In the study a Apply for a student loan? - If the BAföG is not enough and the parents cannot cover the costs either, another source of money for the studies must be found. Except Part-time job or scholarship comes in too student loan in question. As opposed to one installment loan will the Student loan from the KFW paid out in monthly installments. And repayment also differs: In the case of the student loan, installment payments are only due after an 18-month grace period.

BAföG and KFW student loan are the best way to finance studies

What you can learn here

- BAföG and KFW student loan are the best way to finance studies

- Loan as a student: 3 BAföG alternatives with one-time payment

- Loan students one-time payment: the most important things in a nutshell

- Calculate the loan installment for your student loan

- Student loan: what are the options for taking out a loan as a student

- Should you take out a loan as a student?

- Avoid applying for the student loan for purposes other than studying!

- Definition: student loan

- One-time loan payment: installment loans with free use as a student

- One-off payment for student loans – blessing and curse at the same time

- Apply for a student loan

- Student Loan + One-Time Payout = Better Deal?

- Apply for a student loan or student loan (e.g. from KFW).

- Apply for a student loan or student loan with monthly payments?

- Installment loan: one-time payment with the loan for students

- Criteria for Allocation: Student Loan with One-Time Payouts vs. Student Loan with Monthly Payouts

- Fixed interest rate: student loan with one-time payout vs. student loan with monthly payout

- Credit as a student: other options

- What differences and similarities exist between BAföG, classic student loans and an installment loan as a student

- Student loan vs BAföG vs KFW loan

- Your loan options as a student: Student loan vs BAföG vs KFW loan

- Even if you receive BAföG, you can also apply for a KFW student loan

- Before applying for a student loan, determine the amount of the loan with our student loan calculator!

- BAföG + installment loan Hybrid in student loans: take out a loan for student debt?

- Credit for students (one time payout) with parents as co-applicants

- One-time disbursement with the loan for students: Good credit rating of the co-applicant important

- Apply for credit as a student with no income

- Apply for a student loan: Negative SCHUFA information? → Loan as a student without SCHUFA or despite negative SCHUFA

- Necessary documents to apply for the student loan or loan as a student with a one-off payment

- Apply for a student loan: tips for good loan conditions as a student

- Conclusion: Help is available to you when applying for student loans

A KFW student loan to apply for is usually the best way to finance your studies after BAföG. Alternatively you can as a student but also a conventional one Loan with unique payout record, tape. the one-off payout on student loans will by one installment loan with "free use" reached.

If you only need short-term money to bridge 1 to 2 months, however mini loans from ferratum*, cashier* or Vexcash* the means of choice. For a fee of around 10 euros, you can stuff your household budget with it. A credit intermediary or loans up to 62 days is also possible Credit as a student with no income, as well as a Credit for students without SCHUFA possible. Due to the simple application process and few preliminary checks almost everyone gets a loan.

Loan as a student: 3 BAföG alternatives with one-time payment

4 ways, 3x student loan one-time payment

- BAföG: Through the Federal Training Assistance Act, students receive greatly reduced credit conditions and subsidies for repayment. The prerequisite is that the funding conditions are met.

- BAföG Alternative 1: Student loan from KFW: Those who do not receive BAföG can use the KFW student loan record, tape. In contrast to the BAföG, you cannot receive any repayment grants with the KFW student loan. The amount is paid out monthly and must be repaid after the end of the course plus around 4 % interest pa.

- BAföG Alternative 2: Installment loan from banks or private: As a student you can get a loan from a bank or from a private person. In contrast to the KFW loan, you receive the payment all at once and not monthly. However, there is a chance that you can get a Credit with one-time payment even through a bank more favorable conditions than you get from KFW. For the best student loan conditions, you should collateral can offer or one guarantors to have. You can about this one computer create an inquiry and see if it can save you interest on your student loan.

