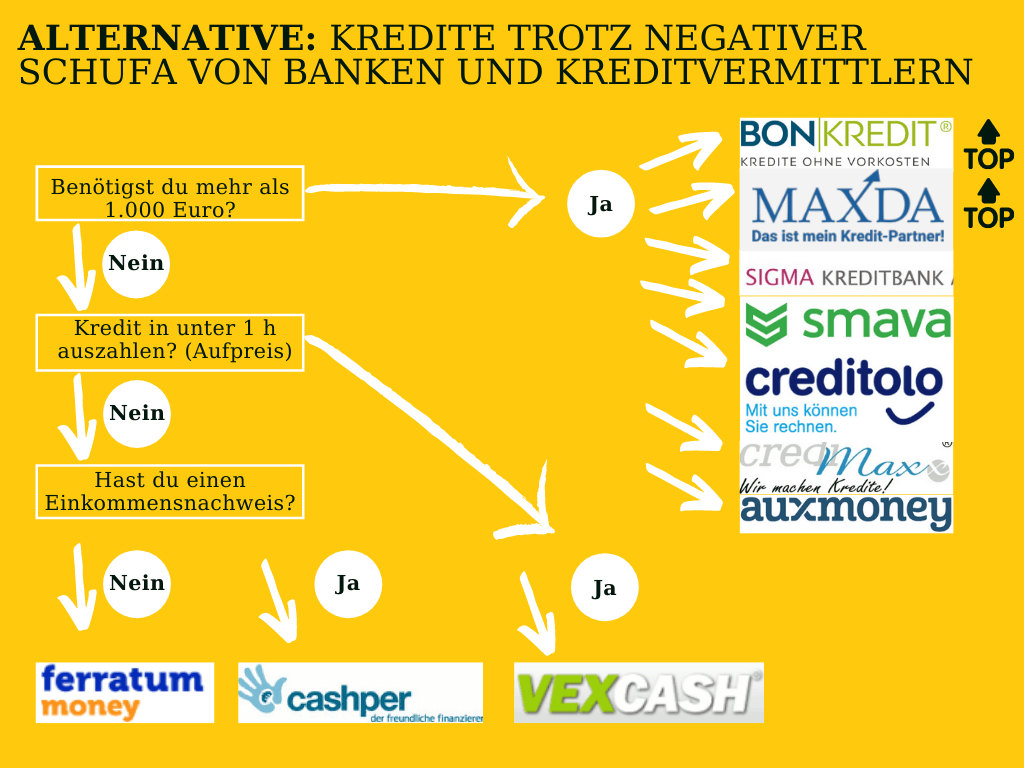

Alternative: Loans despite negative credit bureau from banks and credit intermediaries

provider like bon credit,* Maxda,* or the Sigma bank* can get a car financing even with a negative credit bureau and in difficult cases - such as when receiving sick pay - enable. This makes them a good alternative if you need answers to questions like "Which car dealership finances despite negative credit bureau?" or "Where can I buy a car with a negative credit bureau?“ urgently needed. Because you are not tied to the car dealership when it comes to loans. In addition, the credit without collateral such as vehicle registration document or registration certificate part II can be paid out. Therefore, you can first get the loan on your account and then buy your dream car from a private person, dealer or manufacturer. So you are much more flexible than with financing directly through the car dealership, since only the in-house cars are financed there, which may not always be the best offer.

But also the provider Smava* Loans with mediocre creditworthiness can still arrange a loan despite negative credit bureau. In addition, Smava only requires a minimum income of €600.

When it comes to amounts below €1000 suitable are also the providers Vexcash*, ferratum* and cashper* recommended in difficult cases. In many difficult cases, these mini loan providers approve the loan – even with negative credit bureau entries. Vexcash offers instant payouts in under an hour. At Ferratum, lending is also possible without proof of income.

More choice, cheaper prices

The advantage of financing through banks and credit brokers is that you are much freer in your choice of car. After all, you are not tied to the few car dealers with private financing, but can decide freely. This often gives you a lower price for your dream car. Therefore ask Loans despite negative credit bureau from banks and credit intermediaries a good alternative to car dealers with private financing.

If you have more than 1000 euros credit come the providers bon credit*, Maxda*, Sigma credit bank, Smava*, Creditolo*, credimaxx* or Auxiliary* in question. If you need less than 1000 euros, mini loans are available from ferratum, cashper or Vexcash recommended in difficult credit cases. there is Vexcash*the fastest mini loan provider and pays out the loan to your account in less than an hour for an additional charge. ferratum* however, does not require proof of income and cashper* makes the money available free of charge for loans under €600, even in difficult cases.

Conclusion: Buy a car on installments despite negative credit bureau

In this article we have presented 7 car dealers who offer installment purchase despite negative Schufa and with poor credit rating. Here are directed Honda Hettstedt, Your Dream Car, Auto Scheld and Autocentrum Rheydt to people with bad credit bureau and low income. The provider H+P is pursuing a slightly different strategy: With its vehicles, it is aimed more at self-employed people who have a good income, but who still do not get a loan from the banks because of their self-employment.

Monthly rates and terms

The prices of the vehicles at the more expensive H+P car rental company start at around €500 monthly rate or €15,000 purchase price. On the other hand, the other car dealerships prefer to offer cheap vehicles under €5,000. The monthly rate is in the range of €200. The term of the installment purchase is in the range of 12 to 24 months at Honda Hettstedt, IhrTraumauto, Auto Scheld and the Autocentrum Rheydt. Due to the higher-priced cars, slightly longer terms of 24 to 36 months are usual at H + P.

Alternatives to hire purchase despite negative credit bureau at the retailer

A disadvantage of buying in installments through a car dealer is the very high cost and the inflexible modalities compared to one Car loan despite negative credit bureau. After all, a purchase from another dealer is not possible. While installment purchases are subject to interest rates of 10 percent and more from the car dealer despite negative credit bureau, loans are often clear even with negative credit bureau cheaper interest ratee between 5 and 8 percent is possible.

In addition, for cars that can be purchased on installments despite negative Schufa, the base price is usually also increased. This is easily visible in the advertisements on the portals through the automatic price evaluation. It is therefore advisable when buying in installments despite negative Schufa about alternatives such as a Car loan despite negative credit bureau from bon credit* or an all around carefree Auto subscription despite negative credit bureau from Finn* to think.

But even if you have a Bicycle despite negative Schufa on installments you can benefit from the cash discount if you finance the bike yourself through a loan and pay the dealer in one go.

Cover photo: Tow truck: cdz on Pixabay. Icons made by photo3idea_studio & Freepik from www.flaticon.com.

*Affiliate link: If you use one of these links to go from my website to a provider, I may receive a commission. There are no additional costs for you. For using these links a ❤️ THANK YOU! ❤️

Disclaimer: This is well researched but non-binding information.