- BAföG Alternative 3: if you only one small cash injection during your studies, you can access a mini loan for a maximum of 62 days and 1,000 euros record. (Existing customers up to 3,000 euros). Recommended as a student loan is ferratum*. The provider does not require a minimum income. Alternative mini loan providers are Vexcash* (from 500 € income) or cashper* (from 700 € income). The cash injection Student loans without proof of income from Ferratum cost you about 5 euros for 600 euros and 30 days.

Loan students one-time payment: the most important things in a nutshell

- Students only get a loan with collateral:

- as security can for the bank Guarantors, mortgages, or a loan agreement for two to serve

- Students should have a good Schufa available to get a student loan

- It is worth comparing the interest rates of several providers online.

Study without worries, even without BAFöG and KFW!

✅ Request a student loan for free

✅Best conditions by querying 30 providers

✅Fast payout in 24 hours

Calculate the loan installment for your student loan

Student loan: what are the options for taking out a loan as a student |

1. BAföG ✅2. Student loan from KFW ✅3. Installment credit from banks or privately ✅ |

Credit as a student with no income?at ferratum* you can get a loan as a student without income. Cost: about 5 euros for 600 euros credit for 30 days. 1. Possibility for a loan as a student without income: For short-term money needs, you can switch to mini-loans with a maximum term of 62 days. In the guide Loan without proof of income I have described that you ferratum* you can get a loan even without proof of income. Without an express option, the Ferratum loan will cost you about 5 euros for 30 days.For one longer-term credit did you through one Second applicants or guarantors but also without an income of 600 euros the possibility to get a loan for your studies. Another way to get a student loan with no income is collateral to offer. With a credit broker such as smava* you can quickly and without further obligations find out what options you have for one Credit as a student with no income stand open. The purpose of the student loan is "free use". |

✅Loan for students without SCHUFA or despite negative SCHUFA:for Loans up to 1000 euros should you as a student with a negative SCHUFA mini loan Select. Recommended providers for mini loans are ferratum*, cashper* or Vexcash*.for Amounts above 1000 euros are credit intermediaries like SMAVA* a realistic way to get a student loan despite a negative SCHUFA entry. |

Should you take out a loan as a student?

As a student, money is usually tight. So are the costs for Rent, livelihood and Studies often a challenge. Especially since rents have recently risen sharply in many university towns. The alternative of moving to the country is also not optimal due to long distances. Especially since commuting doesn't exactly go easy on the household budget. The state therefore tries to support students financially. That's why it became BAföG and the Student loan from the KFW brought to life. However, as a student you have other options Loan record. If you change the order

BAföG → KFW student loan → installment loan → mini loan

with the financing for your studies, speaks at responsible handling nothing against taking out a loan as a student.

Avoid applying for the student loan for purposes other than studying!

A student loan should primarily to finance the course to serve: student apartment, semester fees, cost of living, Books and so forth. The temptation to spend a free-use loan on something other than your studies is great. Still, a loan should not for unnecessary consumption, vacations or parties be used. Because you accumulate a lot of debts and it will be difficult to get rid of them later. The Mistakes to take out a consumer loan as a student so you should definitely avoid it. Therefore, the first tip for cheap student loans is: Accurately determine credit needs. Only when you know how big the hole in the household budget is can you fill it with the right amount of money. A calculator for yours credit needs and more tipsto get cheap student loans, see the bottom of this page.

Definition: student loan

First is the term student loan define. A student loan has that aim to study to help fund it. Of course, as a student, it is also possible to take out installment loans, for example to automobile to buy or to finance the move to the place of study. However, since these loans are not used to finance your studies, they are not student loans. In this article, however, we do not only refer to that KFW student loan as a student loan. Instead they should Installment loans to finance your studies or Mini loans for short-term financial bottlenecks during your studies serve as a loan for students. One one-off payout on student loans However, KFW does not offer this. Thus, the installment loan as a student is limited by the one-time payout from the classic student loan.

One-time loan payment: Installment loans with free use as a student

You can also take out an installment loan as a student. For example, to make necessary purchases without delay. However, students usually do not have a fixed income of sufficient amount to meet the demands of the banks. Even if credit professionals beautiful from 600 euros income credits can mediate, banks charge for higher amounts often a guarantor. Parents often vouch for student loans with their assets.

A guarantor allows the bank to offer the loan on better terms. But there is another reason why the student loan is often not that expensive: the banks want to retain the students as customers at an early stage. Therefore, banks often grant good conditions for student loans.

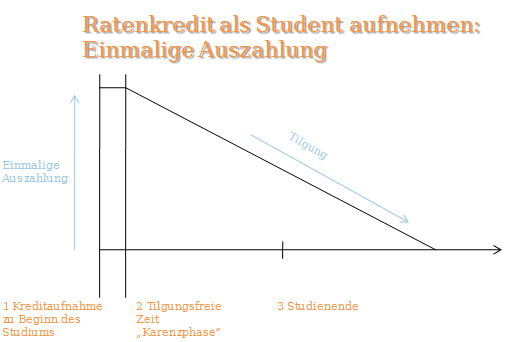

In doing so, a Credit as a student will be used freely requested. Even if the loan is used to finance your studies, it should not be confused with the KFW student loan. After all, the two loans differ in many ways such as one-off (installment loan) or monthly payout (KFW), the type of fixed interest rate (installment loan: fixed, KFW: variable) and some others.

One-off payment for student loans – blessing and curse at the same time

The installment loan for students is granted with a payment. This gives you much more flexibility in use than with KFW student loans that are paid out monthly. One one-off payout on student loans is therefore advantageous. However, there is one one-off payout on student loans also the risk of taking on "bad" debt through consumption or vacations.

Apply for a student loan

Before the Applying for a student loan you should first determine your needs. Students need about between 900 and 1,100 euros to live. In expensive university cities, however, the need can be significantly higher. Calculate your need for credit before applying for a student loan. You can support that Student loan requirement calculator use on this page. Good advice it's the Order BAföG → KFW student loan → installment loan → mini loan in the Student Loan Application to comply with In most cases, BAföG and the KFW student loan are cheaper than an installment loan as a student.

Now credit installment for student loan calculateStudent Loan + One-Time Payout = Better Deal?

Nevertheless, there is just one Guarantors with a good credit rating also have some exceptions from this rule. In fact, one can Installment loans for students are even cheaper than a KFW student loan be. It also has an installment loan for students additional advantages compared to the KFW loan. This is how you get the amount for an installment loan as a student, namely as one-time payout. With this you can clear the student loan more flexible use. But even if you prefer the monthly payment of the KFW student loan, you should at least get a comparative offer. After all, you don't want to pay too much when applying for student loans. More tips about Apply for a student loan with top conditions you can find in the section Tips for good loan conditions as a student at the bottom of this page.

At the Applying for a student loan with a good guarantor can you up Interest rates below two or three percent come, and thus save a lot of money over the years even compared to the KFW student loan with over 4 % interest. So it can actually be that you with a Installment loan with one-time payment is a better offer receive than from KFW. But that is also because the banks are interested in retaining students as long-term customers. A credit broker like smava* can help you find the cheapest installment loan offer as a student.

Now credit installment for student loan calculateApply for a student loan or student loan (e.g. from KFW).

Differences from an installment loan as a student and one Student loan from the KFW

A student loan has several differences from one installment loan. the Differences from an installment loan as a student and one Student loan from the KFW are:

- Criteria for Allocation

- KFW: age, citizenship

- Installment loan as a student: Income, expenses, creditworthiness, guarantor

- form of payment

- KFW: per month

- Installment loan as a student: One-time payout

- form of repayment

- KFW: Monthly repayment after studies and a break or "parental period"

- Installment loan as a student: Monthly repayment after payout. You can arrange a waiting period individually with the bank.

- fixed rate

- KFW: Flexible but linked to the European interest rate index Euribor

- Installment loan as a student: Fixed interest rate agreed over the term

There used to be a student loan from the DKB. Of the DKB student loan is currently no longer offered. Instead, there is only a normal one Installment credit from the DKB* to disposal.

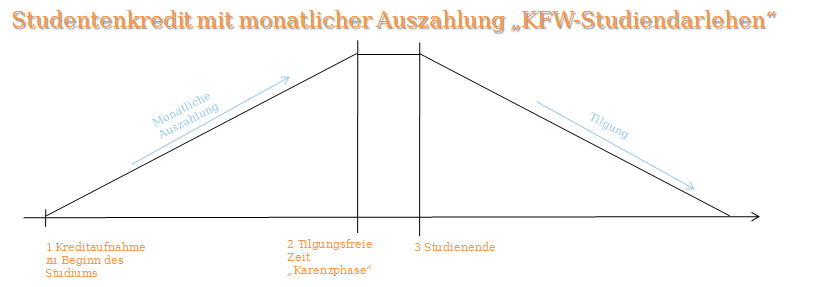

Apply for a student loan or student loan with monthly payments?

Disbursement phase for student loans with monthly payments

At the Student loans with monthly payments from KFW, for example the loan amount increases with each payment at. Therefore climb over time the interest payments.

For this one example: With a monthly payment of €650 and an effective interest rate of 4.16 % pa, the full €650 is paid out in the first month, but only €622.96 after 12 months. After 3 years, €572.21 of the €650 will be paid out. However, the KfW bank also offers the possibility of a interest deferral to set. This will then every month full amount paid off. The incurred Interest charges are there though only deferred, must therefore be repaid after the end of the course.

Amortization-free period or “grace period” for student loans with monthly payments

After the last payout, a grace period. This grace period take usually 18 months. It is intended to make it easier for you to start a job after you have finished your studies. during the grace period only pay the interest on the loan. However, you also have the option of shortening the waiting period and thus saving interest. You can make use of this special repayment right if you got a job faster.

Repayment phase for student loans with monthly payments

At the end of the waiting period, the repayment of the student loan begins. You can largely determine the monthly rate yourself. However, the student loan must be repaid within 25 years. Twice a year you can adjust your loan rate for the KFW student loan. In addition, unscheduled repayments of the KfW student loan are possible at any time.

installment loan: one-off payout on student loans

On the other hand, it is very different Loan as a student with a one-off payment. This is a free use installment loan. Therefore, the loan amount paid in one lump sum. Usually the begins refund immediately, but it is possible grace period to be agreed individually with the bank. Since the money does not come into the account every month, suitable himself the Loan for students with a one-off payment good for one-time purchases, for which there is currently no money available: Laptop, home furnishings, specialist books, replacement of the defective dishwasher and much more. You can also use the student loan with a one-off payment in addition to BAföG or the KFW student loan record, tape. Even the unusual idea one Student debt loan record may be useful. For upcoming purchases during your studies, you can "here" calculate your monthly rate.

Criteria for Allocation: Student Loan with One-Time Payouts vs. Student Loan with Monthly Payouts

Allocation criteria Loan for students with a one-off payment

To apply for a Loans for students with a one-off payment There are a few criteria that must be met for allocation. The reason for this is that lenders have to protect themselves against payment defaults. But also these criteria protect you as a customer, for example against excessive loan amounts, which would then no longer be repayable. Basically, each bank has slightly different criteria for allocating credit. However, the criteria for allocation are similar in many respects. At the Loan for students with a one-off payment the following requirements must be met:

- Residence in Germany

- of legal age

- German bank account

- regular income of at least 600 euros or guarantor with regular income

- No hard negative entries in the SCHUFA information.

Allocation criteria Loan for students with monthly payment

You receive the loan for students with monthly payment from the KFW regardless of your income. Also, no guarantor is necessary. The following conditions apply to Loan for students with monthly payment the KFW:

- Residence in Germany

- Age: 18 to 44 years

- Application before the 10th semester

fixed rate: One-off student loan vs. monthly student loan

At the Loan for students with a one-off payment the interest rate is fixed for the entire term. The interest rate depends on your credit rating as a student. A guarantor with a good credit rating can lower the interest rate significantly. With a larger amount, it's not about peanuts that you save, but about a lot of ashes.

At the Loan for students with monthly payment (KFW), on the other hand, the interest rate is not fixed. Instead, it is dependent on developments in the credit market. The interest on the loan for students with monthly payments is linked to the Euribor index. This coupling causes the subsequent monthly repayment installments fluctuate within a certain corridor be able. Alternatively, you can also compensate for these fluctuations by agreeing with KFW to extend the repayment period or To shorten.

Credit as a student: other options

Furthermore installment loan for students and the classic student loan from KFW There are other ways to finance your studies. These include:

- BAföG

- grants from foundations or, for example, from the German Armed Forces or the employer

- mini loans eg about 300 €, 500 €, 1000 € or even 3.000 €

- credit lines, i.e. credits by overdrafting the account into the red

What differences and similarities between BAföG, classic student loans and a Installment credit as a student

between one installment loan as a student, of promotion BAföG and one Student loans from KfW Bank there are structural differences. The following table shows the main differences between the three types of financing:

Student loan vs BAföG vs KFW loan

Installment loan as a student | BAföG | Student loan eg from the KfW Bank |

|

| requirements |

|

|

|

| Interest charges | Often between 2 and 4 %. With excellent creditworthiness under 1 % possible. | Interest free | Variable but around 4 % |

| repayment | Immediately in monthly installments | Repayment is made no later than five years after the last loan payment | After expiry of the term and a waiting period of 18 months |

| Payout and Purpose | All at once earmarked or freely available | Monthly to finance your studies | Monthly to finance your studies |

| Especially suitable for | One-time purchases during your studies such as furnishing your home 🏠, moving 🚚, computers 💻, specialist books 📚, seminars 👩🏫 etc. | Complete financing of study or as support, if there are other sources of money | Complete financing of study or as support, if there are other sources of money |

Your loan options as a student: Student loan vs BAföG vs KFW loan

the Differences in payout and repayment phases but also with regard to recommended use show how much a Installment loan as a student with a one-off payment of a student loan or the BAföG differentiate. who plans take out a loan as a student, should therefore have a clear approach in mind!

A Installment loan as a student the right financing if you have one short-term financial bottleneck have to overcome. But even if you are a student non-deferrable purchases have to do immediately is an installment loan or a Instant credit up to €3,000 the correct student loan.

On the other hand, if you as a student a long-term credit without income want to apply for is the KfW Student Loan (174) the better choice for you. But before you rush to get the KFW loan, you should first try to apply for BAföG. The requirements for the BAföG are higher than for the KFW student loan, but the conditions are also significantly better! If you insufficient BAföG get to finance your life as a student, you can Close the gap with the KFW student loan. The BAföG is more suitable than the KFW student loan is due, among other things, to the lower interest rate. Because that BAföG eventually will interest free granted, while you have to pay interest on the KfW student loan. But also the maximum possible Debt relief from almost 40 % with BAföG, makes it clear that the more complex application is more than worth it!

Even if you receive BAföG, you can also apply for a KFW student loan

The BAföG support is based on the income of the parents. As a result, this support can often turn out to be less than hoped for. To fill the financial gap, you can KFW Apply for a student loan. However, you should note that you will have to repay both claims later, and this will put you under a high financial burden.

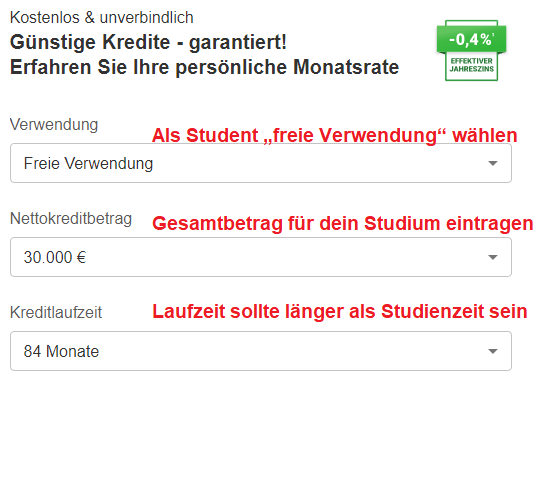

Before applying for a student loan, determine the amount of the loan with our student loan calculator!

On average, students need each month 918 EUR. In individual cases, however, the amount can deviate significantly upwards, especially in expensive cities such as Munich, Frankfurt, Stuttgart, Berlin. Therefore there are Konto-Kredit-Vergleich.de the Requirements calculator for students. If you suspect that your monthly costs are higher than your income, you can use the needs calculator gain certainty. With this you will find out how much credit you need as a student for example one Apply for a KFW student loan or an installment loan .

BAföG + installment loan hybrid on student loans: Take out a loan for student debt?

This is a somewhat special design model hybrid model on student loans. The hybrid model is currently low interest rate on an installment loan with the combined with high discounts for early retirees with BAföG. The BAföG is therefore repaid early, which means that the state grants discounts of up to 40 %. The money is previously taken from a cheap installment loan. If own funds are available, these are used with priority.

Depending on the credit rating and the interest rate granted, the clever combination of BAföG and credit can be financially worthwhile. If you are about to repay your BAföG, you can Calculate your credit rate here. So you can test whether it's worth one borrowing for student debt.

Credit for students (one time payout) with parents as co-applicants

A Second or co-applicant respectively. guarantor with a good credit rating represents a high level of security for the bank. Therefore, a loan application with a solvent co-applicant is often approved. In contrast to the guarantee, a co-applicant cannot limit liability, but is always liable for the full amount.

In addition to your own parents, acquaintances, relatives, possibly children – and – spouses are also suitable as co-applicants. You usually get particularly good conditions with a one-off loan for students with parents as co-applicants and a joint and several guarantee from the parents.

One-off payout on student loans: Good creditworthiness of the co-applicant important

The creditworthiness of the co-applicant must be correct. This is based on documents to be submitted such as proof of income checked by the banks. At a regular income medium height and positive credit bureau are the opportunities on good credit terms, however excellent. Also important to know: If parents appear as co-applicants, they are liable for this.

Apply for credit as a student with no income

Without income and guarantors, a loan as a student at a bank is rejected. If you want to take out a loan as a student, your income should over 600 euros net be. But even with an income of less than 600 euros, you have 2 other options in addition to BAföG or KFW credit.

Apply for a student loan: 1. Opportunity for a loan as a student with no income

For short-term money needs, you can switch to mini-loans with a maximum term of 62 days. In the guide Loan without proof of income I have described that you ferratum* you can get a loan even without proof of income. Without an express option, the Ferratum loan will cost you about 5 euros for 600 euros credit for 30 days.

Apply for a student loan: 2nd possibility for a loan as a student without income

For one longer-term credit did you through one Second applicants or guarantors but also without an income of 600 euros the possibility to get a loan for your studies. Another way to get a student loan with no income is collateral to offer. With a credit broker such as smava* you can quickly and without further obligations find out what options you have for one Credit as a student with no income stand open. The purpose of the student loan is "free use".

Now credit installment for student loan calculateApply for a student loan: Negative SCHUFA Information? → Credit as a student without SCHUFA or despite negative SCHUFA

Students can do one too Credit with negative SCHUFA obtain. for Loans up to 1,000 euros should you as a student with a negative SCHUFA mini loan Select. Recommended providers for mini loans are ferratum*, cashper* or Vexcash*. for Amounts above 1000 euros are credit intermediaries like SMAVA* a realistic way to get a student loan despite a negative SCHUFA entry.

Necessary documents to apply for the student loan or loan as a student with a one-off payment

Once you have decided on a suitable bank, you need the following documents to take out a loan:

- Identity card or passport and registration certificate

- Your last three pay stubs from a part-time job, if you have any.

- If there is further income from capital assets or rental income, appropriate evidence of this

- Evidence of your monthly expenses such as bank statements. This allows the bank to determine your freely available funds using the formula 'sum of income' – 'sum of expenses'

- If the loan is taken out with a guarantor or co-applicant, they must also have ID and proof of disposable income ready.

When applying for a loan online, you must identify yourself. The easiest and fastest way to determine personal details is via the video camera of your smartphone or computer. The procedure is called Videoident. Alternatively, you can be identified with a PostIdent coupon in a post office of your choice. For both procedures you need a valid ID document.

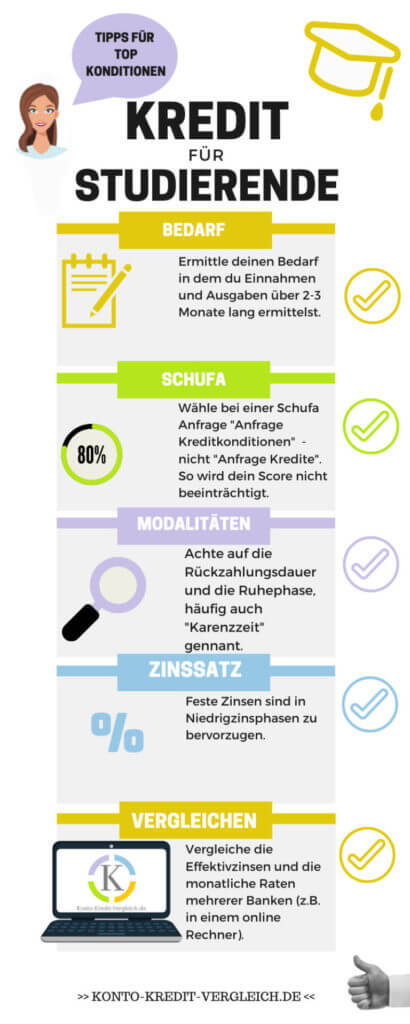

Apply for a student loan: tips for good loan conditions as a student

The infographic shows how to get top conditions for a loan as a student:

1. identify needs

The determination of the need begins even before the loan is actually taken out. By precisely determining your needs, you avoid unnecessarily high borrowing costs for money that you don’t need at all. make you that demand calculator Use this to determine your income gap during your studies

2. Don't be afraid of the Schufa

The transmission of the correct parameter "conditions request" in the credit request is like most credit service providers Smava* Default. This type of request does not worsen your Schufa score. The fear of the Schufa is therefore often unfounded.

3. Use guarantors and collateral

With a guarantors with good credit you will also receive a cheap installment loan as a student. In addition, it is recommended collateral such as offering a car or something similar. In the article Pros and cons of loan collateral you can find out more about loan collateral and what its advantages and disadvantages are.

4. Make multiple requests

In order to get a cheap loan, it is particularly important as a student to compare banks and conditions with each other due to the poor credit rating. The benefit of one credit service provider lies in that with only a request* Check the conditions at around 30 banks. Here's how you get it Credit as a student on the best terms and save yourself expensive surcharges. After all, as a student, money is usually scarce enough and does not have to go to expensive bank advisors.

Now credit installment for student loan calculateConclusion: Help is available to you when applying for student loans

Even if the exam stress is getting out of hand, students do not have to despair when it comes to applying for a student loan. Because with the support of the right financing partner* Part of the work can be delegated. Assistance ranges from determining the possible credit limit to selecting a suitable bank. The credit rating is also taken into account here. With cheap financing, you can save a lot of money every month. It is therefore often worthwhile to use the help of a credit broker when applying for a student loan. But even with the savings that a student account brings with it, students can treat themselves to more in everyday life. With a Student account comparison you're cupping your expenses for a checking account to the bare essentials.

____

**This is from the Student Credit Test of the Center for Higher Education Development (CHE).

*Affiliate link: If you get to a provider via one of these links from my website and open an account there, I may receive a commission. This does not result in any additional costs for you. ❤️ THANK YOU for using these links! ❤️

Disclaimer: This is well researched but non-binding information.